Toronto-based Vendome Resources Corp. (TSXV:VDR) is an exploration company with three active projects in the world-class Sierra Madre del Sur Precious Metal Belt mining district of Mexico and one project – Ivanhoe – in Ontario.

The three Mexican properties – San Javier, which includes the old San Javier Mine, La Diana and San Miguel – are adjacent to each other and cover a combined area of almost 18,000 hectares in the province of Guerrero, where numerous prominent deposits rich in silver, gold, zinc and lead are located. The famous Guerrero Gold Belt is around 150 km northwest, where Goldcorp (NYSE:GG; market cap $30 billion) operates the Los Filos Mine – the largest Mexican gold mine (7.7 million oz at 345,000 oz/year).

In 2010, Farallon Mining Ltd. brought its G-9 deposit into production some 210 km northwest (yearly output: 50,000 t zinc, 1.5 million oz silver and 20,000 oz gold). In 2011, the world’s largest zinc producer, Nyrstar from Belgium, took Farallon over for around CAD 400 million.

Thanks to the missing infrastructure in this part of Mexico, limited exploration was conducted in the past. This is the reason why many prospective areas are virtually untouched or small-scale and semi-professional mining was done at the most obvious mineral deposits cropping out at surface. However, during the last few years the Mexican government has been investing large sums into infrastructure – such as construction of streets, supply of water, electricity and telecommunications – which has made Guerrero substantially more attractive for exploration and mining.

Some examples for success in the province of Guerrero are Torex Gold Inc. (TSX:TXG; CAD 777 million market cap) whose share price rose strongly from CAD 0.15 (2009) to CAD 2.40 (2012) based on extraordinary drill results. Shareholders of Newstrike Capital Inc. (TSX:NES; CAD 199 million market cap) also had the chance to make some substantial profits during the two years when its share price rose some 3,000% (2009-2011).

The VDR-projects La Diana and San Miguel are virtually unexplored but several consolidated findings have been made at San Javier. The grade and trend of mineralization at the old San Javier Mine is known with samples showing the Javier Vein averaging 2,070 g/t silver, 5.2% lead and 2.5% zinc in 2009, while the Ancha Vein returned 273 g/t silver and 0.2% lead and zinc and the Las Juntas Vein 172 g/t silver, 3.7% lead and 2% zinc. Samples from the old stockpile presented a mineralization of 463 g/t silver, 3.8% lead and 2.7% zinc.

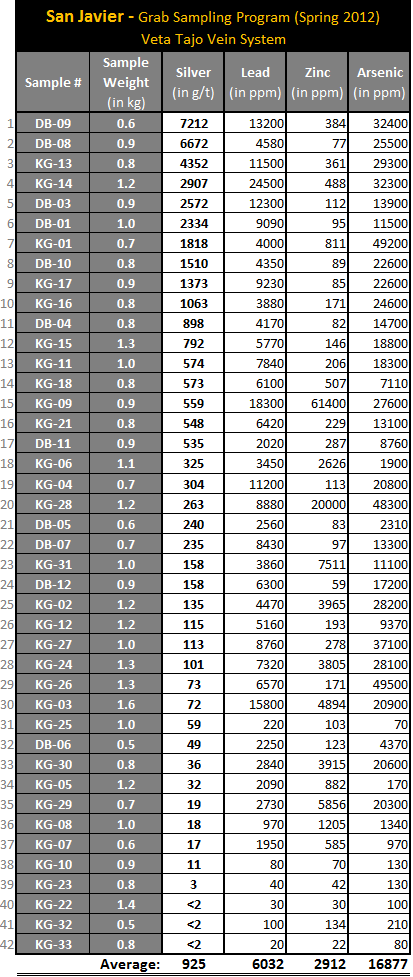

Since December 2011 VDR has sucessfully proven that a significantly more widespread and higher-graded silver mineralization occurs, as previously expected. Only 300 meters southwest of the old San Javier Mine an even larger vein system occurs at surface – the Veta Tajo Zone – which was discovered by VDR and which was apparently overlooked by earlier prospectors. In spring 2012, a total of 42 samples were collected here elating with an overall average of 925 g/t silver and up to 5% lead and 6% zinc (only 14 of the 42 samples had less than 100 g/t silver).

The newly discovered Veta Tajo vein system even extends to the north and south. Additionally, numerous new veins were identified at several other locations on the San Javier property also showing high-grade mineralization at surface, such as 15,000 g/t silver.

The exploration focus of VDR is not only limited to the 253 ha sized San Javier property, but also on the highly prospective neighbor properties San Miguel (2,000 ha) and La Diana (14,722 ha). Hence, the exploration potential of all three properties is extraordinarily high with no other project around in this promising and unexplored part of the district.

We are not aware of any other active silver exploration company having recently started with an aggressive exploration program based on that many and high-grade samples from surface. We rate the prospects for an exploration success as exquisitely high. With a current market cap of solely CAD 11 million, we categorize the shares of Vendome as “undervalued.“ Shortly before drill targets are defined and rigs contracted we anticipate a fast and strong stock price appreciation based on the speculation of a drilling success.

For the next 6 months, we set our price target at a minimum of CAD 0.55 – which represents a market cap of CAD 22 million with 40 million shares issued and oustanding. Should one drill hole confirm even roughly the same mineralization grades as the rock samples from surface, we expect a market cap of at least CAD 50 milion (CAD 1.25/share). The reason we consider such a fast and strong share price appreciation as probable is that such polymetallic vein deposits (in contrast to most other deposit types) can be brought into production relatively fast and inexpensively.

Disclaimer: The author currently holds shares of Vendome Resources Corp. The mentioned companies did not pay any money or other kinds of valuables to the author or Rockstone Research Ltd. Please read the full disclaimer in the above mentioned research report.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Potentially 'The Largest Silver Discovery' Of The Century

Published 08/22/2012, 09:17 AM

Updated 07/09/2023, 06:31 AM

Potentially 'The Largest Silver Discovery' Of The Century

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.