In our May 2010 report entitled “Investing In The Natural Gas Revolution” we concluded that there would long-lasting strong global demand for natural gas for three main reasons.

1. New technological innovations allowing for the extraction of natural gas from previously inaccessible locations – in particular reserves trapped in underground shale basins – have significantly increased the world’s supply of natural gas. This additional supply, and the accompanying drop in prices, will continue to stimulate demand for natural gas for the foreseeable future.

2. The development of liquefied natural gas is connecting countries with previously stranded natural gas reserves to major natural gas producing countries.

3. Natural gas is less polluting than either coal or oil. This is especially the case when compared with coal, its main competitor in the electricity sector.

We also argued that the expansion and modernization of the natural gas-related infrastructure required to keep pace with growing demand would translate into a long term bull market for equipment and services providers active in this sector. This includes equipment and services related to the exploration, development and distribution of natural gas.

The advantages of investing in the natural gas revolution via equipment and service providers:

- While the significant increase in reserves will stimulate demand for natural gas in the longer term, waiting for supply to catch up with demand means squeezed profit margins for natural gas producers, particularly those based in North America where prices have dropped the most. In contrast, equipment and service providers are already benefiting from the infrastructure that is being built to tap and eventually absorb the new supply, as well as to keep pace with growing demand over the longer term.

- Unlike natural gas producers, equipment and service providers are not required to make significant upfront capital investments to get production going before being able to earn a return on their investments. This requirement exposes natural gas producers to the risk that once gas production is up and running, the host country will significantly increase royalties or, in a worst case scenario, completely renege on its contract obligations. Equipment and service providers tend to get paid sooner and a more regular basis, which allows them to limit their losses should the business environment take a turn for the worse.

Recent developments support our main investment thesis

1) The world’s estimated reserves of natural gas continues to surge

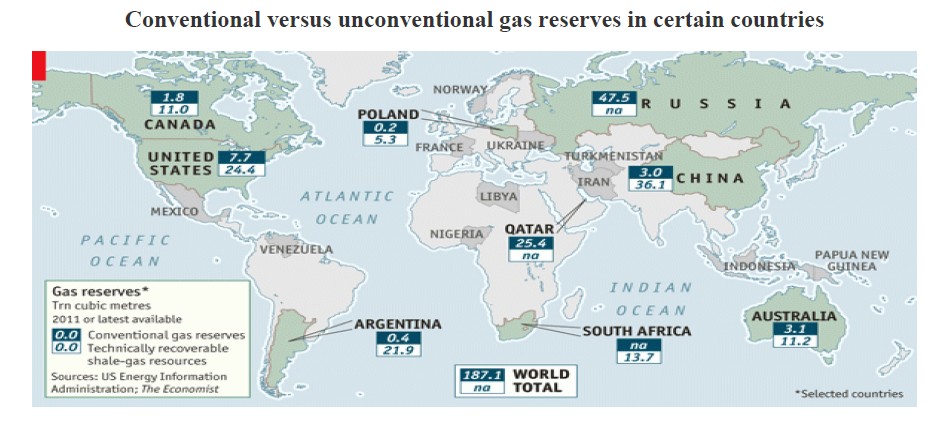

The U.S. Energy Information Administration published a report last April analyzing 48 shale-gas basins in 32 countries. The shale gas reserves identified in these countries alone is estimated to be 190 trillion cubic meters,1 which would increase the world’s technically recoverable reserves by 40%. This study does not take into account possible reserves in the Soviet Union and the Middle East where huge reserves of conventional gas will make investment in shale gas unlikely for many years to come.

2) Global infrastructure needs

The International Energy Agency estimates that meeting growing global demand for natural gas will require that $9.5 trillion be invested in natural gas-related infrastructure between 2010 and 2035. This is a significant increase from its prior estimate of $5.5 trillion for the period of 2007 to 2035.

3) Nuclear power’s loss, natural gas’ gain

In the wake of the nuclear catastrophe in Japan, nuclear power faces unprecedented regulatory and political scrutiny. In the most extreme cases, some countries have even decided to abandon their nuclear programs altogether. The German Parliament voted to close all the country’s nuclear power plants by 2022.The Swiss Parliament voted to phase out nuclear power out by 2034.Belgium set a target for abandoning nuclear power

by 2025.Opposition to the building of plants has also hardened in areas of India where the government is planning to build nuclear power plants. Violent protests near the port of Jaitapur on India's west coast left one fishermen dead and three others injured last April.

Even before the nuclear disaster in Japan, the nuclear power renaissance was already under pressure in the developed world. Many nuclear proposals in the U.S., for example, had been scrapped for financial reasons. According to the Council on Foreign Relations, “building a nuclear power plant ranges anywhere from $5 billion to $12 billion--with construction times estimated at between six and ten years. The lower-end estimate alone is almost double the cost and the construction time of building a coal or gas plant.

4) The Continuing U.S. Natural Gas Revolution

At the start of the last decade, the United States experienced a surge in the construction of liquefied natural gas import terminals over fears its natural gas reserves were in terminal decline. These fears could not have been more wrong. Today, these terminals are sitting idle and the worries now center on finding buyers for the country’s surplus of gas.

One area where this surplus is being deployed is in the electricity sector. Due to the growing regulatory and environmental resistance to coal, utilities have been moving steadily towards natural gas. Between 2000 and 2010, coal's share of U.S. electricity production dropped from 52% to 45%, while gas’ share increased from 16% to 24%.

This influx of supply and drop in prices has also been a boon for both consumers, who benefit from lower heating and electricity costs and manufacturers who are heavy users of natural gas. Indeed, Dow Chemical and other companies in the same sector are building large facilities in the U.S. to take advantage of the cheap supply. This is a radical change from early 2000 when the chemical industry was shutting down U.S. plants and shifting production overseas due to the high cost of natural gas at the time. France’s Vellore& Mannesmann Holdings Inc., one of the world's largest makers of steel tubes for the energy market, has recently decided to build a $650 million plant in Ohio in order to profit from America’s energy renaissance.

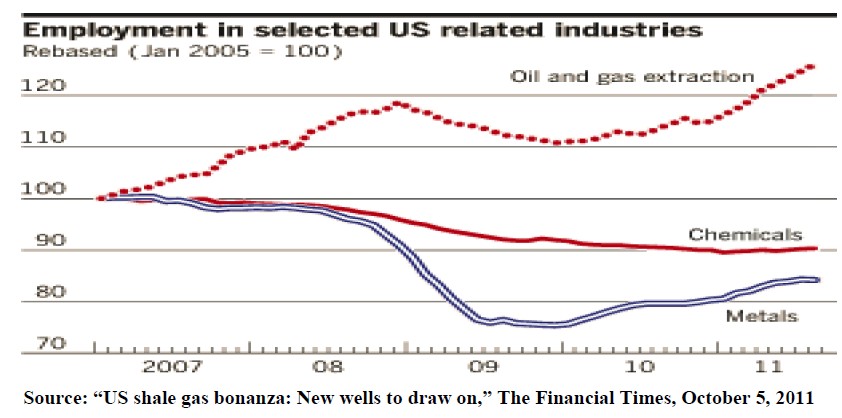

The oil and gas extraction sector is one of the few good news stories on the U.S. job front, with employment having increased by over 20% since 2005. These figures do not include the indirect jobs created by the influx of money into the regions where production is located.

The Interstate Natural Gas Association of America forecasts that by 2035 the US will need to spend $205 billion (in 2010 dollars) on new gas pipelines, processing facilities and gathering systems in order to meet growing demand for natural gas.

5) China jumps on the natural gas bandwagon

China is aiming for natural gas to account for 10% of its energy consumption by 2020, up from its current 4%.12 China’s demand for natural gas has risen by more than 20% annually since 2004. If current trends hold, China will be Asia’s largest consumer of natural gas by 2015, according to the International Energy Agency.

The U.S. Energy Information Administration reported that China’s reserves could hold 36.1 trillion cubic meters of shale gas,an amount equal to 12 times the country’s proven conventional gas reserves.This figure is even higher than America’s estimated shale gas reserves of 24.4 trillion cubic meters.This provides China an opportunity to not only improve its energy security, but to also cut back on air pollution by reducing its reliance on coal. China has cited the importance of acquiring expertise in shale gas exploration and production in its 2011-2015 five year plan.

In order to keep pace with its growing demand for natural gas, China plans to build 300,000 kilometers of natural gas pipelines over the next 12 years. As of the end of 2009, China had 36,000 kilometers of gas pipelines in place.

6) Israel’s potential game changing discovery of new natural gas reserves

Israelis have always complained that they live in the only part of the Middle East with no significant energy reserves. In December 2010, a huge natural gas discovery made inside Israel’s territorial waters put an end to these complaints. Analysts believe the discovery could provide Israel with anywhere from 50 to 200 years of gas reserves at current levels of consumption. Israel currently imports 40% of its gas needs from Egypt. Deteriorating relations between the two countries and the recent cutoff of gas supplies due to the sabotage of the pipeline on the Egyptian side of the border means that this discovery could not have come at a more opportune time for Israel.

7) The Canadian government tilts away from coal, leaving natural gas to fill the void

The government has proposed that, effective July 1, 2015, all new coal plants, including ones that are being refurbished, be forced to limit their discharge of carbon dioxide and other pollutants to the emission levels of high-efficiency natural gas-fired power plants.Coal power plants would in theory only be able to meet certain of these targets by capturing the carbon dioxide and sequestering it underground – a process that is still largely unproven. Once a coal plant reached 45 years in age, it would be forced to shut down if it was unable to comply with the emission requirements.If enacted, these regulations would effectively destroy coal’s growth prospects in Canada for the foreseeable future, setting the stage for natural gas to fill the void.

Investment Recap

We feel that equipment and service providers active in the natural gas sector are best positioned to benefit from the recent developments mentioned above. Companies in this market include:

Halliburton, Baker Hughes and Schlumberger, which provide drilling and other related-services to the gas and oil sectors

GE, Siemens and Caterpillar, which manufacture natural gas-fired turbines

Air Products & Chemicals, which produces liquefied natural gas processing technology

Vallourec of France and Indian-based Welspun Gujarat Stahl Rohren, which build natural gas pipelines

ENN Energy of China, Gujarat State Petronet of India and America’s El Paso Pipeline Partners,which are in the natural gas delivery and storage business

National Oilwell Varco, which is a manufacturer of large mechanical components for land and offshore drilling rigs

Over the long term, we are also bullish North American natural gas producers once their reserves have been connected to the global markets.

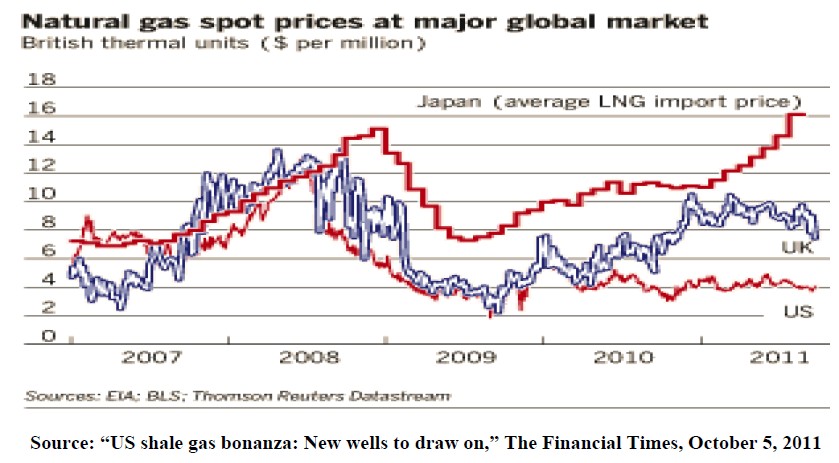

Given the lack of LNG export facilities in North America, the discovery of huge quantities of huge new reserves cannot be sold abroad. As a result the price of natural gas is much cheaper in North America than it is in Asia and Europe.

This price differential should narrow once projects to export gas in the form of liquefied natural gas plants are completed in sufficient numbers. There are at least 6 LNG export projects on the drawing board for North America, including several in the United States that were originally built to import natural gas. In Canada, the Kitimat, B.C., project led by Apache Corp. has been approved by the National Energy Board. Royal Dutch Shell is also considering building a liquefied natural gas export terminal in British Colombia.22 Many companies, which are heavy users of natural gas, are against the idea of exports because they fear it would eventually lead to significant increases in the price of natural gas in the U.S

For a more in depth analysis on the growing global demand for natural gas and related-investment opportunities please refer to our report May 2010 entitled “Investing In The Natural gas Revolution.”