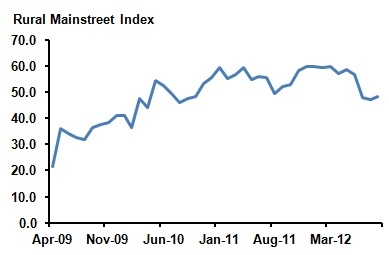

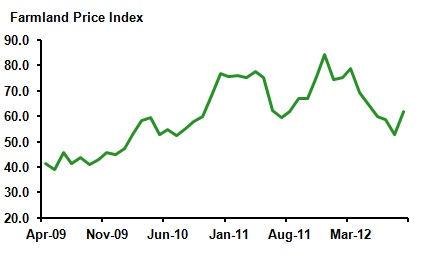

The Rural Mainstreet Index (RMI) remained below growth neutral for the third consecutive month, although the farmland price index jumped to its highest level since May. While farmer income is still strong, businesses linked to agriculture are experiencing retractions, according to bank CEOs.

The Rural Mainstreet Index increased to 48.3 from 47.1 in August and 47.9 in July. The RMI is inching higher but still posted below growth neutral for the third month in a row.

According to Creighton University economist Ernie Goss, “The drought continues to dampen economic activity for businesses linked to agriculture such as ethanol, and agriculture-equipment sellers. I expect food processors to take a hit later in the year as higher food prices work their way through the system.”

Agriculture

The farmland price index, which has been declining for three straight months, got a jump start this month and climbed almost ten points to 61.6 compared to 52.8 in August. This marks the 32nd consecutive month the index has been above growth neutral. The farm equipment sales index increased to an even growth neutral, 50.0, an enormous increase from the 38.3 it posted last month.

Bankers were asked this month to project farmland price growth in the next 12 months. Answers varied, but on average, bankers believe there will be a three percent gain in farmland prices in the upcoming year. Bankers were also asked if they expect harvest to occur earlier than in previous years. Overwhelmingly, 91% of bankers believe harvest will take place earlier than normal.

Banking

For the seventh consecutive month the loan volume index has increased, to a 70.2 from 67.6 a month prior. The check deposit index decreased to 48.3 from 49.1 in August and the certificate of deposit and savings instruments increased to 38.4 from 33.0 in June. “As in previous months, the drought appears to be increasing the cash needs of farmers in the region. We have been tracking a reduction in the percent of farmland and farm-equipment cash sales and upturns in the degree of bank financing,” said Goss.

September's hiring index decreased to 50.9 compared to 51.9 in August. “Even though we tracked hiring growth for the month, the index is trending down. I expect job losses in the months ahead as the impacts of the drought spread to more and more Rural Mainstreet businesses,” said Goss.

The economic confidence index increased to 43.0 in September compared to 39.6 from last month. “The drought along with a lethargic national economy are negatively affecting the business confidence of bank CEOs in the region,” explained Goss.

Survey

This survey represents an early snapshot of the economy of rural, agriculturally and energy-dependent portions of the nation. The RMI is a unique index covering 10 regional states, focusing on approximately 200 rural communities with an average population of 1,300. It gives the most current real-time analysis of the rural economy.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Farmland Price Index Soars

Published 09/24/2012, 07:03 AM

Updated 07/09/2023, 06:31 AM

Farmland Price Index Soars

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.