Here is a quick look at the concept of "monetary transmission" that has basically become the catch phrase to justify periphery bond buying by the ECB.

MNI: Joerg Asmussen [member of the ECB's Executive Board] said the ECB's new bond-buying plan will aim to improve monetary policy transmission that is severely hampered. Currently "monetary signals, like we for example set with the July interest rate cut, filter through to the real economy either unevenly or not at all."

The lack of rate transmission is clear. Portugal's rates for consumer loans for example have remained stubbornly high (discussed here). But the transmission issue is really driven by liquidity conditions that are not balanced across the eurozone. Ambrose Evans-Pritchard discussed it back in December of last year (see discussion) as Italy's M3 showed alarming declines, while Germany's money stock increased (see discussion). And since a great deal of the lending across the eurozone (except to some of the larger firms) is done by domestic institutions (Spanish citizens and companies tend to borrow from Spanish banks), liquidity issues of the domestic banking system translate into fewer loans and higher rates in that nation.

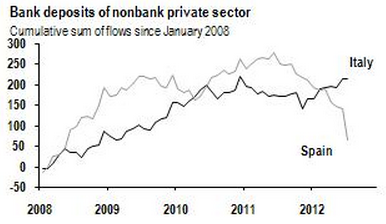

Here is an example. Deposits at Italian banks (surprisingly) have been quite stable recently. Spain on the other hand had a run on its banks.

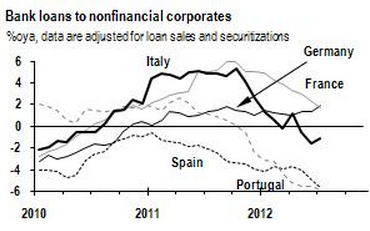

This contributed to (though is not the only cause of) uneven growth in bank lending.

It makes sense therefore to target monetary policy by country in an attempt to even out credit conditions. The belief that monetary policy in the EMU could be managed centrally the way it's done in the US proved to be flawed.

But there are issues with implementation. If "monetary transmission" is indeed the goal, how does the ECB justify making it conditional?

WSJ: If the bond buying program is really about transmitting monetary policy to certain countries, it's hard to justify making that conditional at all. By imposing conditions, the ECB implies that support could be withdrawn in the future. But apart from the practical difficulties of walking away after loading up on Spanish or Italian debt, the conditions themselves suggest that there are circumstances under which the ECB would pull the plug—the opposite of what Mr. Asmussen says the bank is trying to achieve.

And there are significant risks associated with targeted policy conditions.

WSJ: One of the unanswered questions about the ECB's next round of bond buying is what conditions it will impose on the countries that benefit. But one only has to look at Greece to see how double-edged conditionality can become. Two and a half years after being bailed out, Athens is hopelessly behind every target. And yet European and IMF officials aren't considering whether to take Greece off the bailout drip, only how best to fudge the bailout's failure.

Fixing monetary transmission is certainly a sound concept in theory. But in this case is seems to be nothing more than a justification for periphery bailouts by the ECB. The conditional implementation actually looks more like an ESM-style bailout than a central bank monetary policy. To some, this makes the ECB a tool of the European Commission.

Feeling the heat when pressed on ECB's independence, Draghi fired back.

RTT: "It will remain independent. And it will always act within the limits of its mandate...yet it should be understood that fulfilling our mandate sometimes requires us to go beyond standard monetary policy tools."

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Policy Of Targeting 'Monetary Transmission' By The ECB

Published 08/30/2012, 02:16 AM

Updated 07/09/2023, 06:31 AM

Policy Of Targeting 'Monetary Transmission' By The ECB

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.