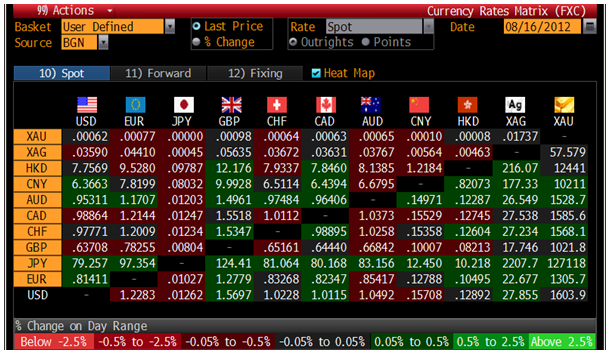

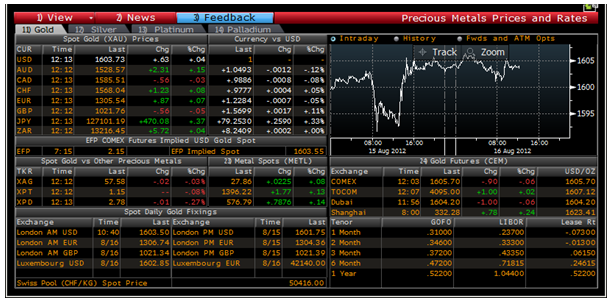

Today's AM fix was USD 1,603.50, EUR 1,306.74, and GBP 1,021.34 per ounce.

Yesterday’s AM fix was USD 1,594.75, EUR 1,293.60 and GBP 1,016.74 per ounce.

Gold rose $4.50 or 0.28% in New York yesterday and closed at $1,604.10/oz. Silver edged off and recovered to a high of $27.99 and finished with a gain of 0.07%.

Gold is floating in a tight range at $1,600/oz today and gold continues consolidating at this level.

The macroeconomic backdrop remains highly supportive with the eurozone debt crisis far from resolved and the risk of debt crisis in Japan, the UK, India, China and the U.S. in the coming months.

US data reported yesterday clouded any certainty over the US need for imminent quantitative easing. However, it is certain that the hawks and doves will have much to discuss at the upcoming Jackson Hole Economic Policy Symposium at the end of the month.

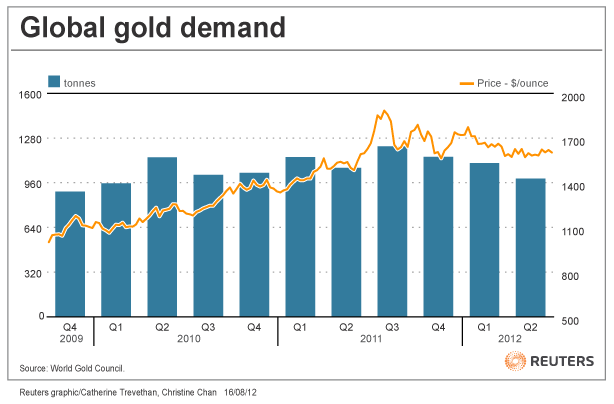

The World Gold Council released its quarterly report today, Q2 2012 Gold Demand Trends Report and can be read in full on the World Gold Council website.

Accumulation of gold bullion from central banks was the bright spot in demand last quarter, as total demand fell 7% globally, which was driven by a 38% fall in consumer demand from India.

Price sensitive Indians have been shunning gold and many have been opting for far cheaper poor man’s gold – silver.

Jewellery and investment demand both fell. Jewellery consumption was down 72.3 tonnes at 418.3 tonnes, while investment fell 88.3 tonnes to 302 tonnes.

The report shows how while record levels of demand from western markets, China and particularly India have been followed by a decline – the seismic shift that is central banks going from being bet sellers to net buyers has provided a new fundamental pillar of support for the gold market.

Physical demand slowed down in western markets and especially in India in recent months but large buyers continue to accumulate - both hedge funds and central banks and this is providing fundamental support to gold above the $1500 to $1,600/oz level.

2Q total central bank gold purchases were double the level reported a year ago as emerging market sovereign nations sought to diversify away from the dollar and euro and heightened economic insecurity.

Gold purchases among central banks hit its highest quarterly levels (157.5 metric tons) since the sector became a net buyer of the yellow metal in 2Q 2009.

The official sector which comprises central banks and other official institutions had by comparison bought 66.2 tons in 2Q 2011.

If central banks continued to purchase gold at the current rate the official sector gold take would total nearly 500 tons this year, topping the 458 tons purchased in 2011 by the sector.

Central banks have become net buyers of the yellow metal increasing their reserves as a hedge against the sovereign debt crises affecting the euro and dollar. Prior to 2009, central banks had been net sellers of gold bullion for nearly 20 years.

Central banks of Russia, Saudi Arabia, Mexico, Turkey, Kazakhstan, Thailand, Ukraine and the Philippines have been recently active buyers of gold.

Kazakhstan's central bank purchased gold for its 7th month in a row this June, rapidly growing its reserves which are now 1 million troy ounces higher than last year, according to International Monetary Fund data.

There is the potential of greater demand from unreported purchases by the People's Bank of China - should they decide to again report an increase in their gold holdings.

The global banking, financial and monetary system is, to put it frankly, a mess and will take years to rectify - in the meantime gold looks set to continue gradually eking out safe haven gains.

Global gold demand is back at levels seen in 2009 which shows that the assertion that there is a gold bubble mania with "Joe and Jane public," the investment and non-investment world “piling into” gold is far from the case.

As a percentage of pension and investment portfolios and of central bank currency reserves gold allocations remain miniscule from a historical basis and miniscule when compared to allocations to more risky equities and bonds.

This suggests that the gradual increase in demand and then slight decline in demand since Q3 2011 is nothing more than then ebb and flow and is sustainable. There is a possibility that the gradual increase in demand in the coming years could give way to a more substantial increase in demand in the coming years.

Given the appalling fiscal and monetary backdrop, demand for gold, particularly from investors and store of wealth buyers will likely increase significantly in the coming years – as gold gradually goes from a its status as a fringe investment back to being a mainstream asset common in all investment portfolios and owned by the majority of investors and savers.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Investment Demand And India, China Demand Down; Central Bank Demand

Published 08/16/2012, 08:34 AM

Updated 07/09/2023, 06:31 AM

Gold Investment Demand And India, China Demand Down; Central Bank Demand

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.