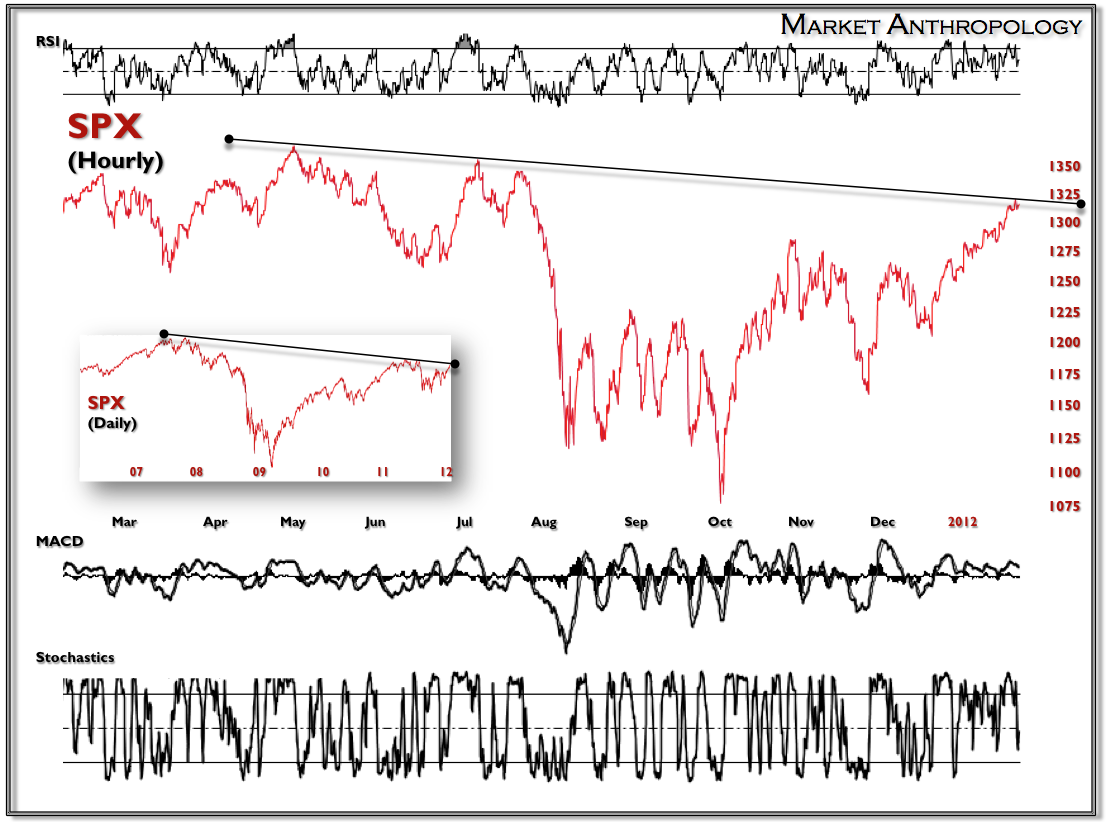

Another day, another marginal high for the SPX. Since the low on December 19th, the market has put in a positive showing a total of 18 out of the last 22 sessions. By all conventional standards a very strong uptrend to step out or in front of.

Of course what has tempered my expectations here, was that it was fully expected - even before it materialized. The pivots in sentiment. The calls from the punditsphere of SPX >1600 this year. The grizzlies capitulating and shedding their coats for warmer climates. The tightening spread in confidence between our monetary handlers resolve and the collective gaming of equity traders - ironically, but aptly coined - irrational exuberance. Certainly the timeframe has extended itself a bit beyond where I thought the market would turn, but tops are a process and one that rarely presents itself with the chiming of church bells (arrogance never discriminates - only humbles)...

With that said and because there's always two sides to a market, there are some good arguments being made by some very bright folks that the equity markets this time around (most similar to perhaps 1998 - I know, "I voted for it, before I voted against it") have it right and there's room to run.

Europe may burn, but it won't catch fire - at least this time around. Most of these arguments revolve around the idea that the U.S. economy has achieved critical mass as indicated in the most recent treasure trove of economic data and that inflation expectations have no where to go but up. There are also compelling arguments being made in the near term by some of the wiser and more nuanced minds in volatility that although the VIX is currently around 19, realized volatility today is below 8 and has been below 10 since January 11th.

Of course its meaning is in the eye of the beholder, but an argument can be made that the VIX is not exactly cheap here. An amazing move considering only a few months back realized volatility had eclipsed implied volatility - a rare occurrence that typically presages large declines. Once again, presage is a relative term, but my general take, albeit simplified, is that although the futures structure of the VIX coming into the year strongly favored a compression in volatility, the positive feedback into the equity markets has only reinforced the tangible layer of complacency these days. I primarily see the VIX as flashing a hazard signal in light of Europe and the slowdowns in Asia.

1937

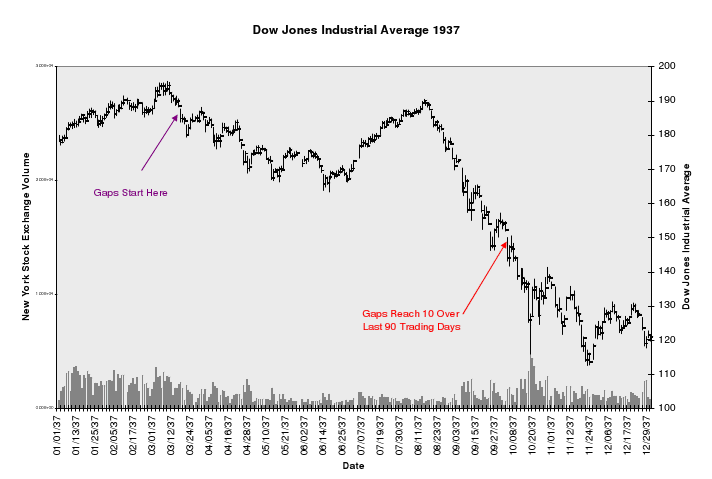

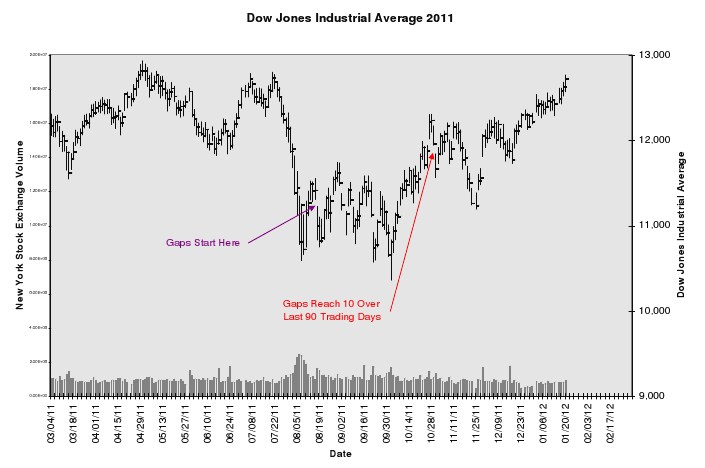

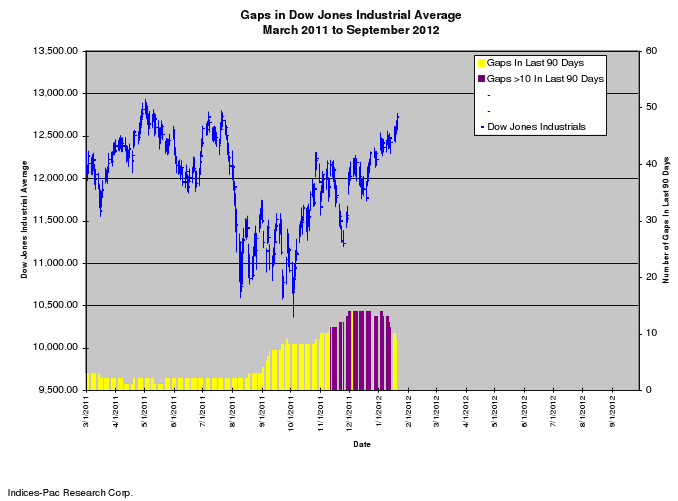

Speaking again of the blowoff top - I am reminded of the historic analog to the late 1930's where Europe was a tinderbox and the U.S. was in the throes of its own fiscal debate. And while the economists and historians will undoubtedly debate causation and how it's different this time around, in terms of market structure, there are far more similarities than differences to the late 1930's. I have spoken in the past about how this summer's decline changed my perspective towards the equity markets this year. To make a long story short - I believed the market's structure had been broken, a consequence of which was apparent in the frequency of gaps within the structure itself as it reflexively bounced off the crash lows from early August. And while gaps within the market are not uncommon during periods of extreme volatility, the nature of these gaps was historically quite rare.

How rare?

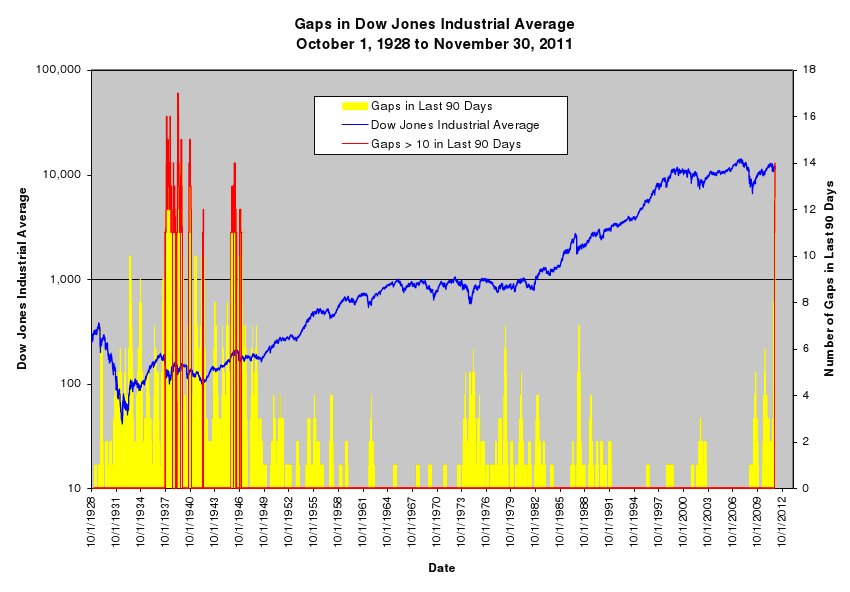

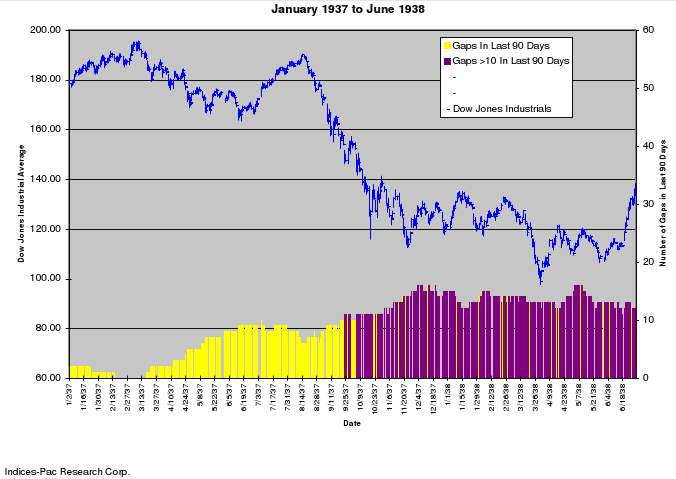

Interestingly, the last occurrence of which first appeared during the late 1930's. Richard Morano at Indices-Pac Research brought a striking data set to my attention recently that illustrated this quite clearly. Richard uses the theoretical highs and lows of the Dow Jones Industrial Average to qualify an open as a gap. For those of you not familiar with this method, here is a brief explanation:

A method of calculating the Dow Jones index (most often the DJIA) that assumes all index components hit their high or low at the same time during the day.

In other words, the "theoretical Dow" uses the daily highs for all 30 Dow components to calculate the index high, and the lows to calculate the index low. In January of 1992, Dow Jones started using the "actual" method, which calculates the index at 10-second intervals throughout the day. Before this point, the theoretical calculation was the only way to compute the high and low of the index.

This method assumes that all stocks hit their high or low at the same time. Because this rarely happens, the theoretical high will almost always be higher than the actual, and the theoretical low will almost always be lower than the actual. Theoretical Dow Jones Index - Investopedia

Using the theoretical highs and lows for the Dow is a very conservative approach for determining gaps, which makes the data that much more compelling from a historical perspective. As illustrate in the charts below from Indices-Pac, the last time the market's structure broke down and was riddled with the frequency of gaps started during the severe retracement decline of 1937.

What is noteworthy is the market traded along a very similar arc to today, initially declining ~15%, before recovering a majority in a low volume comparative "blow off" trajectory. The market then collapsed more than 40% as the global economy went into a sudden, but swift - recession. This period was known as the "recession within the Depression."

There are numerous monetary and fiscal parallels to the 1930's. Whether history repeats or rhymes will be revealed over the next several months and debated by the pundits for generations as either a victory over the pitfalls of the last great financial crisis - or a capitulation to the considerable challenges a financial system faces during like conditions. Perhaps though, and as illustrated by these charts, it is simply the inevitable force of nature or point of friction, that no matter how hard we try and bridle, eventually breaks through and romps where she must.

Water eventually finds the path of least resistance no matter how high and buttressed the levees appear. Traders pavlovian reflexes to central bankings considerable interventions over the past decade presents a dangerous complacency to such outcomes. It is my belief that although each market environment is unique with their own motivators and governors of price, the same inherent emotional momentum (i.e stimulus and catalyst) has been present throughout history in like proportions.

To that respect it it a closed system that will replicate along very similar arcs. Evolution within the transmission of capital within the financial system itself has undoubtedly changed over the course of the past 80 years. But our reflexes to fear and greed, our savings and our investments has remained quite similar as they were during the Tulip Mania, the South Sea Bubble , the Railway Mania, the Roaring Twenties, the Nasdaq Bubble and the Housing Bubble.

Is it different this time around? We can always hope - but I doubt it.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Equity Markets Still Have Room to Run

Published 01/25/2012, 02:33 AM

Updated 07/09/2023, 06:31 AM

Equity Markets Still Have Room to Run

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.