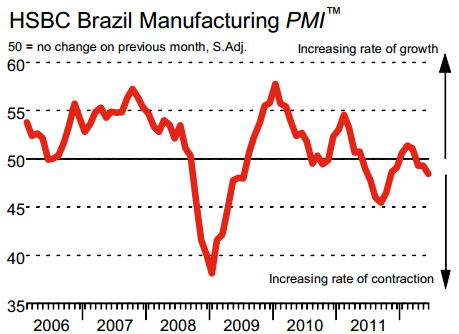

As is the case with China and India, we are now seeing material deterioration in Brazil's business conditions, particularly manufacturing. The June manufacturing PMI is showing some unexpected weakness.

HSBC/Markit: June data indicated a further deterioration in manufacturing business conditions in Brazil. Both output and new orders fell over the month, with the rates of contraction the strongest in eight months. Manufacturers generally commented on weak client demand. Concurrently, job losses were reported for the third month running...

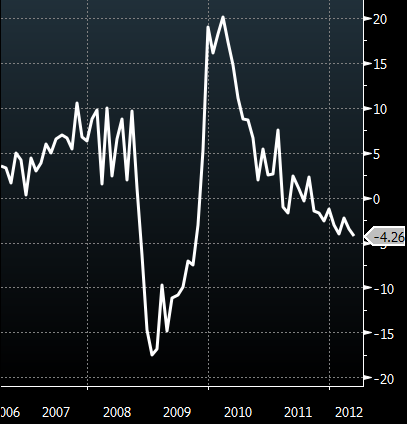

Today's Industrial Production number came in considerably weaker than expected - down 4.3% YOY vs. 3.3% expected.

GS: The industrial sector has been beset by higher costs (e.g., labor), soft domestic and external demand, and external competitiveness issues related to a still overvalued BRL.

The government has been pushing through quite a bit of stimulus to halt economic contraction.

Reuters: Intent on reviving growth, President Dilma Rousseff's administration has chopped central bank benchmark interest rates, provided industries and consumers with tax breaks, and vowed to step up government purchases of industrial goods.

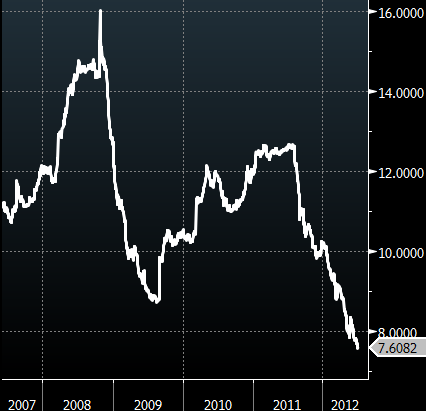

In anticipation of further rate cuts, the yields on government bonds have come off sharply. As the chart below shows, the 1-year yield is at a multi-year low.

Bloomberg: The central bank has cut its target lending rate by 4 percentage points since August, the most among the Group of 20 nations, to a record low of 8.5 percent. Traders are betting policy makers will reduce the benchmark to 7.75 percent by the end of next month, interest-rate futures yields indicate.

Some analysts are suggesting that if Brazil's currency weakens further (BRL is down 16% from this year's highs), Brazil's manufacturing may regain its competitiveness. But as with other emerging market economies, years of strong growth have covered up some structural problems that may not be simply patched up by lower rates, weaker currency, or other government stimulus.

WSJ: [Paulo] Leme [chairman of Goldman Sachs in Brazil], said Brazil's problems may go deeper than a sluggish global economy. Poor infrastructure, lagging educational standards and other structural problems held back Latin America's biggest country. "The country has a lot of room to grow...but it needs to resolve its own inefficiencies."

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

It May Take More Than Stimulus To Arrest Brazil's Slowdown

Published 07/04/2012, 01:59 AM

Updated 07/09/2023, 06:31 AM

It May Take More Than Stimulus To Arrest Brazil's Slowdown

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.