There are few signs of encouragement in UK construction demand and pricing; this, together with previously announced cost overruns, will further delay an earnings recovery. Indian operations are looking to achieve a maiden profit this year and investment is planned to support further expansion.

H1 In Line With Lowered Expectations

The June pre-close statement pre-warned that the H1 result would contain a disappointing £1.5m PBT result. Competitive tendering and internal cost overruns in the UK were both factors here. Activity levels are broadly stable overall, but a merger of three UK operating companies is to take place later in the year in a measure designed to bolster margins. Note that a cash inflow was achieved in the period and an unchanged (though uncovered) H1 dividend of 1.5p was declared. Outside of the UK, the Indian JV is making tangible progress and further investment has been announced, probably with more to come.

Margin Squeeze Reduces Estimates

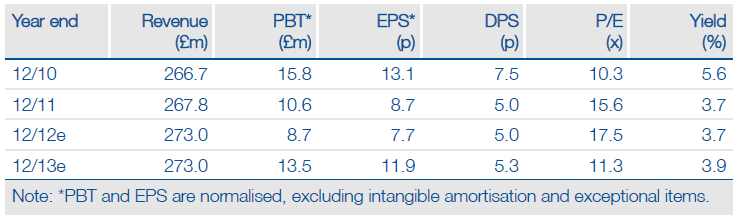

The UK construction market remains tough, with softening demand in some areas and keen pricing. Severfield’s revenue run rate appears stable, but we have taken 170bp off our expected FY12 operating margin (to 3.7%) to explicitly incorporate cost overruns and current conditions. This translates to a net £4m (32%) reduction in expected FY12 PBT. FY13 estimates have been lowered by a more modest £1m (-6%). Lower tax rates dampen these effects at the EPS level. Market pains are being felt more acutely among sector peers (with losses evident) and, if anything, this may strengthen the company’s medium-term market position.

Valuation: Building Value

Near-term valuation multiples are inflated by bottom-of-the-cycle earnings estimates. We have previously outlined a mid-cycle fair value illustration in excess of 200p for Severfield’s industry-leading UK operations (see March Outlook note). Granted, in current conditions, market position tends to be obscured by shorter term considerations but we maintain that this will re-assert itself as demand for construction steel improves and stand by this valuation. The Indian JV is making progress and we will ascribe a stand-alone value to it once the profit model is more established. Taken together, we believe that there is significant earnings and valuation upside on a medium-term view. While a UK upturn is the primary catalyst to realise this currently, India will become increasingly important.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Severfield-Rowen, H1 Results

Published 09/07/2012, 11:00 AM

Updated 07/09/2023, 06:31 AM

Severfield-Rowen, H1 Results

Headwinds Unabated

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.