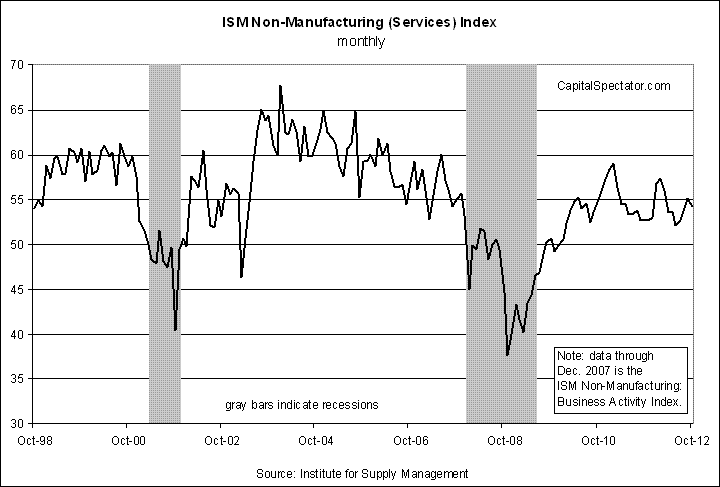

Today’s update of the ISM Non-Manufacturing (Services) Index for October corroborates the upbeat news from its manufacturing counterpart. In short, the economy continues to grow, or so these two widely watched indicators from the Institute for Supply Management suggest. The expansion is still well short of strong growth, but it's hard to make the argument that the economy is in danger of shrinking any time soon.

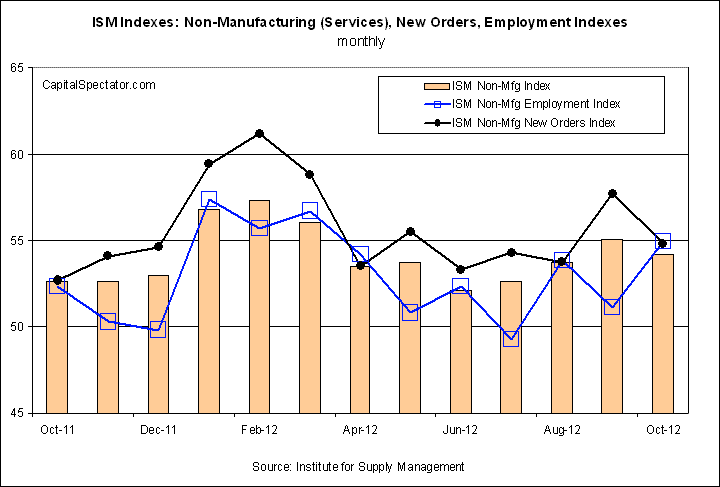

Although the ISM Services Index slipped a bit to 54.2 last month from 55.1 in September, it’s still well above 50 -- a sign that the services sector overall is still expanding. That's no trivial point for the dominant slice of commercial activity in the U.S. Any reading above 50 equates with growth. On that note, the ISM indexes for new orders and employment indexes in services also remain well above 50.

Combined with the growth bias in ISM’s read on manufacturing, it all adds up to a convincing data set that implies that October’s economic profile will remain in the modest-growth camp when the final summary is published.

"Moderate growth in the U.S. economy continues," Joseph Trevisani, chief market strategist at Worldwide Markets, tells Reuters.

In fact, that’s been the general narrative all along. True, there have been a few bumps along the way, sometimes shaking confidence. But remaining focused on a broad set of indicators, primarily on a year-over-year basis, has offered valuable perspective on the primary trend, as shown by the regular updates of The Capital Spectator Economic Trend Index (CS-ETI). You can never really trust a handful of numbers, particularly if you're looking at how they've performed in recent months. A more reliable perspective requires looking across a broad spectrum of indicators, and filtering out the short-term noise.

The future, of course, can and does bring nasty surprises. But based on the numbers available so far, recession risk still looks low. That’s been a constant theme at CapitalSpectator.com for many months for a simple reason: the indicators, overall, tell us so. For various reasons, some analysts have been arguing otherwise, warning that the U.S. economy is poised to fall off the cyclical ledge, if it hasn’t already. A dark view of the business cycle, although understandable on an emotional level, has remained highly speculative and deeply flawed.

October’s macro profile is still in its infancy, and so anything can happen. But we’re off to a good start. Will the statistical support for anticipating modest growth continue in the days and weeks ahead? Stay tuned.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

ISM Index Points To Continued Growth

Published 11/05/2012, 01:40 PM

Updated 07/09/2023, 06:31 AM

ISM Index Points To Continued Growth

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.