As a record number of 204 nations compete at the XXX Olympic Games in London, and millions of couch-watchers root on their favorite athletes, a different simultaneous competition is occurring…the 2012 Financial Olympics. So far, both Olympics have provided memorable moments for all. While the 2012 London Olympic viewers watched James Bond and Queen Elizabeth II parachute into a stadium filled with 80,000 cheering fans, investors cheered the Dow Jones Industrial Average above the 13,000 level on the same day of the opening ceremony.

We have already witnessed a wide range of emotions displayed by thousands of athletes chasing gold, silver, and bronze, and the same array of sentiments associated with glory and defeat have been observed in the 2012 Financial Olympics. There is still a way to go, but despite all the volatility, the stock market is still up a surprising +10% in 2012.

Here were some of the key Financial Olympic events last month:

Draghi Promises Gold for Euro: Some confident people promise gold medals while others promise the preservation of a currency – European Central Bank President (ECB) Mario Draghi personifies the latter. Draghi triggered the controversy with comments he made at the recent Global Investment Conference in London. In the hopes of restoring investor confidence Draghi emphatically proclaimed, “The ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough.”

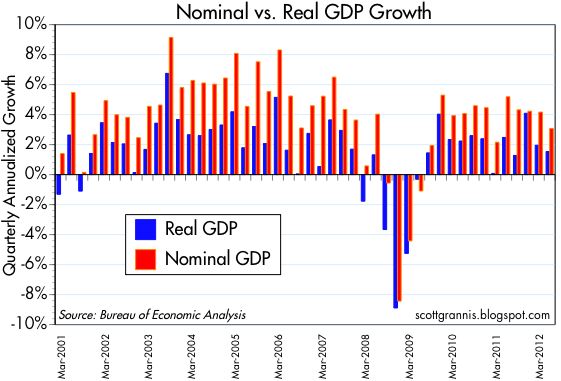

U.S. Economy Wins Bronze: Whereas Europe has been disqualified from the Financial Olympics due to recessionary economic conditions (Markit predicts a -0.6% contraction in Q3 eurozone GDP), the U.S. posted respectable Q2 GDP results of +1.5%. This surely is an effort worthy of a bronze medal given the overall sluggish, global demand.

Fears over a European financial crisis contagion; undecided U.S. Presidential election; and uncertain “fiscal cliff” (automatic tax hikes and spending cuts) are factors contributing to the modest growth. Nevertheless, the US of A has posted 12 consecutive quarters of economic growth (see chart below) and if some clarity creeps back into the picture, growth could reaccelerate.

No Podium for Spain: Spain’s recent economic achievements closely mirror those of the athletic team, which thus far has failed to secure a sporting medal of any color. Why no Spanish glory? Recently, the Bank of Spain announced the country’s economy was declining at a -1.6% annual rate. Shortly thereafter, Spain estimated its economy would contract by -0.5% in 2013 instead of expanding +0.2%, as previously expected. Adding insult to injury, Valencia (Spain’s most indebted region) said central government support would be needed to repay its debts.

These factors, and others, have forced the Spanish government to adopt severe austerity measures to cut its budget deficit by $80 billion through 2015. Spanish banks have negotiated a multi-billion-euro bailout, but they will have to hand control over to European institutions as a concession. Considering these facts, combined with an unemployment rate near 25%, one can appreciate the dominant and pervading losing spirit.

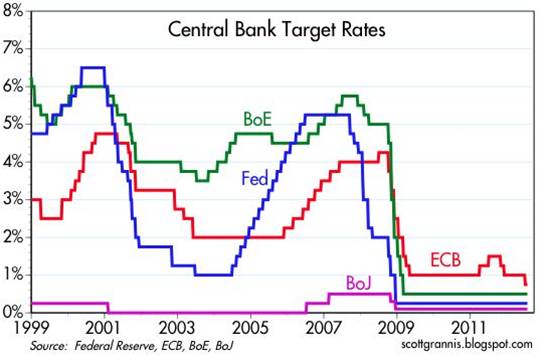

Global Central Banks Inject Financial Steroids:The challenging and competitive global growth environment is not new news to central bankers around the world. As a result, finance leaders around the world are injecting financial steroids into their countries via monetary stimulus (mostly rate cuts and bond buying). Like steroids, these actions may have short-term invigorating effects, but these measures can also have longer-term negative consequences (i.e., inflation). Here are some of the latest country-specific examples (also see chart below):

- U.S. Federal Reserve Chairman Ben Bernanke has already shot a couple “Operation Twist” and “QE” (Quantitative Easing) bullets, but as global growth continues to slow, he has openly acknowledged his willingness to dig into his toolbox for additional measures under the right circumstances, including QE3.

- The PBOC (People’s Bank of China) surprised many observers by employing its second rate cut in less than a month. The PBOC lowered its one-year lending rate by 0.31% to 6%.

- The ECB (European Central Bank) lowered its key lending rate by 0.25% to an all-time low of 0.75% and also cut its overnight deposit rate (the equivalent of our Federal Funds rate) by 0.25% to 0%.

- Brazil’s central bank recently cut its benchmark Selic rate for the 8th time in a year to an all-time low of 8% from 12.5%.

- South Korea’s central bank lowered its key interest rates by 0.25% to 3%, its first such action in three years.

- The BOE (Bank of England) raised its quantitative easing goal by 50 billion pounds (~$78 billion).

Banks Disqualified from Libor Games:

As a result of the Libor (London Interbank Offered Rate) rigging scandal, Barclays CEO Robert Diamond resigned from the bank and agreed to forfeit $31 million in bonus money. Libor is a measure of what banks pay to borrow from each other and, perhaps more importantly, it acts as a measuring stick for determining rates on mortgages and other financial contracts.

In an attempt to boost the perceived financial strength of their financial condition, multiple banks artificially manipulated the calculation of the Libor rate. Ironically, this scandal likely helped consumers with lower mortgage and credit card rates.

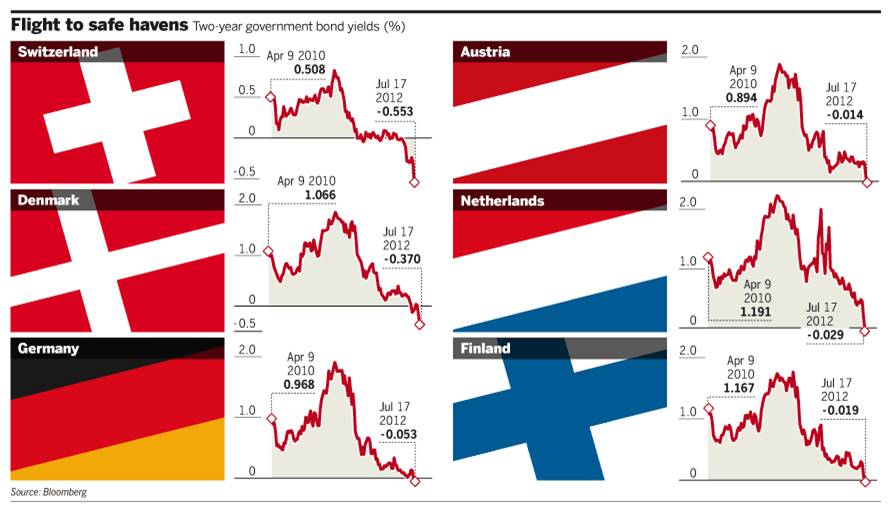

Rates Running Backwards: Sports betting on teams and events is measured by point spreads and numerical odds. In the global debt markets, betting is measured by interest rates. So while losing, debt-laden countries like Greece and Spain have seen their interest rates explode upwards, winning, fiscally responsible countries (including Switzerland, Austria, Denmark, Netherlands, Germany, and Finland) have seen their bond yields turn NEGATIVE. That’s right, investors are earning a negative return.

Rather than making a bet on higher yielding bonds, many investors are flocking to the perceived safety of these interest-losing bonds (see chart below). This game cannot last forever, especially for individual and institutional investors who require income to meet liquidity and return requirements.

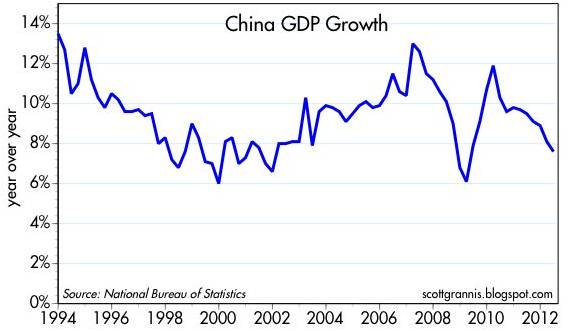

China Wins GDP Gold Medal but No World Record: China led in both the Olympic Games gold medal count (China 13 vs. U.S. 9 through July 31st) and GDP competition. Given the fiscal and monetary stimulus measures the government has implemented, it appears their economy is bottoming. Despite the tremendous anxiety over China’s growth, China’s National Bureau of Statistics just announced a +7.6% Q2 GDP growth rate (see chart below), down from +8.1% in Q1.

Although this is the slowest growth since the global financial crisis, even though this was the slowest GDP growth rate in over three years, most countries would die for this level of growth. Adding evidence to the bottoming storyline, HSBC recently reported the preliminary Chinese PMI manufacturing index rose to 49.5 in July, up from 48.2 in June – the highest reading since early this year (February).

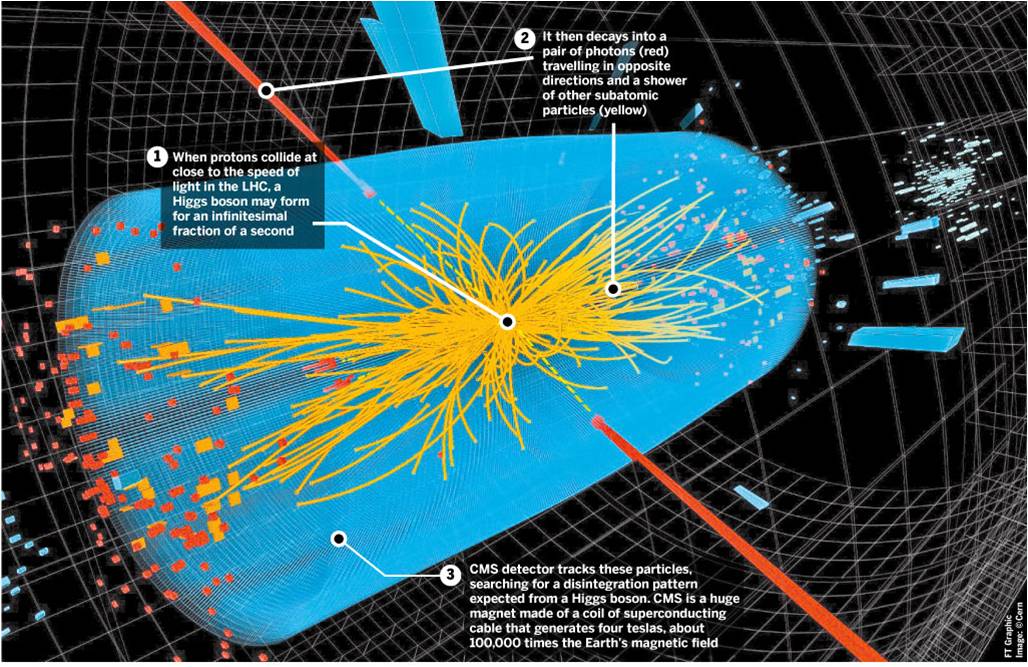

Higgs Wins God Particle Gold: Michael Phelps and Missy Franklin are not the only people to win gold medals in their fields. Peter Higgs and fellow scientists had 50-years of their physics research validated when the Large Hadron Collider discovered the long-sought Higgs boson (a.k.a., the “god particle”). The collider, located on the Franco-Swiss border, measured approximately 17 miles in length, took years to build, and cost about $8 billion to finish. Pundits are declaring the unearthing of Higgs boson as the greatest scientific discovery since the sequencing of the human genome. Higgs’s gold medal may just come in the form of a Nobel Prize in Physics.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at the time of publishing SCM had no direct position in Barclays or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.