The euro traded down against the U.S. dollar Monday, as disappointing German business confidence numbers and uncertainty over the Spanish bailout weighed on the single currency. The single currency extended early losses against the U.S. dollar following a report indicating that Germany’s IFO business confidence index deteriorated to the lowest level since March 2010 this month, amid ongoing concerns over euro zone’s debt crisis. The Ifo index fell to 101.4 from 102.3 in August, the fifth monthly decline in a row, compared to expectations for a reading of 102.5. Meanwhile, uncertainty over whether Spain will request a full scale sovereign bailout weighed. In other news, concerns over Greece persisted as Athens prepared to present a package of spending cuts demand by international lenders to euro zone officials at the end of this week, amid fears that the country’s budget shortfall could be larger than expected. EUR/USD" title="EUR/USD" width="551" height="551">

EUR/USD" title="EUR/USD" width="551" height="551">

GBP/USD

The pound remained lower against the U.S. dollar on Monday, as sustained concerns over the debt crisis in the euro zone dominated market sentiment, weighing on demand for riskier assets. Risk sentiment weakened after a report earlier showed that Germany’s Ifo business confidence index deteriorated to the lowest level since March 2010 this month, amid ongoing concerns over euro zone’s debt crisis. The German Ifo business climate index fell to 101.4 from 102.3 in August, the fifth monthly decline in a row, compared to expectations for a reading of 102.5. Meanwhile, uncertainty over whether Spain will request a full scale sovereign bailout weighed. Meanwhile, concerns over Greece persisted as Athens prepared to present a package of spending cuts demand by international lenders to euro zone officials at the end of this week, amid fears that the country’s budget shortfall could be larger than expected. GBP/USD" title="GBP/USD" width="551" height="551">

GBP/USD" title="GBP/USD" width="551" height="551">

USD/JPY

The U.S. dollar edged lower against the yen on Monday, trading close to a seven-day low as uncertainty over whether Spain plans to request a full scale bailout supported demand for the safe haven yen. Investors remained cautious, as Madrid is to present its draft budget for next year and announce structural reforms on Thursday, while the results of bank stress tests are due on Friday. In addition, ratings agency Moody’s is expected to complete a ratings review on Spain later this week. Over the weekend, Spain’s economy minister said the country would not rush to seek external financial aid, as pressure mounted on Spain to seek a bailout. Separately, Greece's finance ministry dismissed German media reports that the country's budget shortfall could be as much as EUR20 billion, almost twice as much as previously thought. Earlier in the day, the minutes of the Bank of Japan's August meeting showed that policymakers expect Japan's economy to return to a moderate recovery path on firm domestic demand and improving demand from overseas economies. The bank added that exports have slowed in recent months due to the slowing of other economies, especially those in Europe. USD/JPY" title="USD/JPY" width="551" height="551">

USD/JPY" title="USD/JPY" width="551" height="551">

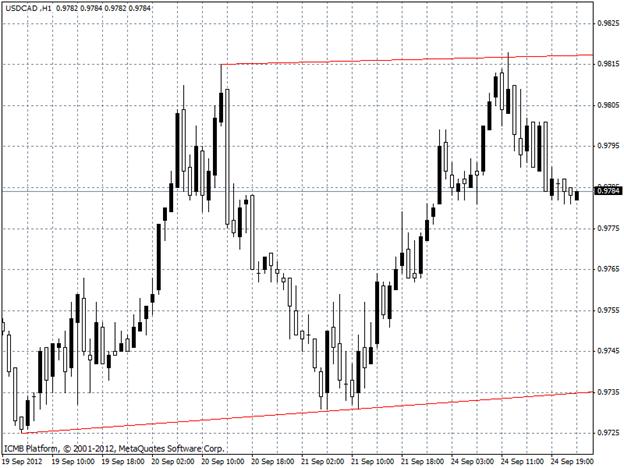

USD/CAD

The U.S. dollar advanced to a two-week high against the Canadian dollar on Monday, as renewed concerns over the long running debt crisis in the euro zone dampened demand for higher-yielding, riskier assets. Market sentiment was hit after a report showed that Germany’s Ifo business confidence index deteriorated to the lowest level since March 2010 this month, underlining concerns over the outlook for the bloc’s largest economy. Meanwhile, uncertainty over whether Spain will request a full scale sovereign bailout weighed on risk appetite. Trade was expected to remain subdued on Monday, with neither the U.S. nor Canada scheduled to release any major economic data. Investors were looking ahead to Tuesday’s Canadian retail sales data to provide more direction for the pair. USD/CAD" title="USD/CAD" width="551" height="551">

USD/CAD" title="USD/CAD" width="551" height="551">

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Major Currency Pairs Analysis

Published 09/25/2012, 07:32 AM

Updated 04/25/2018, 04:40 AM

Major Currency Pairs Analysis

ICM Brokers

EUR/USD

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.