While everyone is focused and worried about the news flow from Europe, I am less concerned about the prospects for Greece and the eurozone. As I wrote in my last post (see Draghi, The Last Domino, Falls), Germany is becoming increasingly isolated and I expect her to start to bend on the issue of eurobonds. While they may not be eurobonds in the strictest sense, we are likely to see some sort of typical European compromise on Pan-European infrastructure bonds.

I am more concerned about the news flow out of China, which is likely to deteriorate over the next few months - and none of the negative news has been discounted by the market.

The consensus on China

Currently, the consensus view on China is that while the economy is weakening, the authorities are aware of the problem and they are taking steps to remedy the situation. Indeed, Bloomberg reported that Premier Wen Jaibao made some remarks on May 20 suggesting that more stimulus was on the way:

Chinese Premier Wen Jiabao said the government will focus more on bolstering economic growth, indicating policies may be loosened further as inflation moderates.

“The country should properly handle the relationship between maintaining growth, adjusting economic structures and managing inflationary expectations,” Wen said during a tour of Wuhan, the capital of China’s Hubei province, from Friday to Sunday.

“We should continue to implement a proactive fiscal policy and a prudent monetary policy, while giving more priority to maintaining growth,” Wen said.

The market interpreted his comments as being growth friendly:

Wen’s remarks cited in the report, which didn’t mention concern about inflation, indicate the government might take more aggressive steps to support the economy after April data showed the slowdown may be sharper than expected. The central bank this month cut banks’ reserve requirement ratio for the third time since November to boost liquidity.

Take a look at the Shanghai Composite, which reflects this ambiguity about China's near-term growth outlook. The index is currently testing the downside of an unresolved wedge formation, which indicates indecision. A breakout to the upside of the wedge would be interpreted bullishly while a downside breakdown would be bearish.

Turmoil beneath the surface

While the picture of the Shanghai Composite reflects this consensus view, a tour of secondary market indicators suggest that not all is well with the Chinese economy. First of all, the flash PMI release showed contraction.

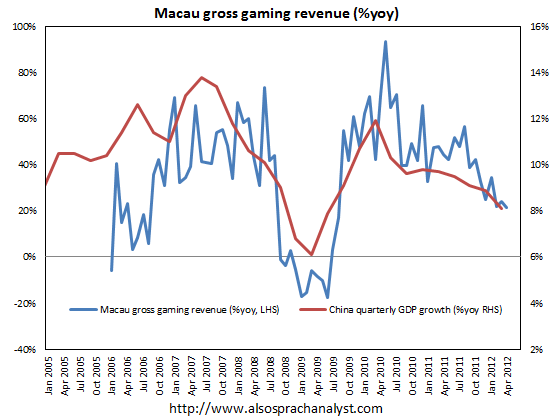

Signs of economic weakness are everywhere, this analysis shows a a tight correlation between Macau gaming revenues and Chinese growth - and gaming revenues are falling.

Next door in Hong Kong, the Hang Seng Index is not behaving quite as well as the Shanghai Composite. The index rallied in February to fill the downside gap that occurred in August 2011, but the rally couldn't overcome resistance. The index has now violated an important support zone and weakening rapidly.

Further north from Hong Kong, South Korea is an economy that is highly sensitive to global economic cycle. In particular, the South Koreans export a lot of capital equipment and other goods to China. That country's stock market isn't behaving well either. In fact, it's cratering.

China has been an enormous consumer of commodities. Commodity prices have also been weakening as the CRB Index is in a downtrend and has violated an important support level.

Australia is not only a major commodity exporter, it is highly sensitive to Chinese commodity demand because of its geography. The AUD/USD exchange rate is falling rapidly.  AUD/USD" title="AUD/USD" width="698" height="309">

AUD/USD" title="AUD/USD" width="698" height="309">

Just to show how bad things are, the Canadian economy is similar in characteristic to Australia's. Both are industrialized countries that are large commodity exporters. The only difference is that Australia is more levered to China, whereas Canada is more sensitive to US growth. Take a look at the AUD/CAD cross rate as a measure of the forward expectations between the level of change in Chinese and American growth.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Focus On China, Not Europe

Published 05/28/2012, 04:21 AM

Updated 07/09/2023, 06:31 AM

Focus On China, Not Europe

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Hi Cam,

Just wondering where you will see the US markets going once operation twist ends? Perhaps what we see in the US markets is already reflecting the ending of operation twist and that no further stimulus from the Fed will show further deterioration?

Will the Fed come to the rescue once again?

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.