The recent massive demand for ECB's LTRO (Long Term Refinancing Operation)--nearly 490 billion euro in three-year 1% loans from 523 banks--only confirmed the suspicion of some market participants that European banks are having financing issues, and that the LTRO is unlikely to flow into the Euro Zone supporting the troubled sovereign debt and economy.

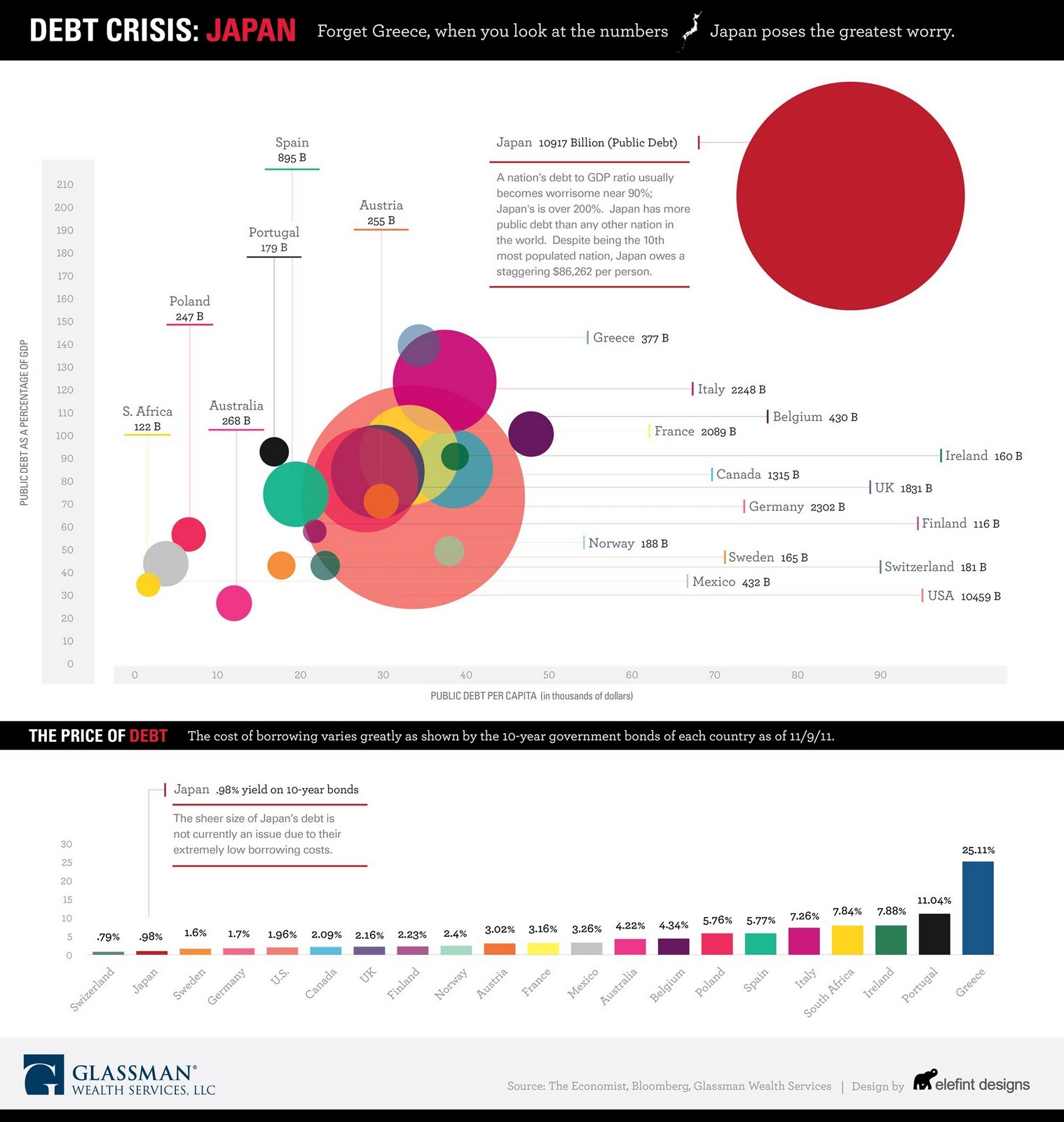

In addition to the current Euro crisis, Japan, the world's third largest economy, could have its own debt crisis as early as 2012 bigger than the Euro Zone. (see graph below)

Japan has long been mired by an aging population, sluggish growth and deflation since an asset bubble popped in the early 1990s. The country already has the highest debt-to-GDP ratio in the world--about 220% according to the OECD -- and a debt load projected at a record 1 quadrillion yen this fiscal year.

Based on a plan approved by the Cabinet in Tokyo on 23 Dec, the country is now looking to sell 44.2 trillion yen ($566 billion) of new bonds to fund 90.3 trillion yen ($1.16 trillion) of spending in fiscal year 2012 starting 1 April. That will raise Japan budget’s dependence on debt to an unprecedented 49%.

According to Bloomberg, the government projects new bond issuance will surpass tax revenue for a fourth year. Receipts from levies have shrunk about a third this year after peaking at 60.1 trillion yen in 1990. Non-tax revenues including surplus from foreign exchange reserves also halved to 3.7 trillion yen. Social-security expenses, now at 250% of the level two decades ago, will account for 52% of general spending next year

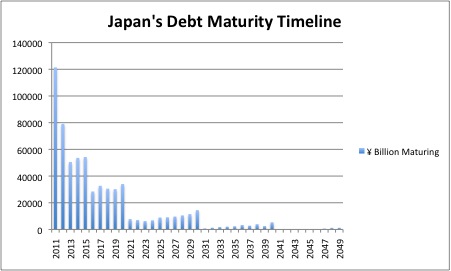

Moreover, an April 2011 analysis by CQCA Business Research showed that "Japan has an extremely near-future tilted debt maturity timeline" (see chart below). CQCA estimated that in 2010, Japan was able to push 105 trillion yen into the future, but concluded it is doubtful that Japan will be able to continue this.

Indeed, as one of the major and relatively stable economies in the world, and since almost all of its debt are held internally by the Japanese citizens or business, Japan has been able to still borrow at low rates (10-year bond yield at 0.98% as of Dec. 26, 2011), partly thanks to the Euro debt crisis going on for more than two years.

So as long as Japan could keep financing a majority of its debt internally without going through the real test of the brutal bond market, the country most likely would not experience a debt crisis like the one currently festering in Europe.

But the chips seem to have stacked against Japan now. On top of the new and re-financing needs, the Japanese government estimated that the economy will shrink 0.1% this fiscal year citing supply-chain disruptions from the earthquake and tsunami disaster in March, the strengthening of the yen and the European debt crisis. Moreover, S&P said in November that Japan might be close to a downgrade. After a sovereign debt downgrade to Aa3 by Moody's in August, 2011, it'd be hard pressed to think Japanese bond buyers would shrug off yet another credit downgrade.

Burgeoning debt, coupled with the global and domestic economic slowdown, and continuing political turmoil (Japan has had three Prime Ministers in the last two years, and the current PM Noda’s popularity has fallen since he took office in September), would suggest it is unlikely that Japan could continue to self-contain its debt.

It looks like its massive debt could finally catch up with Japan in the midst the sovereign debt crisis that's making a world tour right now. While some investors might see Japan as a bargain, it remains to be seen whether the country will continue beating the odds of a debt crisis.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Debt Crisis 2012: Forget Europe, Check Out Japan

Published 12/27/2011, 05:18 AM

Updated 05/14/2017, 06:45 AM

Debt Crisis 2012: Forget Europe, Check Out Japan

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.