Market movers today

- Trade war headlines and geopolitical developments remain the key market drivers, although the news flow might calm down compared to the last days after the G7 summit. In Italy, look out for the ongoing coalition talks, as a deal seems to be moving closer. This morning news media report that PD is still undecided on Conte. Talks will resume at 11:00 CEST.

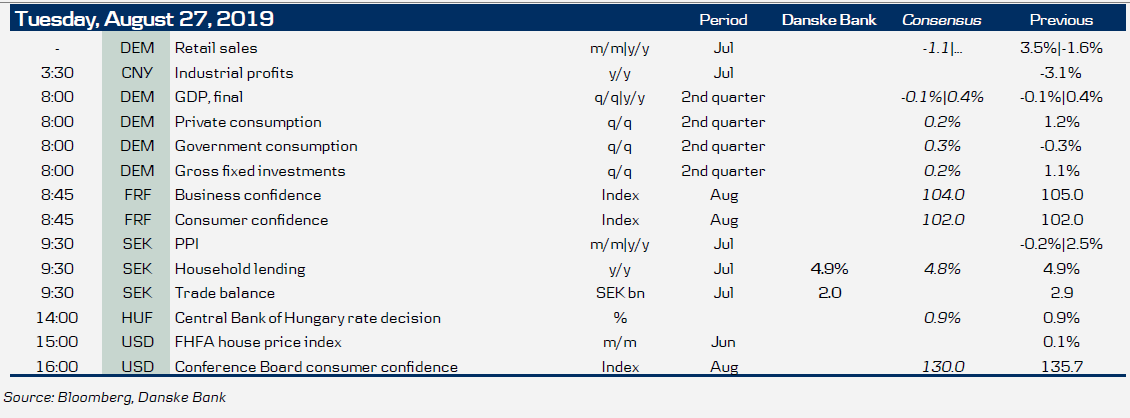

- Final German Q2 GDP data will reveal how hard net exports have been hit by the escalating trade war and Brexit uncertainty. We will also look out for signs of weakness in domestic demand, especially weaning investment growth.

- ECB Vice President Luis de Guindos and BOE policy committee member Silvana Tenreyro speak at a conference in Manchester.

- The Hungarian central bank will publish its rate announcements at 14:00 CEST. We expect the policy rate to remain at 0.90%, as inflation has fallen closer to the 3% target from its overshooting levels. Furthermore, the current global monetary easing bias will keep the MNB from hiking.

- In Sweden, household lending and trade balance figures are due for release. The trade balance is still likely to show a surplus, possibly lower than last month's SEK2.9bn.

Selected market news

An eventful G7 meeting concluded yesterday. On Iran, French President Emmanuel Macron said that an US-Iran deal could be reached if Iranian President Hassan Rouhani and Trump meet. Trump agreed 'if the circumstances were correct'. An agreement still seems far away, though.

On global trade, the G7 leaders agreed that there is a need for modernising and reforming the WTO system to make it more efficient, reflecting the changing economic structures. While it seems doubtful the US and China are anywhere close to a trade deal despite Trump's comments yesterday, it was positive that Trump said that the US and the EU are 'very close to doing a deal'. We have to be careful about Trump's comments but this topic will be increasingly on our radar ahead of Trump's decision in November whether to impose tariffs on auto imports from Europe or not.

On Brexit, the EU and UK talks are now intensifying on the back of positive meetings ahead of and at the G7 meeting. In our view, the EU seems more willing to compromise, well knowing that the backstop is a major hurdle for avoiding a no deal. Also, PM Boris Johnson seems more pragmatic (probably well knowing that a no-deal Brexit may backsplash economically and hence politically eventually). Still, the EU has said it is up to the UK to find ways to avoid the backstop.

In China, industrial profits rose 2.6% y/y in July versus a decrease of 3.1% in June. While this seems positive on the surface, it is more about base effects and year-to-date profits are still down, indicating the economy has slowed.

Scandi markets

In Sweden, household lending and trade balance figures are due for release. The trade balance is still likely to show a surplus, possibly lower than last month’s SEK2.9 bn.

Fixed income markets

Global yields edged slightly higher yesterday as Trump scaled back on his rhetoric towards China and risky assets moved higher. However, markets are nervous and the underlying support to fixed income is in our view intact. The weak German Ifo, which yesterday dropped to the lowest level since the financial crisis, underlines that the European economy and particularly Germany might already be in recession.

The issuance season kicks off this week. Finland is often the first country out late August and it has already announced that a new 5Y benchmark bond is due in H2. We take a closer look at the 5y segment in Finland in this research note.

The Italian treasury announced yesterday that it will introduce a new Apr 2030 BTP on Thursday and up to EUR4bn will be sold in the new bond. Yesterday BTPs recovered early losses as a deal between the 5-star movement and PD seems to have moved closer.

President Mattarella has given the two parties a new deadline on Wednesday to report back whether they can form a new government or not. This morning news media report that PD is still undecided on Conte. Talks will resume at 11:00 CEST.

The Danish financing requirement for 2020 was published last night and is just DKK65bn. It covers an estimated budget surplus (net financing requirement) of DKK36bn and buy-backs of government guaranteed mortgage bonds and refinancing of DGB 11/20 of DKK29bn and DKK55bn, respectively. Even though the budget surplus could be smaller as new initiatives are introduced later in the year, this is a very small borrowing requirement and the DMO is likely to issue fewer DGBs and/or T-bills in 2020 compared to 2019. If not, it will result in an unwarranted build in the government cash buffer. The higher 2019 finance requirement has already been taken into account by the DMO. For more see Finansministeriet.

FX markets

Should USD/JPY be at 104, 105 or 106? Yesterday, we played the full range as the initial reaction to the weekend’s trade news was knee-jerk negative - bringing it to 104. Later in the day, sentiment improved somewhat on the back of Trump tweeting about renewed progress on trade and not least with Iran, bringing the cross back above 106. Our view is to sell the rally in USD/JPY as we have seen such headlines about improvements countless times in the past year (without results) and the economic trend continues to support the JPY. We target USD/JPY short-term at 105 but continue to see further downward adjustment of that forecast as probably being needed.

The SEK was on the defensive yesterday, despite better-than-feared risk sentiment and ahead of this week’s domestic macro data. We think retail sales tomorrow will be relatively upbeat (SEK positive), whereas NIER confidence figures on Thursday will paint a bleaker outlook for the economy (SEK negative). The trade war is taking its toll on the Swedish economy where both exports and imports printed negative y/y in June. Fundamentally, an escalating trade war should not bode well for the krona.

Key figures and events