The strong earnings report from AutoZone Inc (NYSE:AZO) started the Q4 earnings season for us, though we are still a few weeks away from the from the earnings season taking the spotlight. Companies with fiscal quarters ending in November are reporting these days and all of these get counted as part of the Q4 earnings tally. We have 39 companies reporting results this week, including 12 S&P 500 members. This week’s list of reporters includes a number of industry bellwethers like FedEx (NYSE:FDX), Nike (NYSE:NKE), Oracle (NYSE:ORCL) and others.

The market has plenty of domestic economic data to digest this week in a backdrop of persistent oil market weakness. On the docket this week are a host of housing, inflation, and manufacturing sector reports, but the focus will be on the FOMC meeting, particularly Fed Chairwoman Yellen’s press conference. It will be interesting to see if the Fed will finally come around drop the ‘considerable time’ phrase from its post-meeting statement.

Estimates Keep Coming Down

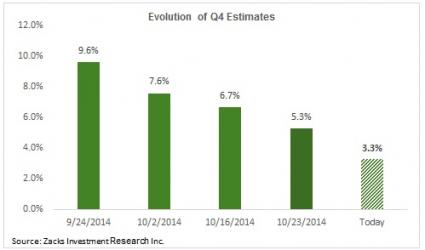

Estimates for 2014 Q4 started coming down at an accelerated pace as companies predominantly guided lower on the 2013 Q3 earnings calls, consistent with the trend we have been seeing for almost two years now. Total Q4 earnings for companies in the S&P 500 are currently expected to be down +3.3% from the same period last year, a material decline from the +9.6% growth expected at the start of the quarter in early October.

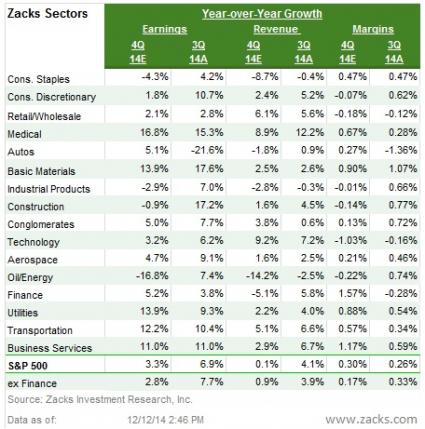

The table below presents the summary picture for Q4 contrasted with what companies actually reported in the Q3 earnings season. Please note that the Q3 earnings season isn’t officially over yet, as one S&P 500 member has yet to report results for that quarter –Joy Global (NYSE:JOY) reporting this week will be the last S&P 500 member to report Q3 results.

The chart below shows how estimates for Q4 have evolved since the quarter got underway. Please note that the magnitude of negative revisions for Q4 is the highest we have seen at comparable periods in other recent quarters, with the Energy sector as the biggest drag.

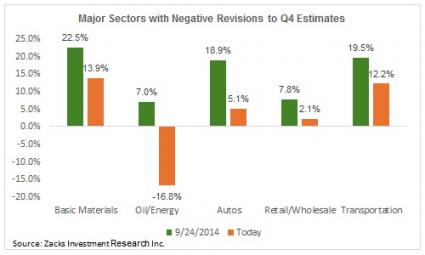

The negative revision trend is widespread, but is particularly notable for the Retail, Basic Materials, Autos, and Transportation sectors, in addition to Energy. Utilities is the only sector where estimates have modestly gone up while Business Services saw estimates remain unchanged.

The chart below shows the sectors with big negative revisions.

With roughly two-thirds of S&P 500 companies beating earnings expectations in any reporting cycle, actual Q4 results will almost certainly be better than these pre-season expectations. In fact, a look at the revisions trend for the last 5 quarters show that the actual growth rate at the end of the reporting cycle roughly approximates what was originally expected at the start of the quarter. You can see this trend play out clearly in the chart below.

What this means is that at the growth rate at the start of the (calendar) quarter is a good representation of what is actually achieved in that period. For example, earnings were expected to be up +6.3% in Q3 at the start of the quarter in July. But those growth estimates came down over time and fell to +3% by the time the Q3 reporting season got underway. The actual growth in Q3, however, turned out to be +6.3%.

Will we see a repeat performance in Q4 as well? We will have to wait through the end of February to find out.

Monday-12/15

- Not much on the earnings front, but the November Industrial Production and the December homebuilder sentiment index will be coming out.

Tuesday -12/16

- Housing Starts is the key economic report this morning, while the two-day FOMC meeting will get underway as well.

- Darden Restaurants (NYSE:DRI) will be reporting November quarter results before the open.

- Earnings ESP or Expected Surprise Prediction, our proprietary leading indicator of positive earnings surprises is showing Darden coming out with an earning beat.

- Our research shows that companies with Zacks Rank of 1, 2 or 3 and positive Earnings ESP are highly likely to beat EPS estimates. Darden has Zacks Rank #2 (Buy) and Earnings ESP of +3.7%.

- To better understand the Zacks Earnings ESP, please click here.

Wednesday-12/17

- The Fed is in focus today, with the FOMC coming out with its statement and followed by Chairwoman Yellen’s press conference.

- FedEx, General Mills (NYSE:GIS) and Joy Global will report in the morning, while Oracle will report after the close.

- Earnings ESP is showing FedEx beating EPS expectations. FedEx has Zacks Rank #2 (Buy) and Earnings ESP of +4.1%

Thursday -12/18

- In addition to weekly Jobless Claims, we will get the December Philly Fed survey in the morning.

- ConAgra (NYSE:CAG) and Accenture (NYSE:ACN) will report before the open while Nike (NYSE:NKE) will report after the close.

Friday-12/19

- Not much on the economic calendar, while BlackBerry(NASDAQ:BBRY) and CarMax Inc (NYSE:KMX) will report earnings results, both in the morning.

- CarMax with a Zacks Rank of 3 and Earnings ESP of +1.9% is expected to come out with a positive earnings surprise.

Here is a list of the 39 companies reporting this week, including 12 S&P 500 members.

| Company | Current Qtr | Year-Ago Qtr | Last EPS Surprise % | Report Day | Time | |

| Charming Shoppes (NASDAQ:CHRS) | N/A | N/A | N/A | Monday | AMC | |

| Verifone Systems Inc (NYSE:PAY) | 0.31 | 0.13 | 11.54 | Monday | AMC | |

| FuelCell Energy Inc (NASDAQ:FCEL) | -0.03 | -0.05 | 0 | Monday | AMC | |

| Fifth Street (NASDAQ:FSAM) | 0.21 | N/A | N/A | Monday | AMC | |

| Applied DNA Sciences Inc (NASDAQ:APDN) | -0.18 | 0 | N/A | Monday | N/A | |

| Darden Restaurants (NYSE:DRI) | 0.27 | 0.15 | 0 | Tuesday | BTO | |

| FactSet Research Systems Inc (NYSE:FDS) | 1.33 | 1.22 | 0 | Tuesday | BTO | |

| Heico Corporation (NYSE:HEI) | 0.44 | 0.44 | 11.36 | Tuesday | AMC | |

| Dave & Buster's Entertainment (NASDAQ:PLAY) | -0.1 | N/A | N/A | Tuesday | AMC | |

| Upland Software Inc (NASDAQ:UPLD) | -0.44 | N/A | N/A | Tuesday | AMC | |

| FEDEX CORP | 2.18 | 1.57 | 7.69 | Wednesday | BTO | |

| General Mills Inc (NYSE:GIS) | 0.76 | 0.83 | -11.59 | Wednesday | BTO | |

| ORACLE CORP | 0.64 | 0.66 | -1.67 | Wednesday | AMC | |

| JOY GLOBAL INC | 1.14 | 1.11 | -6.98 | Wednesday | BTO | |

| Biodel Inc (NASDAQ:BIOD) | -0.27 | -0.22 | 42.31 | Wednesday | AMC | |

| WESCO International Inc (NYSE:WCC) | 1.51 | 1.26 | 1.33 | Wednesday | BTO | |

| Eagle Pharm (NASDAQ:EGRX) | -0.49 | N/A | 46.15 | Wednesday | BTO | |

| Civitas Solution (NYSE:CIVI) | -0.03 | N/A | N/A | Wednesday | AMC | |

| Jabil Circuit Inc (NYSE:JBL) | 0.4 | 0.63 | 157.14 | Wednesday | AMC | |

| Herman Miller Inc (NASDAQ:MLHR) | 0.51 | 0.42 | 2.17 | Wednesday | AMC | |

| Apogee Enterprises Inc (NASDAQ:APOG) | 0.48 | 0.33 | 29.63 | Wednesday | AMC | |

| NIKE INC-B | 0.69 | 0.59 | 23.86 | Thursday | AMC | |

| CINTAS CORP | 0.78 | 0.7 | 2.63 | Thursday | AMC | |

| ACCENTURE PLC | 1.2 | 1.15 | -1.82 | Thursday | BTO | |

| ConAgra Foods Inc (NYSE:CAG) | 0.61 | 0.62 | 11.43 | Thursday | BTO | |

| RED HAT INC | 0.27 | 0.3 | 11.54 | Thursday | AMC | |

| Rite Aid Corporation (NYSE:RAD) | 0.05 | 0.04 | 116.67 | Thursday | BTO | |

| Neogen Corporation (NASDAQ:NEOG) | 0.22 | 0.17 | 4.35 | Thursday | BTO | |

| Marcus Corporation (NYSE:MCS) | 0.14 | 0.14 | -10 | Thursday | BTO | |

| Sanderson Farms Inc (NASDAQ:SAFM) | 4.21 | 1.97 | -14.51 | Thursday | BTO | |

| Winnebago Industries Inc (NYSE:WGO) | 0.45 | 0.4 | 4.35 | Thursday | BTO | |

| Worthington Industries Inc (NYSE:WOR) | 0.68 | 0.59 | 6.56 | Thursday | BTO | |

| Bio-Reference Laboratories Inc (NASDAQ:BRLI) | 0.63 | 0.4 | 1.85 | Thursday | BTO | |

| Pier 1 Imports Inc (NYSE:PIR) | 0.2 | 0.26 | -23.08 | Thursday | AMC | |

| AAR Corp (NYSE:AIR) | 0.37 | 0.5 | -12.2 | Thursday | AMC | |

| PAYCHEX INC | 0.46 | 0.43 | 2.17 | Friday | BTO | |

| CarMax Inc (NYSE:KMX) | 0.54 | 0.47 | -4.48 | Friday | BTO | |

| BLACKBERRY LTD | -0.05 | -0.67 | 88.24 | Friday | BTO | |

| The Finish Line Inc (NASDAQ:FINL) | 0.02 | 0.06 | -10 | Friday | BTO |