Greek program ends with default

Last night’s IMF payment deadline came and went with little noise and light; Greece has not paid the EUR1.5bn that was owed and is now officially in arrears – a default in the language of the IMF. Greece is the 47th richest economy in the world and has defaulted the amount of money that seems to be thrown around for the next tech start-up on a weekly basis. The juxtaposition of that shows how mismanaged this entire process has been.

Clever wordplay will not save the Greek economy moving forward however. Yesterday the Greek Prime Minister Tsipras asked to extend the now expired program for a few days in order to cover Sunday’s referendum as well as debt relief – changes to the term, amount and interest due on the country’s debt pile, plus a two-year loan from the European Stability Mechanism.

“No” camp leading in opinion polls for now

Angela Merkel seems happy to let any further negotiations wait until Sunday’s referendum has passed. The first opinion poll on the matter has showed a clear lead for the “No” camp at the moment. 54% of poll respondents would vote to reject the terms of the bailout and possibly drive Greece out of the euro, while 33% would say “Yes” with 13% undecided. There is a lot to play for and there seems to be gathering momentum behind the “Yes” camp; some commentators believe the “No” camp support has fallen around 10 percentage points since the imposition of capital controls on Sunday night.

Euro is lower this morning following that poll announcement but is not collapsing as yet. Large pro-EU demonstrations in Athens overnight may have given the market some succour that all is not lost.

UK GDP revised higher in Q1

Yesterday’s UK GDP announcement showed a dependable if unspectacular reading of 2.9% on the year. Q1 of this year was the 9th consecutive month of positive growth and the battle remains largely between a strong domestic demand picture and a weak export landscape.

Our outlook remains that UK growth will sit at around 3.3-3.5% on the year through the rest of 2015 – barring a Grexit catastrophe – and this expansion will be driven once again by the services sector and improvements in wage settlements as the year goes on.

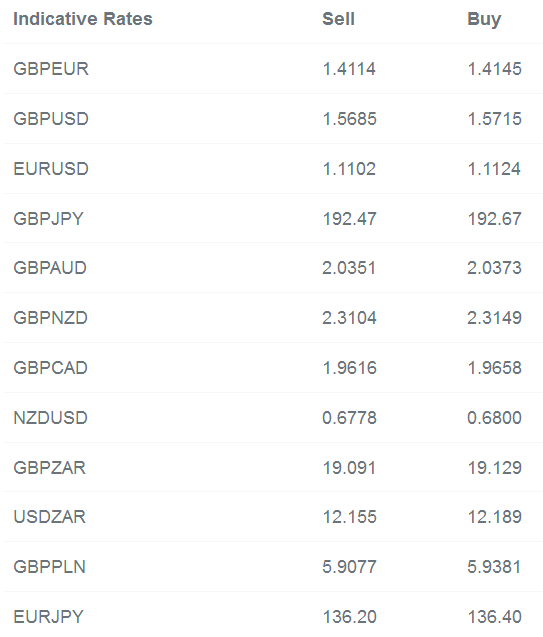

The outperformance against estimates allowed sterling some time to run higher, driving upwards against higher yielding and commodity currencies – AUD, CAD, NZD, ZAR– as they are sold on fears of just what might be next for these markets.

Greece and PMIs today’s focus

Today’s markets will obviously be dominated by any further developments from Greece but as it’s July 1st we will once again be taking a look at the world’s manufacturing sectors. Overnight, China’s manufacturing industry managed to eke out a marginal rate of growth (50.2 vs 50.4 expected, where anything over 50.0 is seen as expansion) as the impacts of stimulus seem to be stabilising as opposed to expansionary.

With China’s release out of the way we focus on Europe and the US. Italy’s number is due at 08.45, France at 08.50, Germany at 08.55, and the Eurozone wide measure at 09.00 with the UK number due at 09.30. The US’s ISM is due at 15.00.