- this was the always bullish Joe Weisenthal's headline yesterday morning following the release of the New Home Starts and Building Permits data. "It's hard to think of a bigger bullish trend right now, at least in the short term," he stated.

That is indeed a very bullish statement about a sector of the economy that is still running at very recessionary levels of activity. However, the reports for September showed that on a seasonally adjusted basis, new home starts surged to 872,000, a 15% gain for the month, and a rise of 34.8% from a year-ago. While it was once again the multifamily component which jumped 25.1%, the single-family component also improved, gaining 11.0%. Housing permits also jumped 11.6% in September to an annualized pace of 894,000 which was up 45.1% from a year-ago. This is good news, however, it is not quite worth the euphoria that Mr. Weisenthal attributes to the report. However, I have never known Mr. Weisenthal to be anything BUT exceptionally bullish. In the now famous words of Jerry Seinfeld: "There is nothing wrong with that."

However, let's analyze the data beyond the headline to determine what is really occurring.

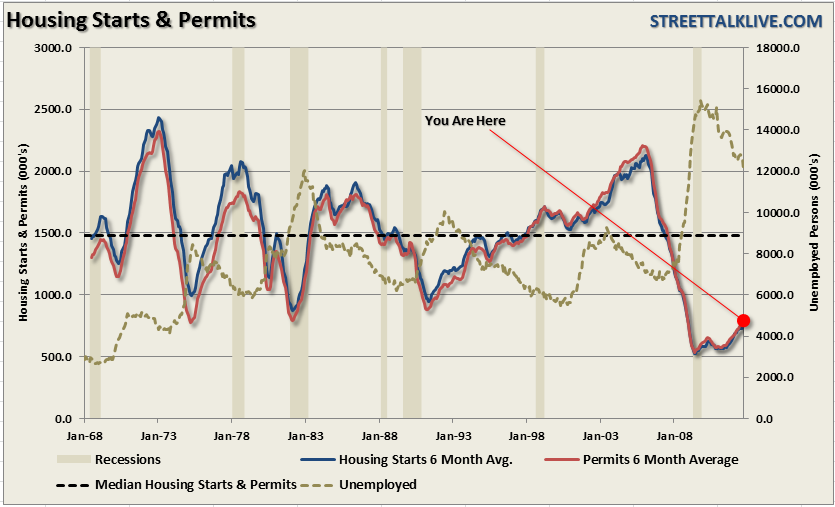

As we have discussed so many times in the past, it is not the monthly data point that matters but rather the trend of the data that is much more important. The chart below shows new housing starts and permits. Clearly, while the data has ticked up in recent months, we are still a very long way from being able to call this a recovery.

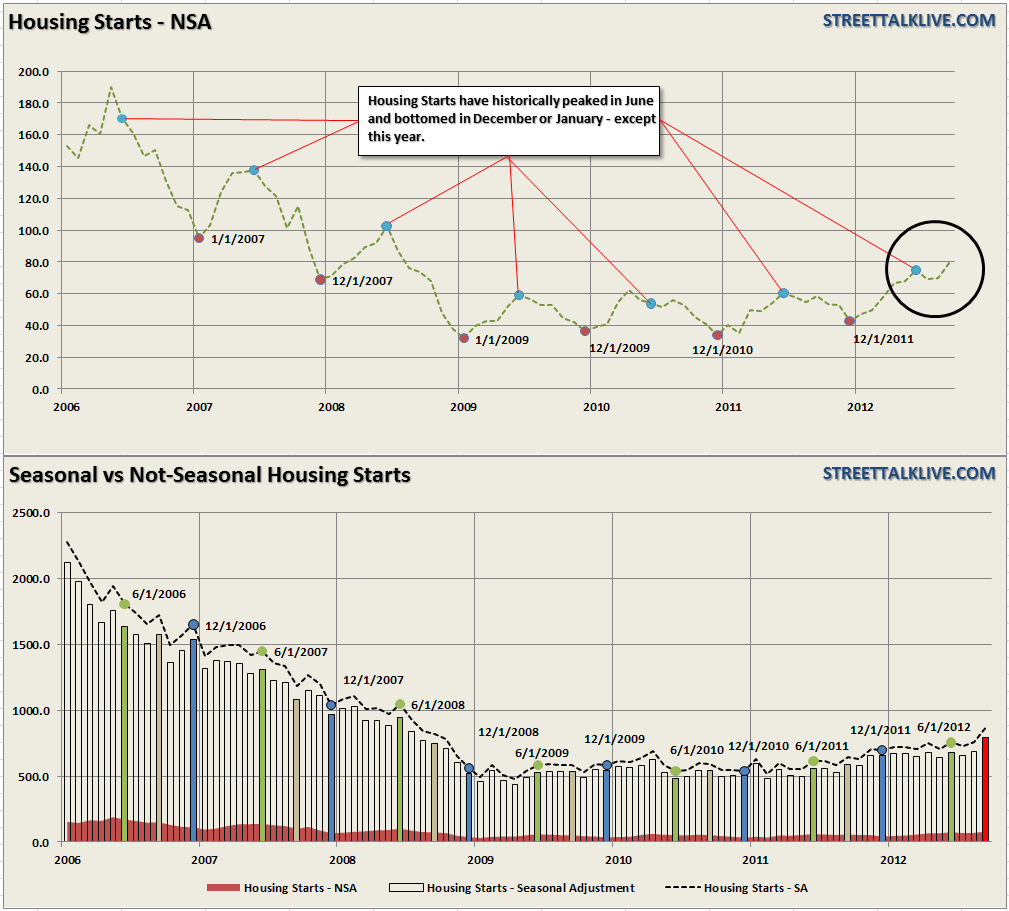

Secondly, the seasonal adjustments, as we saw with retail sales, were exceptionally large in September. The series is highly volatile to begin with so seasonal adjustments are used to smooth the data. However, in the most recent month, the seasonal adjustment was larger than normal and the entire trend has been diverging from historical norms.

The chart below shows the Seasonal versus Non-Seasonal Housing Starts data going back to the peak of 2006. Just for the record, the number of new home starts in September, on a non-seasonally adjusted basis, was 79,000 up from 70,100 in August.

Housing starts tend to peak around June of each year and then trail lower through the end of the year. More importantly, the seasonal adjustment in September is normally lower than, or roughly equal to, the June adjustment. That is until the last two years of the "housing recovery" where the seasonal adjustments have been pushing the data higher. The seasonal adjustment for September, on a percentage change basis from August, was the largest on record at 15.28% going back to 1959.

While it should be expected that by now we should be seeing some pickup in housing, the majority of the activity is still occurring in the lower end of the price spectrum. The problem going forward remains the economy.

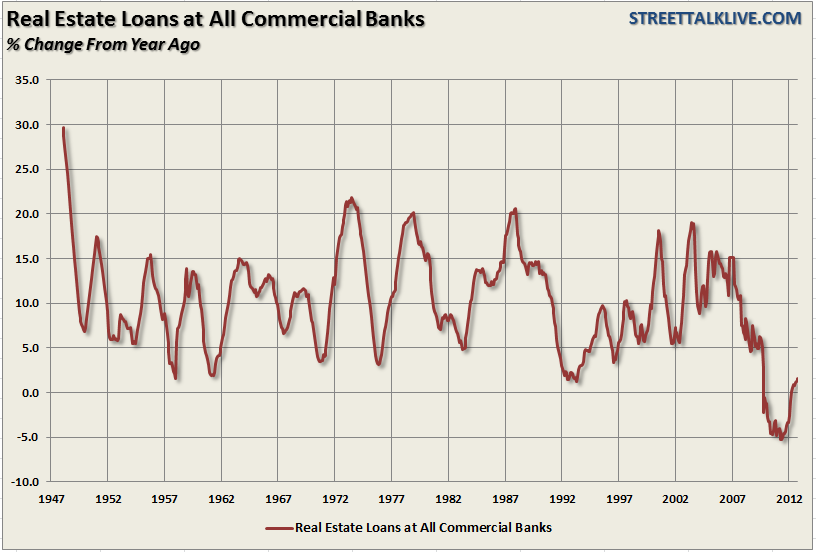

The underlying fundamentals, especially in the 25-35 cohorts, are simply not in place to create a sustainable upturn in housing. This is particularly the case as consumer liquidity remains severely impaired by high unemployment, stagnant wages and negative real income growth. Furthermore, there is a disconnect between new home starts and real-estate related loan activity at commercial banks. The change in lending from August to September was up a mere 0.2% and is only up 1.6% from a year ago.

Of course, that data represents all real-estate related lending and covers both existing and new homes, however, the level of activity is still well shy of something that would support such a rampant increase in the latest month's data. Furthermore, when it comes to new home sales in particular, there are many exogenous related factors that can skew the data in the short term such as requirements on builders to maintain lines of credit, unusual weather patterns as we saw at the end of 2011, shifts in lending requirements, over anticipation of demand by builders which leads to excessive spec-home building and contractual requirements on developers.

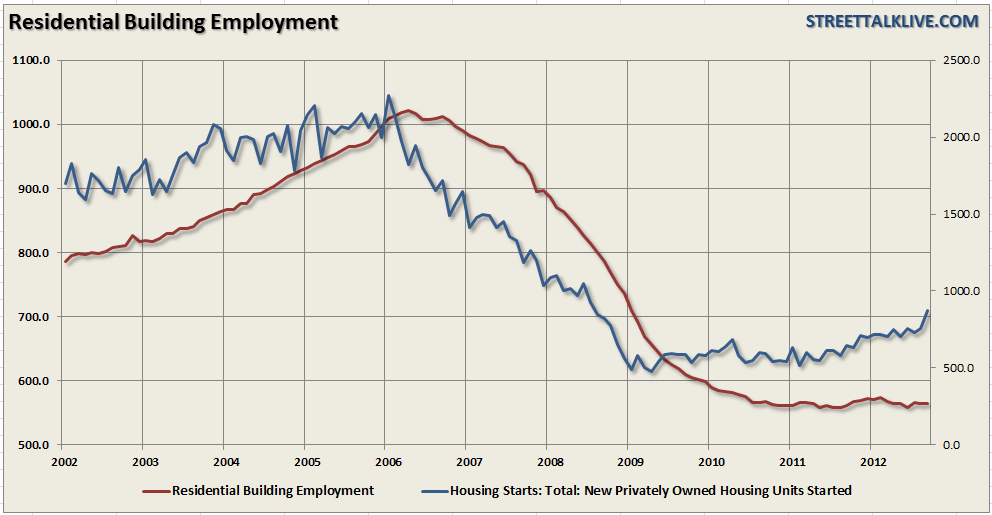

One of the areas that we would expect to have seen increase sharply at this point would be residential construction workers. The mainstream media has been touting the housing recovery for well over a year now yet residential construction has remained stagnant.

The disconnect between the housing data and the real demand for construction workers is important and suggests that the demand for new homes has not yet reached a level where builders are forced to take on more full time labor. One of the reasons why home construction has historically been very important to the economy is the impact of the multiplier effect from construction. Without employment turning up the "multiplier effect" remains muted.

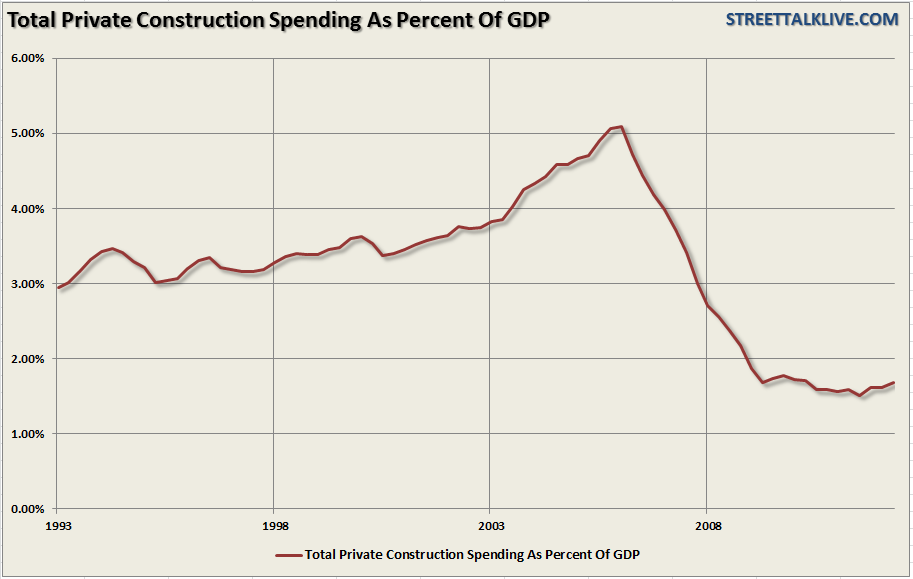

This is why the impact from housing on GDP is questionable. While the upturn in housing does have some effect on the overall economy the impact has been greatly reduced in recent years as the economy has shifted into the global marketplace. Today, total private construction spending makes up less than 2% of GDP where it was greater than 5% at the 2006 peak.

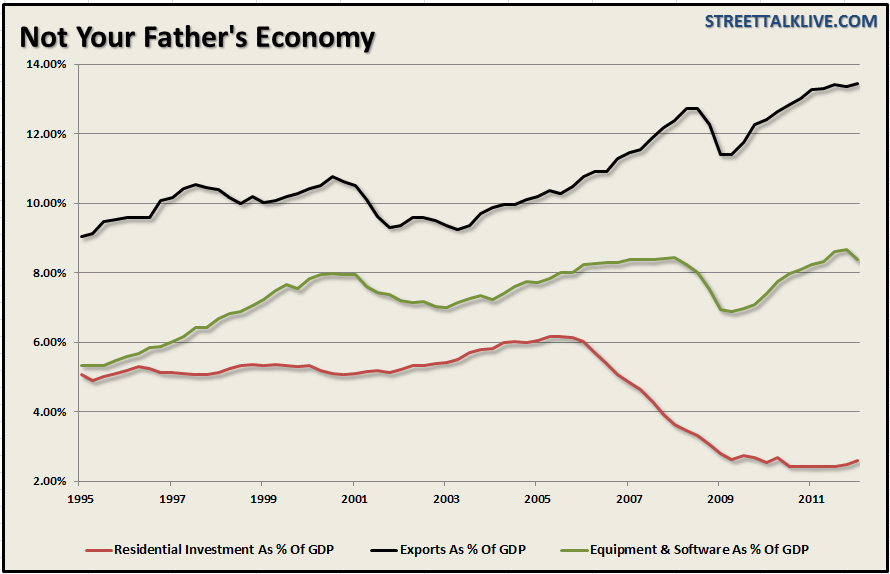

Since the turn of the century, globalization has changed the drivers of the domestic economy. While the economy was once driven by domestic manufacturing and housing, today it is driven by expenditures on equipment and software and exports to our trading partners.

The drive for higher profits while delivering cheaper products to consumers required companies to invest heavily into productivity, outsource manufacturing and aggressively cost cut to maintain profitability. At the same time the globalization of the market place made exportation of products and services a much greater percentage of overall domestic corporate profits. Expenditures on equipment and software currently makes up more than 8% of GDP as exports comprise more than 13% of the economy.

The recession in Europe and slowdown in China, as witnessed by reports from many international companies including Caterpillar (CAT), Norfolk Southern (NSC), FedEx (FDX), UPS (UPS), Intel (INTC) and IBM (IBM), is impacting the domestic economy. The slowdown in exports is likely to be a more substantial headwind to economic growth than the roughly 2% contribution from residential investment can offset.

The bottom line here is that the recent months reports are certainly good, and welcome news in an otherwise fairly weak and stagnant economy. However, let's not put the "cart in front of the horse" in assuming that the economy is about to come roaring back to life. The protracted stagnation in the housing market which remains at recessionary levels well into its fourth year of activity gives little to be excited about. The current activity falls well within the bounds of normal volatility, and we will likely see revisions lower in the coming months ahead, as seasonal variations began to negatively impact the data towards year end.

The important point, however, is that while the housing data on the surface is showing improvement, the more important components to sustainability from employment to lending are not. As stated above - the impact on the economy from the recessionary drag in Europe and slowdown in Emerging Markets is likely to have a far greater impact on the domestic economy today than housing can offset.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Housing Starts And Permits: Euphoria May Be Premature

Published 10/18/2012, 01:18 AM

Updated 02/15/2024, 03:10 AM

Housing Starts And Permits: Euphoria May Be Premature

"The Most Bullish Development On The Entire Globe"

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.