AIMA has issued an updated “roadmap to hedge funds,” written by Alexander Ineichen for the benefit of actual and potential investors.

Much of the road map is Ineichen’s effort to steer investors away from some myths. From the point of view of the hedge fund industry, some of the myths are negative (such as the idea that hedge fund investing is just gambling) some are positive (such as the notion that hedge funds generate strong returns in all market conditions.) Let’s stick with just those two.

To the observation that hedge funds are gamblers, Ineichen replies that their business model is a good deal closer to that of the managers of a casino. A casino itself is simply involved in a form of statistical arbitrage, "betting" that the laws of probability will hold.

Let us consider, next, the excessively optimistic myth that hedge funds win in all market environments.

Performance and Fees

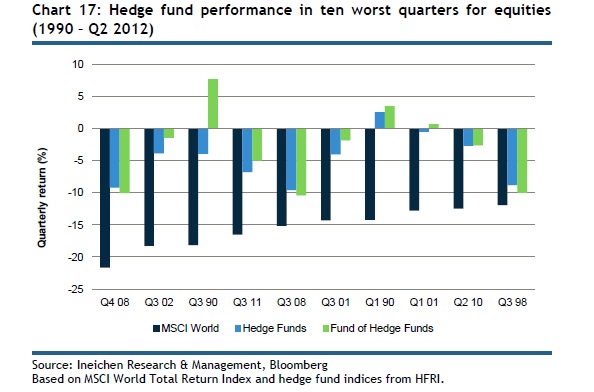

In the above chart, the dark bars represent equity performance, and the X axis displays the ten worst quarters for equities since 1990, ranked from most to least hideous. The blue bar represents hedge fund performance and the green bar represents funds of hedge funds.

Fund of funds produced positive performance in three of those bad quarters, and single fund results as indexed by the HFRI showed a positive performance in one of them, the first quarter of 1990. Most of the time, though, hedge funds are negative if the equities markets are sharply negative, although the funds’ relative performance is better. Even when the three bars seem to converge, notably in the third quarter of 1998, the time of Russia’s default and the Long-Term Capital Management crisis, this relationship held.

Ineichen also addresses some of the hot-button issues of investor/management interaction, including fees, leverage, and style drift. As to fees, he points out how hedge funds differ from mutual funds. Mutual funds typically remunerate their managements based on the percentage of assets under management, regardless of performance. This leaves them without the incentive effects for high performance that are built into hedge fund fee structures. It also means that talent, or perhaps entrepreneurial initiative or boldness, tends to move over time into the hedge fund orb.

Leverage

It was, Ineichen tells us, “banks and homeowners, not hedge funds, that misjudged the dangers of leverage” in the events leading up to the 2008 global financial crisis.

More broadly speaking, the accounting-based measurement of leverage can be very misleading. This method of measurement treats leverage as the ratio of total asset to equity capital on a balance sheet. If a fund has $4 million in liabilities, and $5 million in assets, then its net worth is the difference, $1 million, and this should show up as the value of its equity. Its leverage then is 5:1. If the value of its assets falls by 10 percent from $5 million to $4.5 million, and the liabilities are unaffected, then its equity has fallen to $0.5 million, and the leverage is now 9:1.

Suppose the managers have the fixed idea that 5:1 is the right leverage ratio. They could return to it by selling $2 million in equities, paying off that amount of their liabilities. This means the entity now has equity of $0.5 million, and that the 5:1 ratio has been restored.

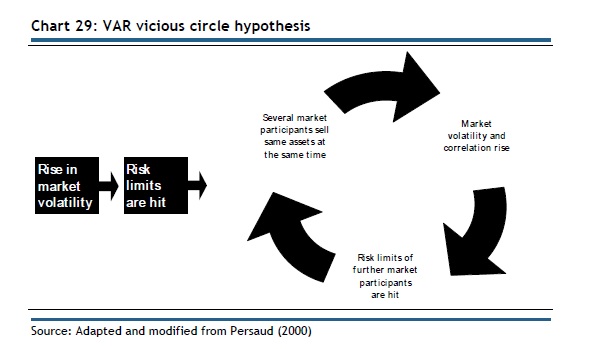

But a lot of asset managers acting on the same imperative create a very dangerous cycle. If the situation is homogenous (that is, if the reduction in asset level was set off by an event that affected a lot of such firms in much the same way) then they’ll all be trying to sell the same sorts of assets at the same time. What will be the consequence of that?

From Ineichen’s Roadmap adapted from Avinash Persuad.

Ineichen’s point here is simply that quantifying leverage isn’t a straightforward operation. But the two take-aways from his discussion of the issue are: that hedge fund leverage is very small compared to that of banks, and that only in a very small portion of the hedge fund industry does it exceed five.

Style Drift

Style drift, another big issue for many investors in hedge funds, is the risk to investors that managers will gradually move away from those areas of expertise or strategy where they originally had an edge, the edge that may have attracted the investment of those investors in the first place.

Although investors are naturally inclined to see such style drift as a bad thing, they should be cautious about demanding that managers stay within a tightly-defined core area of expertise. After all: every market changes.

“Market inefficiencies, for example, have a tendency to disappear,” Ineichen says, “ as they become known to the market and attract capital, If manager restrictions were too tight, the manager would not be able to exploit inefficiencies in a neighboring or related market as they appear, thereby missing the first-mover advantage.”

The many flash points notwithstanding, perhaps the key feature of the topography of this map is an understanding of the favorable relative performance of hedge funds, and the possibility that there is in the end “no such thing as a safe place for wealth to rest; government guaranteed investments included.”

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Investing In, Not Gambling Within, The Casino

Published 11/21/2012, 02:34 AM

Updated 07/09/2023, 06:31 AM

Investing In, Not Gambling Within, The Casino

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.