Market Preview February 25 - March 1

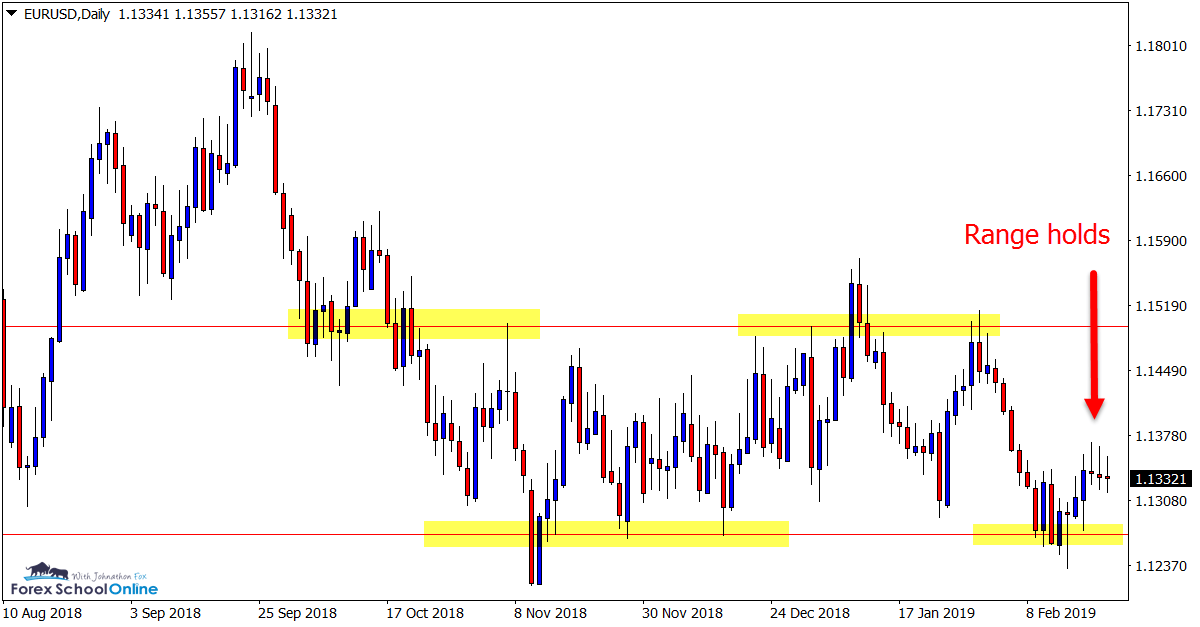

EUR/USD Daily: Pin Bar at Range Low – Price Moves Into Mid-way Point

Price action on the daily chart of the euro has been stuck inside a sideways range box for many months.

This week after attempting to break out and through the lows of the range, the price fired off a bullish pin bar and engulfing bar to once again reject the support and move higher.

Until the price makes a decisive break from this range, trading anywhere within the middle of the range looks to be incredibly tricky.

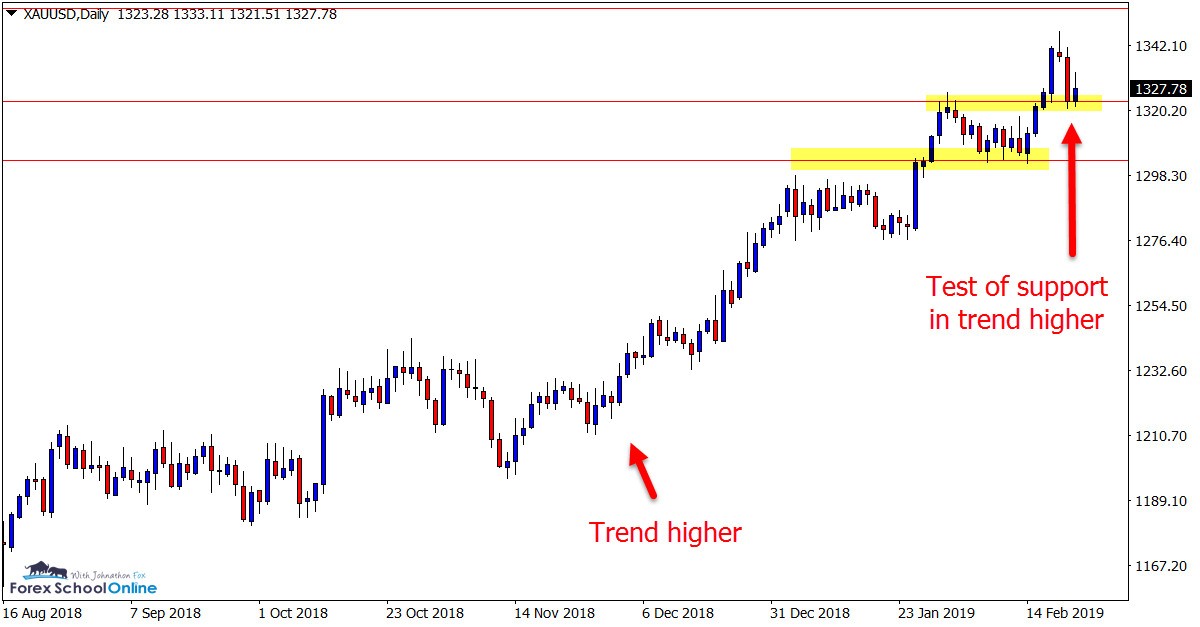

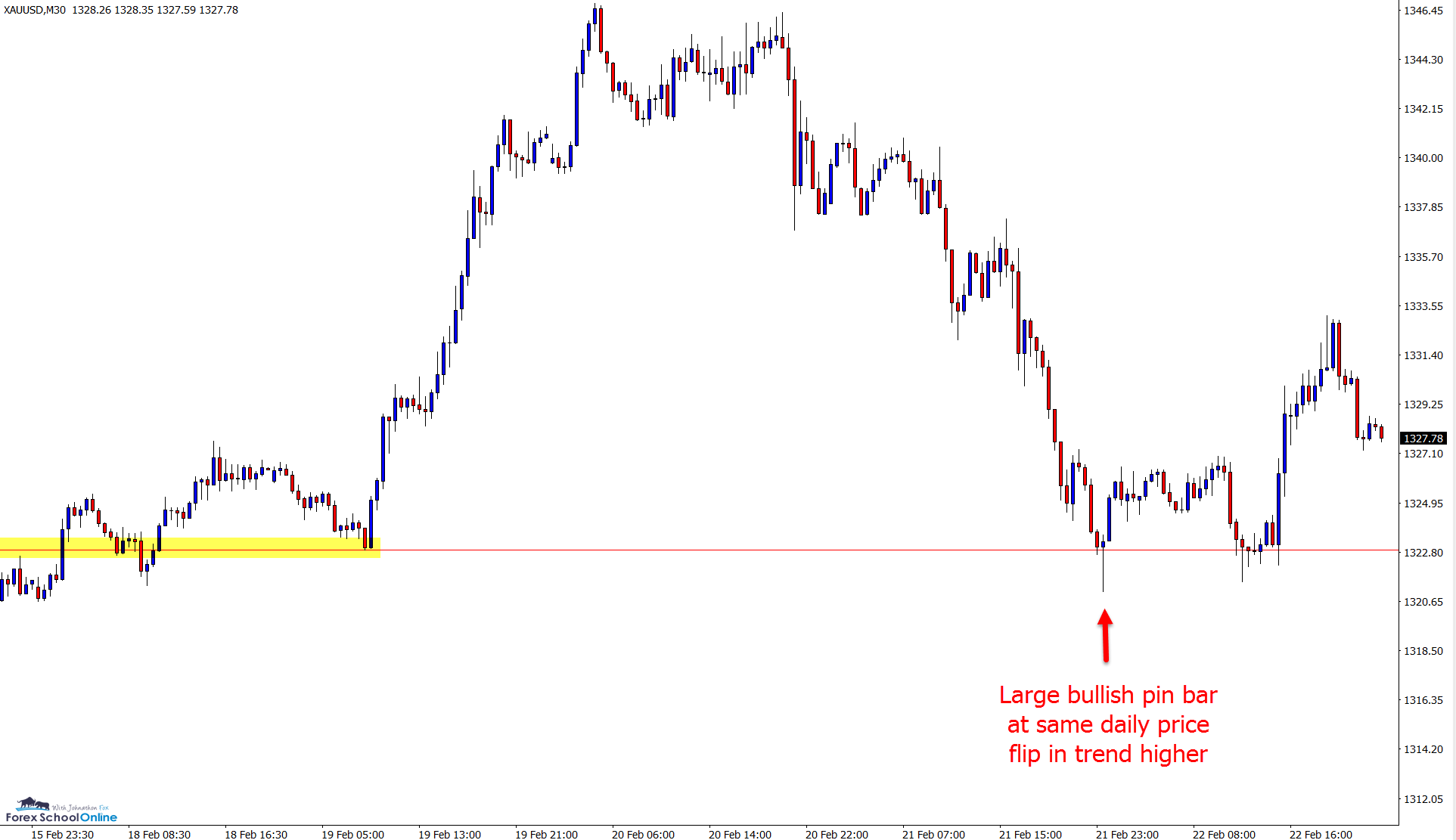

Gold Daily And 30-Minute Chart: Price Flip And Pin Bar In Strong Trend

In last week’s trade ideas we discussed this market and the strong trend higher price had been clearly moving in.

Over the past week, the price of Gold has continued this move, making a new high and breaking out of the daily resistance level.

We have now had an intraday test of the old daily resistance and new support, with price forming a pin bar on the 30-minute chart.

After a large move higher off the back of the pin bar, the price has since hesitated. This week will be interesting to see if the price can gain momentum and move back into the extreme highs that 2018 reached.

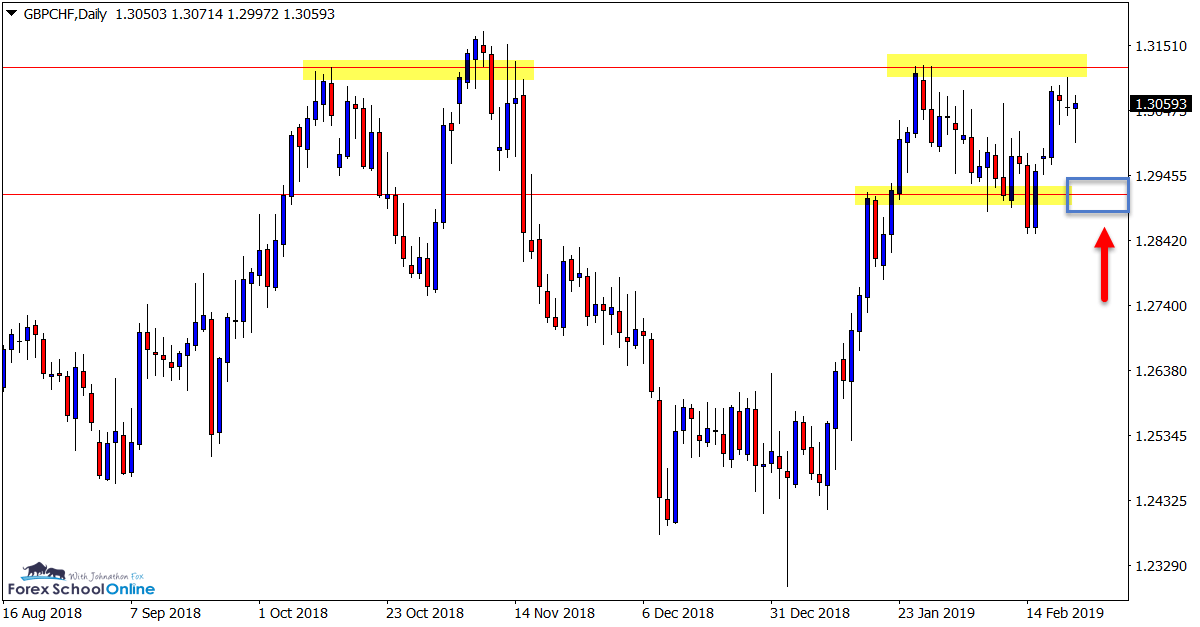

GBP/CHF Daily Chart: Test of Consolidation Area To Come

Price action on the daily chart of this pair is stuck in a consolidation period after making a recent strong move higher.

After making a solid rejection of the daily resistance level and retracing lower, the GBP/CHF price is now back at the highs and once again looking to make another test.

A break higher and through this resistance level could open the door for fast breaks and aggressive moves higher, but value traders could also watch the daily support level for price action clues if price makes a rotation lower in the next few sessions.

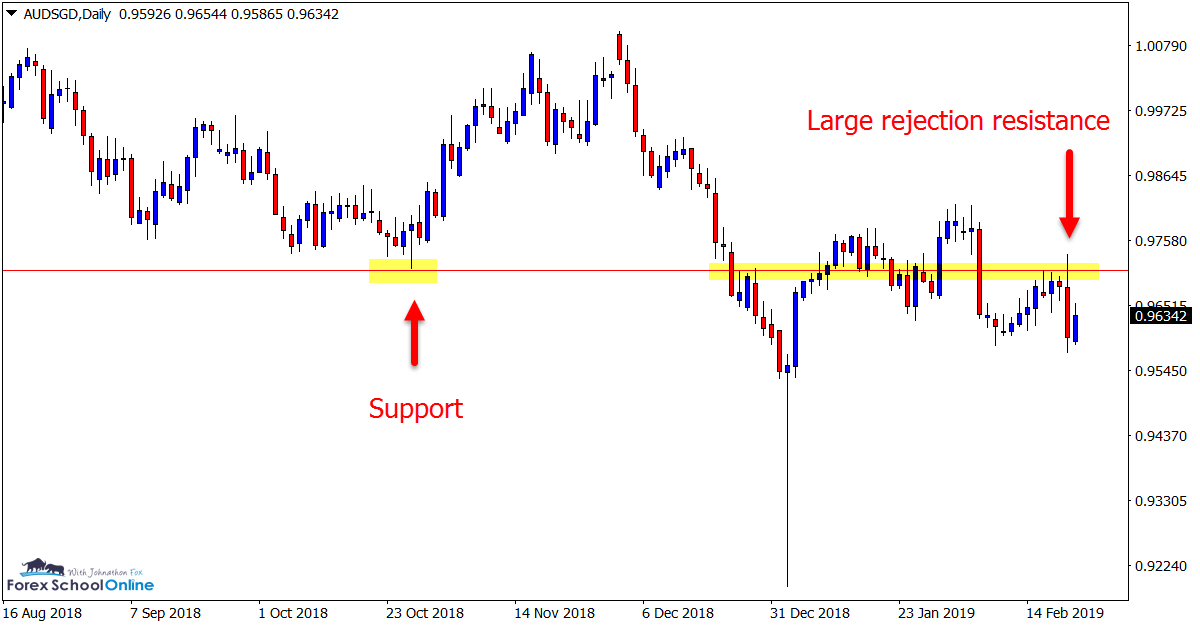

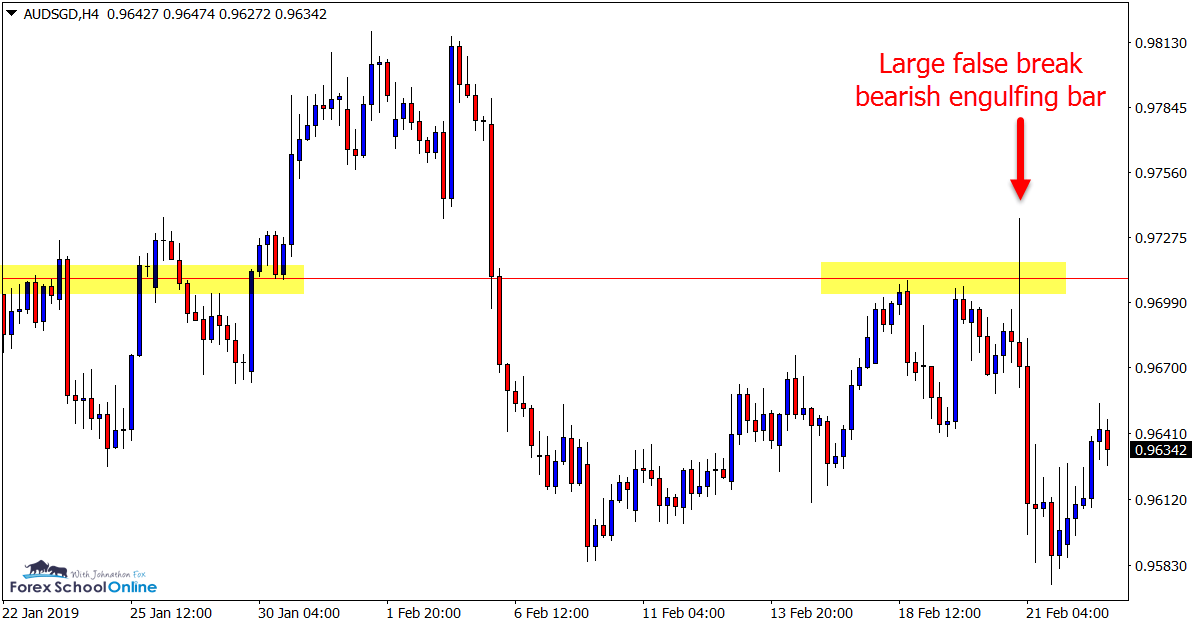

AUD/SGD Daily And 4-Hour Chart: Daily And Intraday Engulfing Bars

Both the daily and 4-hour chart of the AUD/SGD fired off false break Bearish Engulfing Bars = BEEB’s this week.

Whilst both the BEEB’s were at the major daily resistance, the 4-hour charts engulfing bar was a lot cleaner as it was up at a swing high and had a lot more room to move lower.

The daily charts engulfing bar is yet to break lower and is sitting on a recent daily swing low support.

For any move to occur we would need to see the engulfing bar break lower, which would also see the recent daily swing low support broken.