The recent release of the retail sales report for September showed a month-over-month increase of 1.1%. Econoday stated, The consumer was out spending more than expected in September-even after discounting gasoline prices. And also Apple appears to have bumped the numbers up. Total retail sales in September advanced 1.1% after gaining 1.2% the month before (originally up 0.9%). This was notably above market expectations for a 0.7% boost. Motor vehicle sales increased 1.3% after a 1.8% jump in August. Ex-auto sales jumped 1.1%, following a rise of 1.0% in August (originally up 0.8%). The consensus was for a 0.5% rise.

Gasoline sales continued strong gains, increasing 2.5% in September, following a 6.1% spike the prior month. Excluding both autos and gasoline components, sales still posted a healthy 0.9% gain, following a 0.3% gain in August (originally up 0.1%).

Core components showed widespread gains. Leading the way were electronics & appliance stores (up 4.5%), nonstore retailers (up 1.8%), and building materials & garden equipment (up 1.1%). Electronics & appliance store sales likely reflected to a notable degree sales of iPhone 5. Still, the broad based gains are encouraging.

Stop Reading

This is all very encouraging as long as you don't look any further than the headlines. So, stop reading now.

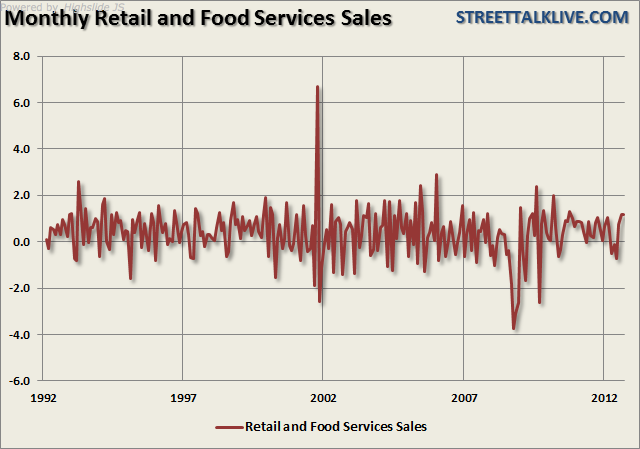

Behind the headlines a very different picture emerges (and will be further exacerbated when CPI is released and we can look at the inflation adjusted data.) As I have discussed at length in the past, it is the trend of the data which is far more important than the month to month data points. The chart below is the month over month percentage change in retails sales?

This is useless data from an analytical standpoint due to the noise. This "noise" is further exacerbated by seasonal adjustments. However, before we go there, it is important to understand that consumer spending, which makes up 70% of GDP is really affected by two major components -- changes in income and credit.

Making Ends Meet On Credit

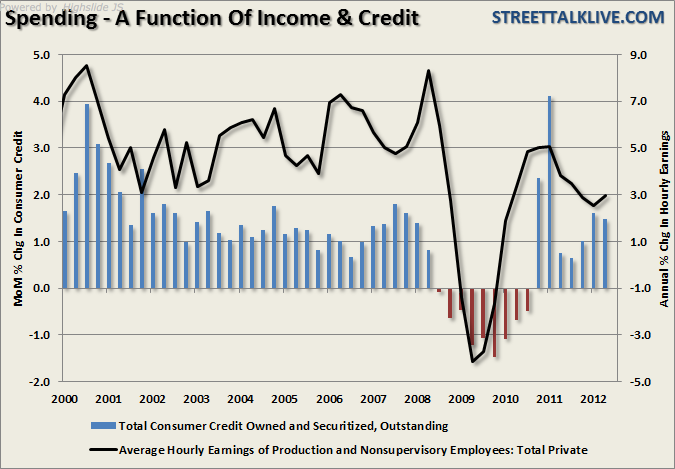

The chart below shows the annual change in hourly incomes compared to the monthly change in consumer credit. What is important here in the most recent quarters is the decline in hourly incomes is being offset with increases in credit. This is a function of individuals making ends meet by using credit to shore up shortfalls in family budgets.

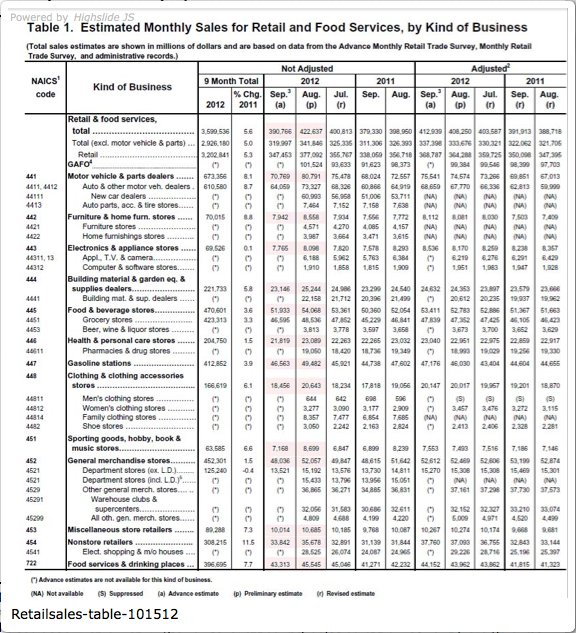

This brings me back to this month's retail sales report. The table below shows both the seasonally and not-seasonally adjusted data.

Seasonal Adjustments

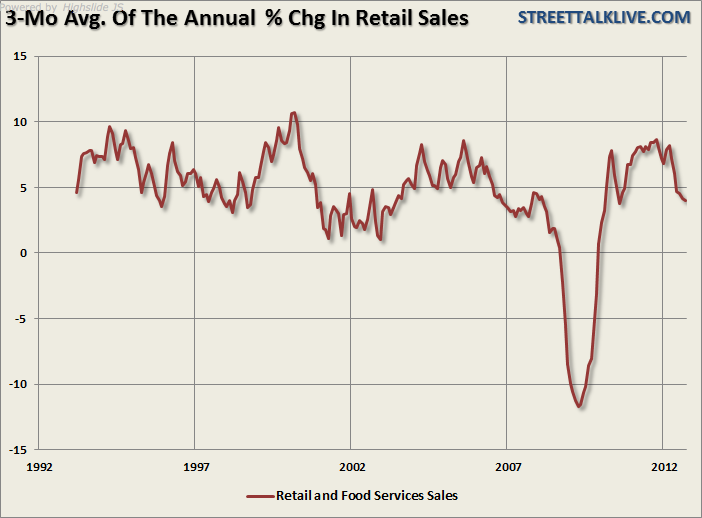

Here is what should be jumping out at you. The entire gain for the month of September came from seasonal adjustments to the underlying data. There was not ONE major category that showed a month over month gain on a not-seasonally adjusted basis. However, let's go one step further and look at the three-month average of the annualized rate of change in retail sales which strips out the seasonal adjustment factors.

The steep decline in retail sales when smoothed is much more telling about the state of the consumer. Previous declines of this magnitude have occurred during the onset of an economic recession. Let me be clear, I am not saying we are in recession now, however.

Income Shortfall

For the average American the impact of rising inflationary pressures due to higher food, energy and gasoline costs are being exacerbated by stagnant or declining incomes. The shortfall between incomes and the family budget has to be filled in with credit. The problem with that, of course, is that if incomes don't eventually start to pick up the default risk of extended credit increases.

The month over month data, especially when seasonal adjustment factors are included, can skew the data in the very short term. However, the economy, and the underlying earnings of the companies within the economy, is impacted more by the quarterly and annualized changes in the data. It is from those longer term views that hiring, expansion and production decisions are being made. Unfortunately, the trends of the data from manufacturing, production and sales do not bode well for the coming quarters ahead.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Retail Sales Not As Strong As Headlines Suggest

Published 10/15/2012, 02:47 PM

Updated 02/15/2024, 03:10 AM

Retail Sales Not As Strong As Headlines Suggest

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.