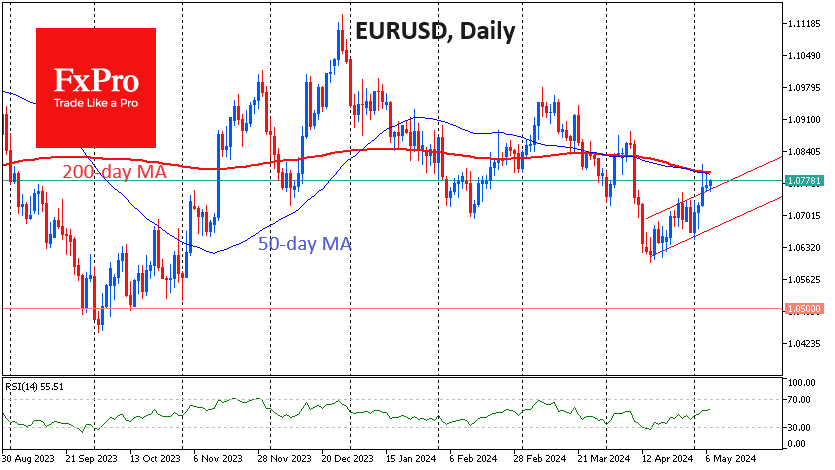

The single currency is trading near $1.076, waiting for further cues and facing serious resistance in its attempt to consolidate above 1.08 on Friday.

On Friday, EURUSD's growth accelerated against the trend of the previous three weeks on negative US labour market data for the dollar. However, the attempts of the bulls in the pair to consolidate above 1.08 failed.

It is easy to understand the sellers of the single currency, as the balance of risks is shifted towards a softer monetary policy in the eurozone compared to the US. ECB officials are cementing expectations of a June cut and fuelling sentiment that further cuts will follow. Friday's US labour market data narrowed the gap, as after it, the odds of a rate cut before September rose to 67% from 46% a week earlier. And markets are used to playing up changes in US expectations first, only then spreading them to related markets.

Separately, we note that the market finds the euro attractive at current price levels. Throughout 2023, EURUSD was reversing to the upside, with an approach of 1.05. But last month's dip to 1.06 appeared attractive to cautious buyers.

The local technical picture points to a slight bearish bias as EURUSD is trading below its 200- and 50-day moving averages. Moreover, they are both pointing downward. On the other hand, the bulls have not given up trying to break through this resistance, making attempts on Friday and Monday in addition to accelerating the gains seen last month.

The bull and bear positions in EURUSD are very balanced, and this is a good time to watch what the next move will be. A sharp change, by 1% or so, in either direction could signal the start of a relatively long trend.

In terms of levels, EURUSD overcoming the 1.0850 level opens prospects for a rise to the 1.1050 area with the potential for further upside. On the contrary, a failure under 1.0650 could force buyers to regroup in the 1.05 area and possibly trigger a further downward trend.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

EUR/USD at Equilibrium: Where Next?

Published 05/07/2024, 10:29 AM

EUR/USD at Equilibrium: Where Next?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.