After starting the week under pressure from the Spanish regions requesting aid, the euro found short-term support – perhaps from the short sales ban in Italy and Spain. Although this tool is meant to curb short speculation on those economies, I’d like to point out two facts about short sale bans:

1) When have they ever worked?

2) Speculators will just move their short speculation to other economies which then bear the risk (i.e. Germany and France) which then puts pressure on them, and considering German taxpayers Germany is the bank for Europe, this will be a failed idea

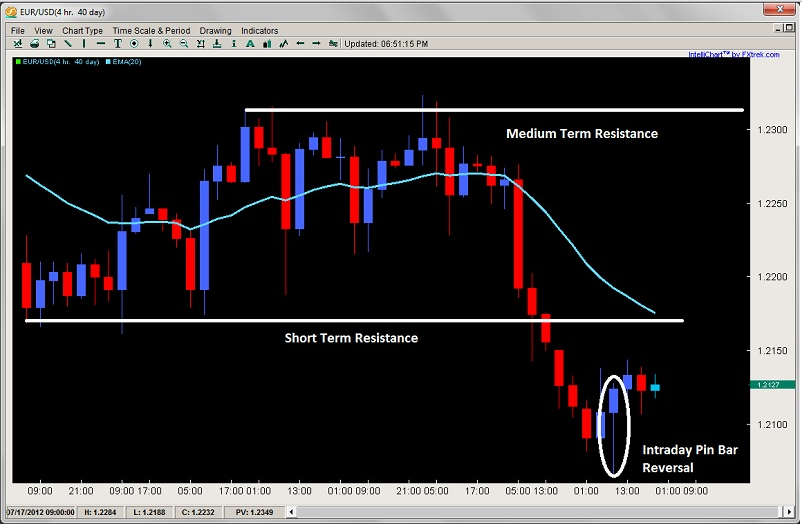

Nevertheless, the EUR/USD formed an intraday pin bar on the 4hr time frame at 1.2066, currently sitting at 1.2129. Does this trader think it will hold? Unlikely, this is why I prefer selling rallies either at the short-term resistance at 1.2169 area (and 20ema), or should this break, wait for a pullback to 1.2312 targeting 1.2175 and 1.2075.

Global Market Commentary:

Surges in Spanish and Italian yields, along with a recent Moody’s downgrade of Germany and Holland have been all the news and pressure on global investors as they look for the exits on any risk assets. Global markets sold off from Asia to Europe to the US anywhere from 1-3% per index. Spain and Italy have re-initiated a short sale ban (good luck with that) which has failed at every attempt, but this is simply a communication of how desperate and worried they are that things will get worse.

Spain will likely need a full-fledged bailout as all its regions are going bankrupt and will need assistance, meaning the money Spain got from the ESM will not be enough. Once we see how bad it really is in Spain, expect more fear and risk assets to sell off further. And don’t forget about Greece as it meets with its Troika creditors to see if they can meet their budget cuts (unlikely).

Expect the themes which started the week off with a bang to dominate till Friday’s close.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Forex Price Action Setups: EUR/USD Pin Bar Reversal?

Published 07/23/2012, 03:10 AM

Updated 05/14/2017, 06:45 AM

Forex Price Action Setups: EUR/USD Pin Bar Reversal?

EUR/USD

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.