Gold took a serious tumble today, a day filled with news releases regarding Europe’s LTRO (long-term refinancing operations), and commentaries from Bank of England Governor Sir Mervyn King and Fed Chairman Ben Bernanke.

There were other forces at work as well. The European Central Bank sold 7.6 tons of gold last week, very likely as part of a fund-raising move to meet its share of the Greek bail-out contributions. Many hedge funds sold off as well, in order to cover their losses in equity markets.

There is also a rumor that the Chicago Mercantile Exchange will again raise its margin requirements for the precious metal, as they did back in August. Larger margins, of course, mean holders of gold contracts must either make additional deposits on their accounts, or sell off some positions.

So does all this pressure mean our rally is over?

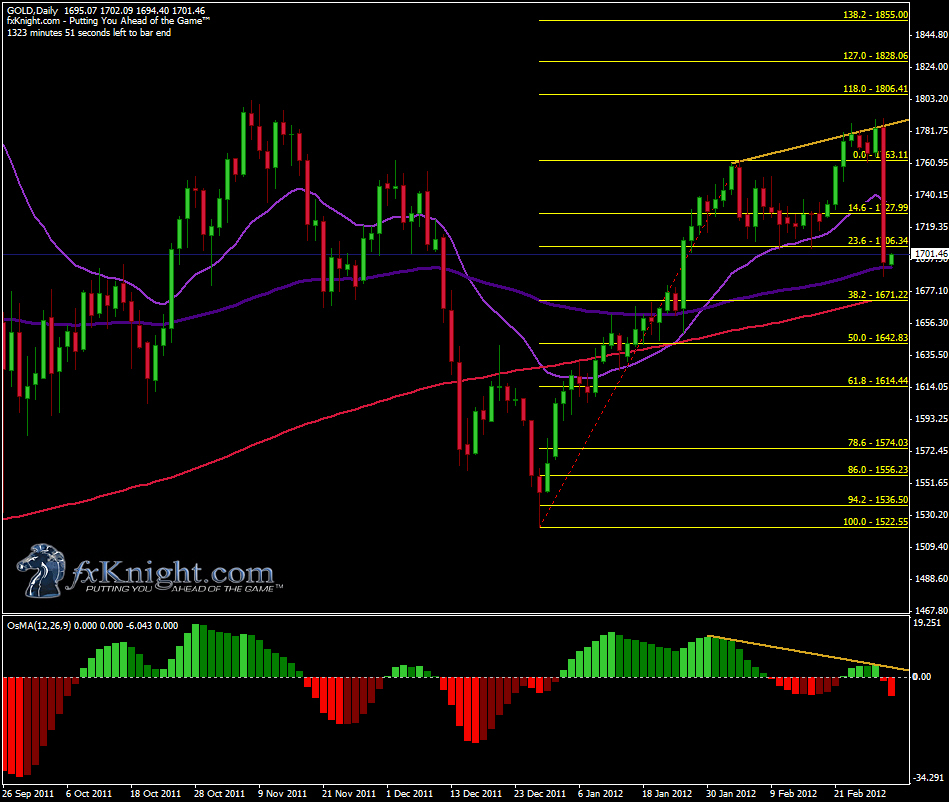

Not necessarily. While today’s drop was indeed dramatic, gold actually managed to find support above the weekly 21 exponential moving average. Also, to some extent, this drop was to be expected from a technical perspective, as 1787.79 is a prior high from October. There were also divergences visible on both the daily and 4-hour charts.

Where do we go from here? That depends on a large part whether we can find support in the 1671.22 – 1690.74 zone in the days ahead. If so, look for gold to rally back up to 1763.11, possibly 1787.79 once again (our long-term targets for gold are at 1828.06 and 1855.00, possibly as high as 1881.39, but that’s only IF we can break 1787.79 and find some support there, first).

If gold fails to find support at 1671.22, then the next potential downside targets include 1647.10 and 1614.44

Personally, over the long-term, I remain confident that as governments continue print their way out of this financial crisis, gold will continue to become increasingly more attractive to investors.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Gold Takes a Tumble – Is This the End of the Bull Run?

Published 03/01/2012, 05:15 AM

Updated 05/14/2017, 06:45 AM

Gold Takes a Tumble – Is This the End of the Bull Run?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.