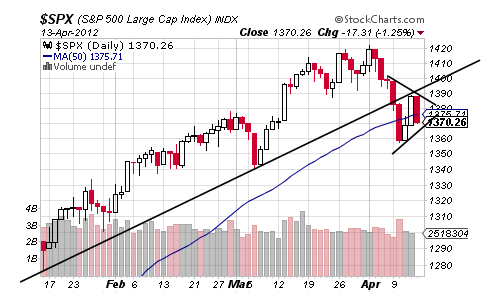

In just breezing through a few of the key charts, it appears that, yes, Monday may be a mess. So much so, it’s hard to know where to begin to convince you of this possibility so let’s just start with plain vanilla and this means my favorite the S&P.

Not only is the S&P trading in a confirmed intraday Bear Pennant not shown above with a target of 1358 but the S&P has closed below its 50 DMA once again and appears to be showing a nice Pipe Top within a Bear Pennant. Relative to Monday, it is the Pipe Top that is worth watching and it confirms at 1357 for a target of 1327 while the Bear Pennant confirms at the same level but carries a target of 1310.

Both possibilities are showing in the chart of the VIX with its inside candle looking less violent than before but nonetheless one that supports fireworks and probably up and off of yesterday's low for a target of just below 22 and a level that is consistent with the sideways range shown below even though the VIX provides some room for the mess to come mid- to late next week rather than on Monday.

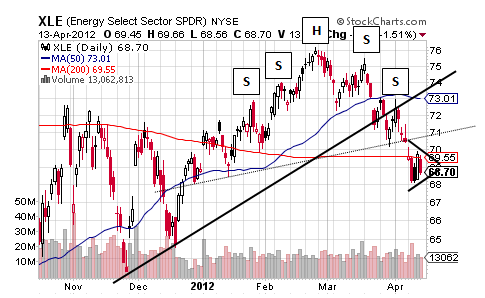

Rather than turning this into a charting bonanza, though, and perhaps break some of those charts out over the weekend, let’s turn to the chart that may make the most bearish case of all and that is none other than the XLE and a chart that’s been watched here closely for weeks now as a Complex H&S developed, confirmed and an event that the took the XLE below its 50 DMA.

Now there’s a lot of busyness going on in that chart above but it all boils down to the XLE’s position below the ascending trendline marking its near-term uptrend and something that took the XLE below its 50 DMA on that Complex H&S only to trade into a Bear Pennant below its 200 DMA. Maybe the XLE somehow uses that consolidation to put in one last shoulder between $71 and $72 but based on the look of the previous charts it seems doubtful.

Rather it seems that the XLE will confirm that Bear Pennant by dropping below $68.10 for a very conservative target of $63.20 and a level that the XLE is likely to hit in the weeks ahead unless it climbs above $70.14.

When the bulk of this potential drop takes place is to be seen, but there does seem to be a decent chance that Monday is going to be a mess.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Is Monday Going To Be A Mess?

Published 04/15/2012, 02:30 AM

Updated 07/09/2023, 06:31 AM

Is Monday Going To Be A Mess?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Gee I thought this was for Monday June 4th. lol

WRONG

euro wont recover Obama need to win some votes so he will have to bring oil down usd up as for now hes losing with a MESS with oil and cost of living POPING

Very little mess so far for stock markets. A bit more messy for the Euro.

Let's hope the bears will take control of the rest of the day.

Go Bears!

with Spain next to bat it will be a mess also china

ng ng tanks some more and crude gold will be volatile

shes cute

Thank you Abigail.

Hopefully indeed Monday will be a complete mess.

This week ~100 companies of the S&P 500 will publish their earnings.

Let's hope it will increase the Bearish sentiment.

Can you analyze XLF please?

In my opinion it is about to drop 10%-15% in the coming month.

Thanks

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.