I have been bearish on NZD/USD for quite some time now as I think the pair might start a drop down sooner or later. There is a bearish divergence on the daily chart as shown below, which adds value to our bearish view. There is also a bearish hidden divergence forming on the weekly chart as well.NZD/USD" title="NZD/USD" src="https://d1-invdn-com.akamaized.net/content/pic1fe9f123f31df9f3960e33f2d6a5d4ad.jpg" height="458" width="722">

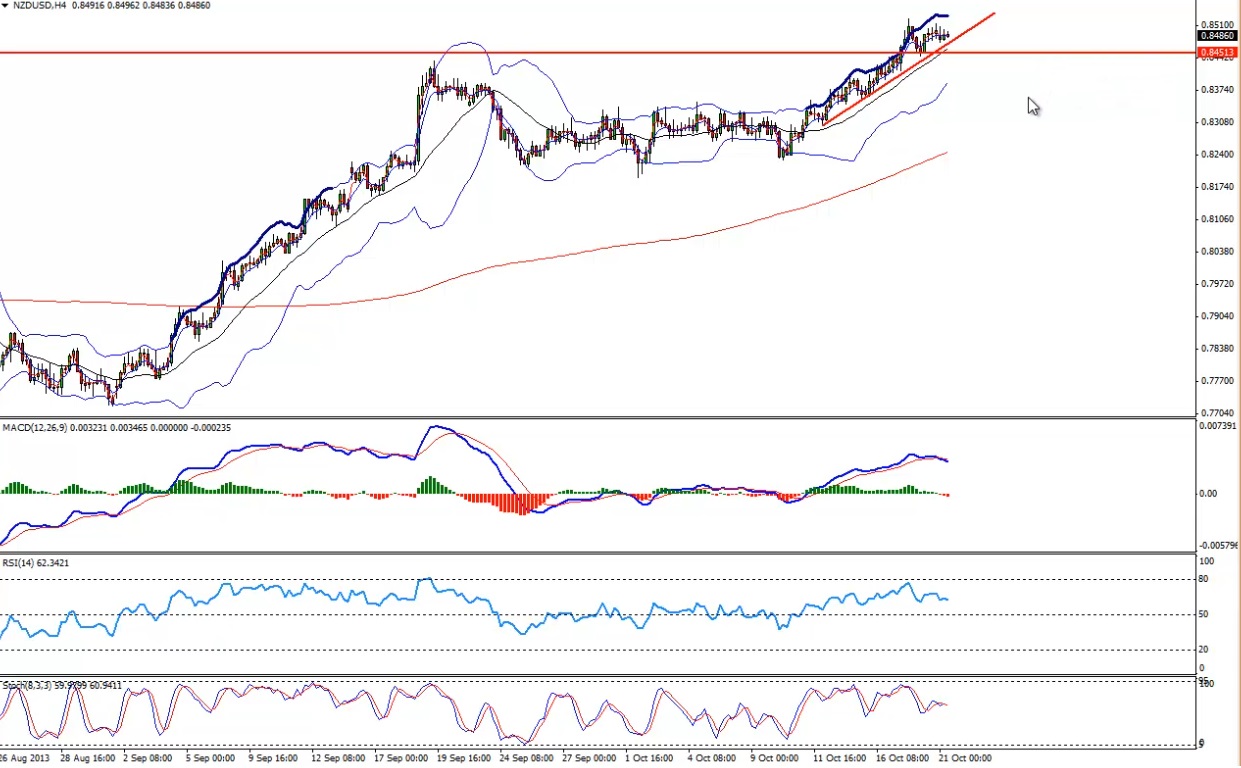

NZD/USD has an up-move trend line as plotted on the 4 hour chart shown below. To enter a sell trade, we want the pair to break this trend line and first immediate support, which is currently at around 0.8450. If the pair manages to break the trend line and support, closes below it, then we will jump into a sell trade for NZD/USD. Remember, we need a 1 hour close below the trend line to enter into the trade. We do not want to trade any false break in the current market conditions.

Initial target should be around the next up-move trend line as plotted on the chart below and final target could be the gap close at around 0.8140. Stop should be placed above the previous high after entering the trade. NZD/USD" title="NZD/USD" src="https://d1-invdn-com.akamaized.net/content/pic4e06b1b073babfe229bb893790218a20.jpg" height="458" width="722">

Reviewing Friday’s events and trades US dollar lost a lot of ground this past week after the US debt deal was made at the last moment. US dollar was sold off heavily going into the weekend as EURUSD, GBPUSD and AUDUSD all traded higher. Canadian inflation data was released this past Friday, which registered a better reading than expected. The Canadian dollar was seen gaining some bids on Friday. Other than this, there was no major fundamental event scheduled from the US on last Friday.

Fundamental Outlook for the day US existing home sales data is one of the major fundamental events scheduled later in the day, which is expected to show a minor decline from the previous outcome. Other than this Canadian Wholesale sales data and Chicago Fed national activity figure is also lined up later in the NY session. A lot of moves are expected in the coming days as some key fundamental data are scheduled. It would be interesting to see whether US dollar is able to recover some of the lost ground or not. So, keep an eye on all the event’s friends and trade safe.

This analysis is taken from today’s Daily Market Forecast, which also includes trade opportunities on: EUR/USD, GBP/USD, AUD/CAD, GOLD, SILVER, NASDAQ, DOW JONES and EUR/NZD.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

NZD/USD: A Sell Opportunity?

Published 10/21/2013, 05:52 AM

Updated 07/09/2023, 06:31 AM

NZD/USD: A Sell Opportunity?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.