Fed helps restore global confidence by signalling rate cuts

Leading indicators for global growth have been declining for over a year, US capacity utilisation has been falling since December and inflation expectations have been falling since May. This indicates policy action is required from central banks.

In the bigger picture, we have been in this situation before. In the 90s, the Tequila and Asian crises did not evolve into something too bad for the global economy. In past years we have seen a similar slowdown several times, which was turned around by central banks acting accordingly.

Central banks in Europe, emerging markets and now the US Fed are clearly taking steps towards easing in recent weeks. History suggests this can turn the global economy around if they stay committed and given time, but we have yet to see the actual turnaround.

For now, what seems to be playing out in FX is a 'battle of easing.' We think broad USD will weaken as a result, against Latin America, EUR and Scandies (not least versus NOK).

In Europe, SEK, NOK and GBP are also getting some help versus EUR through Fed action. Although GBP and SEK could weaken a bit more versus EUR, the expected weakening is less than what it otherwise would have been. In the coming quarters, the Fed reaction and USD moves are becoming very important for all major crosses both versus USD but also crosses against EUR.

Trade war fears and Fed repricing

Trump increased his pressure on China with tariffs moving from 10% to 25% on USD200bn worth of Chinese goods in May and worsened the tension with new threats of additional measures if Xi Jinping failed to meet him during the G20 meeting in late June. We do not expect a deal until H2 19, as we probably need to see more pain on both sides before they are willing to resume the serious trade talks. US growth seems to have peaked, inflation expectations and actual inflation are low and trade uncertainty may start weighing on the economy. Without more easing, it also increases the likelihood of sub-trend growth or perhaps even a forthcoming recession. We have changed our call to the Fed cutting by 75bp by year-end, with the first cut already in July. We still have a constructive US macro outlook, but we believe the risks are greater by not easing at all than easing too much or too early. If the Fed cuts rates, it is unlikely to be a 'one and done' cut, at least seen from a historical perspective, as the Fed usually follows a cut by lowering the rate further.

Oil - crashing to USD60/bbl

The oil price collapsed towards the end of May before finding support at USD60/bbl. The risk-off in the oil market came on the back of new threats from Trump towards Mexico and fears over further escalations in the US-China trade war. The balance in the market still looks tight. On the supply-side OPEC+ is implementing the output cuts agreed upon in December 2018 and is discussing a possible extension from June. Venezuelan production is in freefall, Libyan output is at risk following an insurgence and the waivers on Iranian sanctions have expired. On the demand side, the macro backdrop remains relatively weak as the macroeconomic data and global trade growth prospects have been weak. Risk assessment remains with any further rise in tensions between the US and Iran posing upside risks and a further escalation of the US/China trade war posing downside risks to the oil price. OPEC will meet early July to discuss extension of current cuts and adjustments to production to mitigate the effects of Iran, Libya and Venezuela. We see Brent on average at USD75/bbl in Q3 and USD80/bbl in Q4.

USD – Fed is now fighting for broad dollar weakness

The Fed has clearly signalled forthcoming easing and we expect a 25bp rate cut in July and an additional two rate cuts before year-end. This will contribute to sending the USD weaker as the carry attractiveness of the USD diminishes. Emerging Markets’ FX also stands to gain from this move.

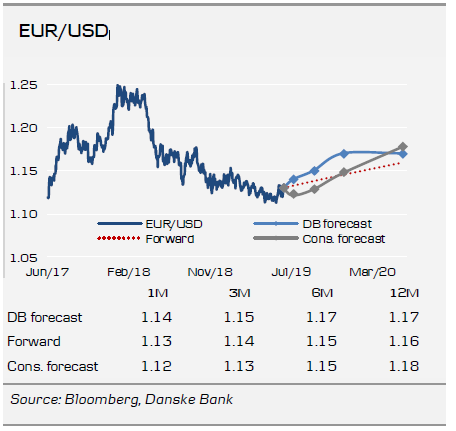

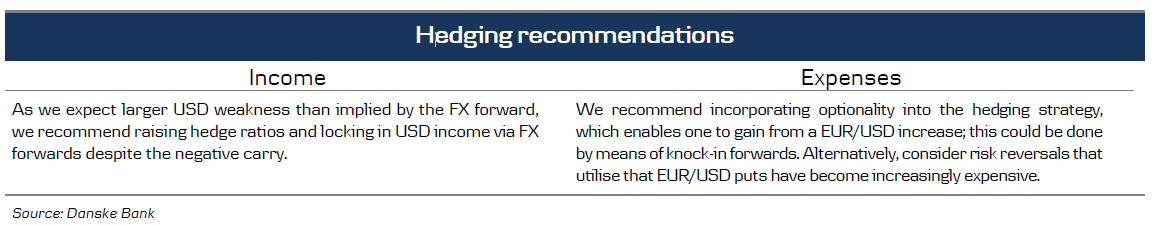

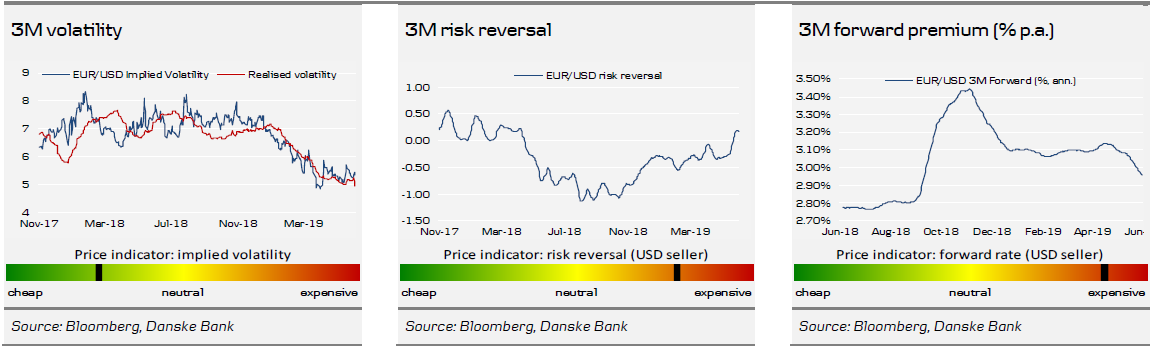

Outlook for EUR/USD

- The Fed is now clearly saying it will lower rates to keep the record-long expansion going and mitigate the ongoing weak global growth numbers.

- We do not expect global data to turn around for the better and see little risk of an end to the trade war anytime soon. Fed should hence stay dovish and pave the way for a continued trend higher in EUR/USD. However, a trade deal would also be USD negative.

- A trade deal and a ‘decent Brexit’ would be positive for the Eurozone and could pave the way for positive surprises later in the year, as a lot of negativity is priced in on the euro political side. The ECB is trying to talk down EUR/USD but we expect these efforts to have only secondary effect.

- External balances, as measured by relative current-account balances, hint at EUR/USD upside medium term but as history suggests, a deficit is sustainable for prolonged periods, notably for a world reserve currency such as the USD. The USD remains generally overvalued on most measures and our MEVA and PPP estimates for EUR/USD are in the 1.20s.

- ECB easing in the form of rate cuts, QE and/or further deterioration of the trade war are important downside risks to our forecast. In our view, the Fed has blinked and rate cuts are coming from July. The Fed-ECB monetary policy divergence should pave the way for a higher EUR/USD over the coming six months, as Fed is likely to be more dovish than the ECB. On 1- 3M (NYSE:MMM), Fed initiating an easing cycle will do most of the lifting, while on 3- 6M a US-China trade deal should weaken USD. We see EURUSD at 1.14, 1.15, 1.17 and 1.17 in respectively 1M, 3M, 6M and 12M.

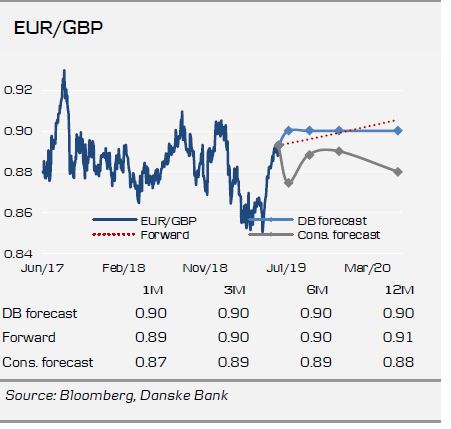

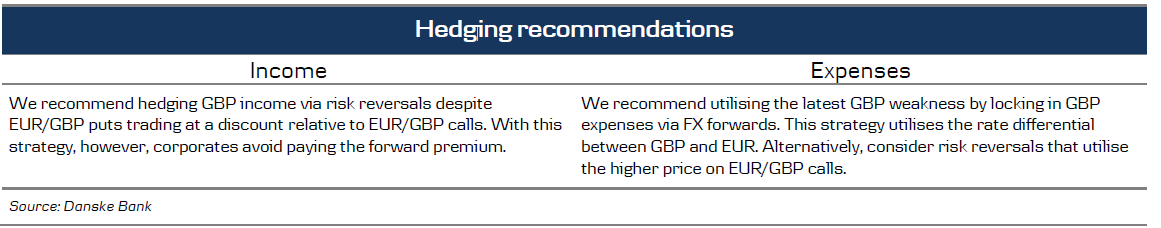

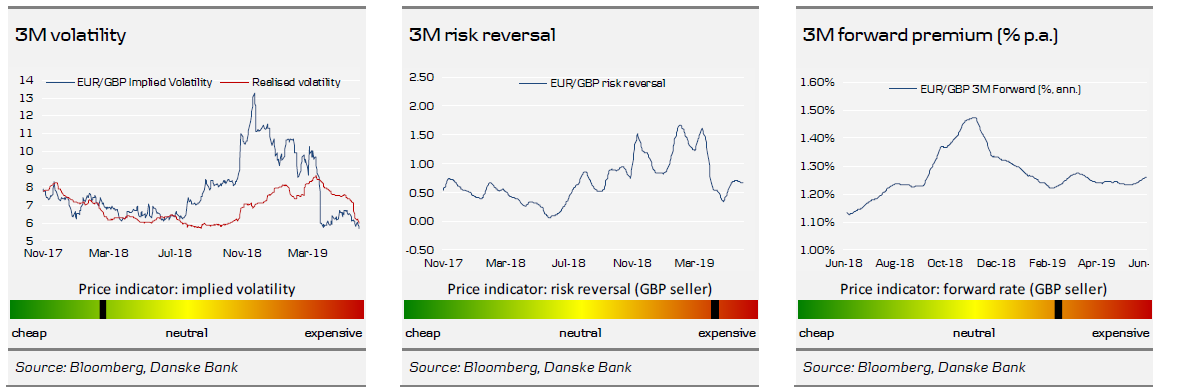

GBP – to remain a range play

Theresa May stepped down in June as PM and the Conservative party is in the process of finding a new leader. Boris Johnson remains the favourite. We expect EUR/GBP to trade near 0.90 over the summer but the risk of moving towards 0.91 has clearly diminished: Fed easing will do the heavy lifting that might otherwise have needed to be done by Bank of England.

Outlook for EUR/GBP

- EUR/GBP has gone substantially higher after the breakdown in cross-party talks that also led Theresa May to step down. We expect non-Brexit drivers to weaken the GBP slightly over the summer, as weak macro data is starting to take EUR/GBP higher.

- Bank of England does not seem in a hurry to raise rates in the current environment with UK leading indicators suggesting a slowdown, inflation and wages under control, weakness in Europe and prolonged Brexit uncertainty. This was again confirmed at the June meeting.

- A dovish FOMC makes it less likely that we should think about targeting a large move higher into the 0.90s. Part of a potential BoE reaction to weak UK data is now being handled by the Fed loosening global financial conditions. There is a large Brexit premium (about 5%) which, if unwound, would strengthen the GBP substantially.

- The GBP remains fundamentally undervalued: our PPP estimate is 0.76 but the no-deal Brexit risk makes a correction towards such very improbable. In terms of capital flows, foreign investors’ appetite for UK assets may rebound when we get some Brexit clarification but we are not seeing that yet.

- In turn, we forecast EUR/GBP at 0.90 over the summer. The likely range of outcomes is 0.86 - 0.91. The upper end of 0.91 is less likely as the Fed is set to do some of the lifting that might otherwise need to happen via BoE.

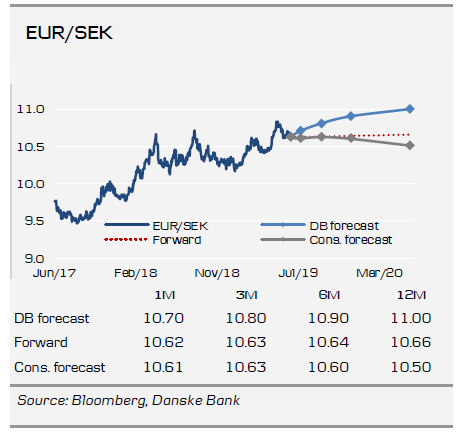

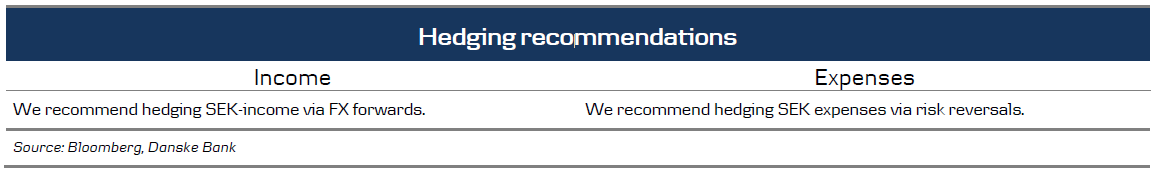

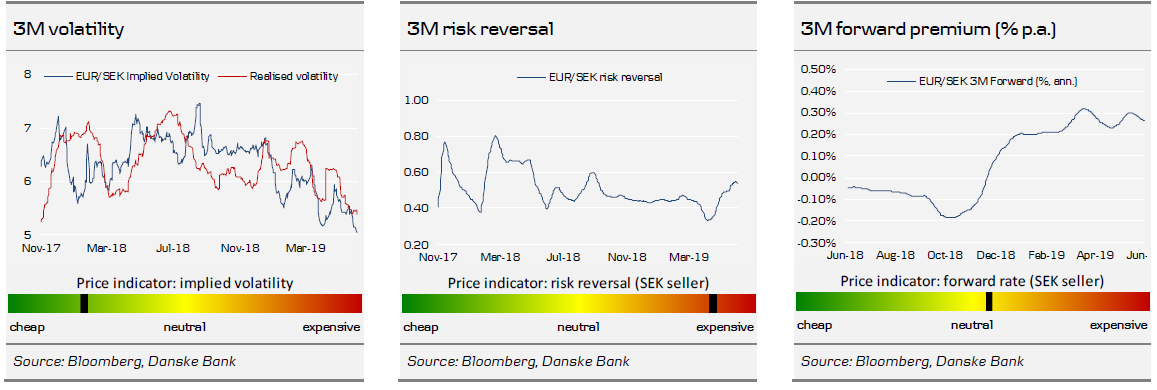

SEK – still difficult to turn bullish

As the major central banks in the world soften, the case for the Riksbank to keep its relatively optimistic outlook is deteriorating by the day.

Outlook for EUR/SEK

- Even though the two latest GDP prints exceeded consensus expectations, we would still argue that underlying Swedish growth has been weak. The reason is that the releases were boosted by net exports, which have counterbalanced the weak domestic demand. There is a clear risk that consumer spending and investments will remain weak throughout the year and thus we maintain our call for sub-trend Swedish growth during 2019.

- The inflation outlook remains a challenge, which probably will force the Riksbank to postpone planned rate hikes. Moreover, as international central banks soften, the scope for the Riksbank to keep its relatively upbeat rhetoric is shrinking by the day. We do not expect any major policy revisions at the July meeting. If anything, there might be a dovish shift with regard to market communication.

- The sizeable rate gap versus the USD has held back commercial and investors’ demand for the SEK and fuelled carry trades where the SEK has been the funding currency. As the Fed enters an easing cycle, these flows may abate, which in turn could support the SEK, providing downside risk to our EUR/SEK forecast.

- As international central banks soften, the scope for the Riksbank to keep its relatively upbeat rhetoric is shrinking by the day. That said, we do not expect any major policy revisions at the July meeting. A pronounced global risk-off environment could send the SEK down the drain, though partially balanced by investors scaling back carry positions. Significant Fed cuts (more than we pencil in) may send USD/SEK (and EUR/SEK) lower than suggested by our forecasts. We see EUR/SEK at 10.70, 10.80, 10.90 and 11.00 in respectively 1M, 3M, 6M and 12M.

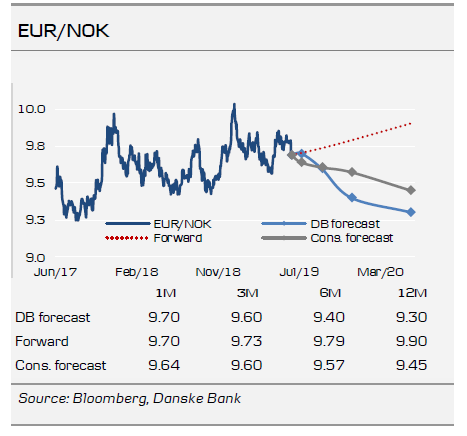

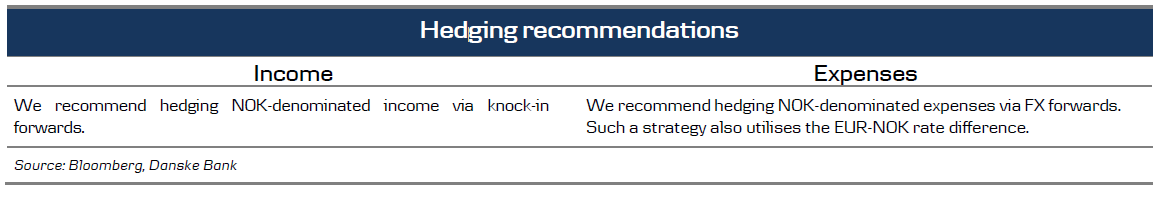

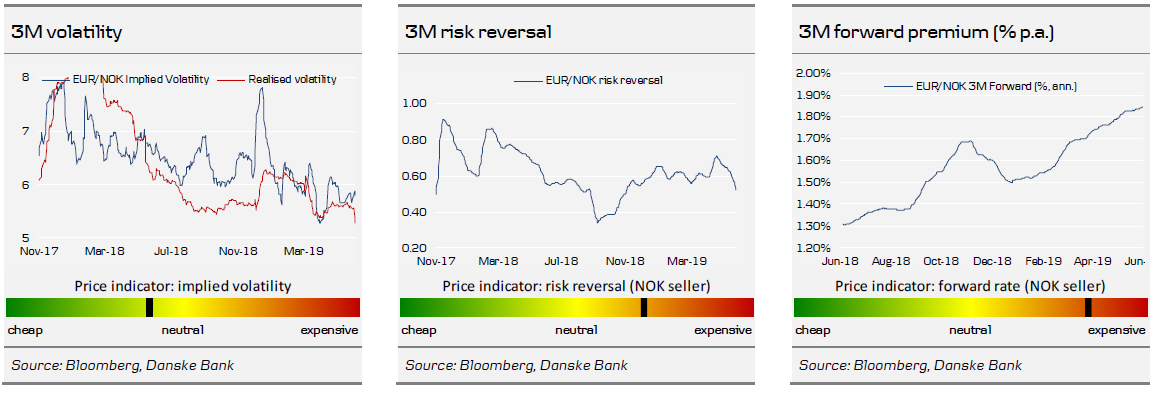

NOK – Norges Bank is the sole hawk in town

Norges Bank remains the sole G10 central bank hiking policy rates. So far, the relative rates’ impact on the NOK has been limited but we expect this to change as the NOK increasingly becomes attractive for foreign investors amid strong domestic growth.

Outlook for EUR/NOK

- As expected, Norges Bank hiked policy rates by 25bp at the June meeting. Meanwhile, more importantly the central bank maintained its clear tightening bias by signalling roughly two hikes over the coming year with the next one due already in September. This leaves Norges Bank as the sole G10 central bank hiking rates. So far, the relative rates’ impact on the NOK has been muted but we expect this to change as the carry in the NOK catches up alternatives in AUD, NZD and CAD.

- The important Regional Network Survey indicated growth in coming quarters of around 0.8% q/q, which is above trend potential and suggests that domestic wage pressures will continue to rise. This, in turn, has implications for inflation, as it means there now is less room for higher imported inflation – and hence a weaker NOK – if Norges Bank is to fulfil its 2% inflation target. As long as the growth outlook remains healthy, we believe this underpins the need for higher short-term rates.

- The NOK has suffered from foreign selling amid the escalating US/China trade war, lower oil prices and falling global inflation expectations. The decoupling from relative rates has been very pronounced over the past year and while a slowing China and the existence of more attractive commodity carry alternatives can partly explain NOK weakness, we still think the fundamental NOK backdrop is key to remember. As long as the global economy does not fall into a recession, global petroleum industries do not collapse and Norwegian competitiveness does not erode, the NOK would have to strengthen for Norges Bank to fulfil its inflation target.

To read the entire report Please click on the pdf File Below..