The £20.6m acquisition of Euro Dismantling Services (EDS), completed 20 June, doubles Silverdell’s (SID.L) revenues. EDS’s business is complementary, expands Silverdell’s geographic horizons and provides significant opportunities for cross-selling. The challenge is for management to exploit the opportunities successfully and manage the step up in size and its attendant potential. The current valuation does not recognise this potential.

A well targeted acquisition

The deal to buy EDS, completed 20 June, provides Silverdell with global reach, a more attractive ratio of revenues to cost base and opportunities to cross-sell its services into the global blue chip customer base of EDS. This is a truly complementary business, with a large pipeline of orders (£209m for the combined company) and earnings accretion.

No more big acquisitions anticipated

Management recognises the need to bed down EDS before embarking on any further substantial acquisitions, although there may be a call for selected acquisitions to open up potential opportunities such as the German nuclear decommissioning market. Management would also consider small consultancy businesses in the fields of water testing, soil testing or legionella detection.

Forecasts updated

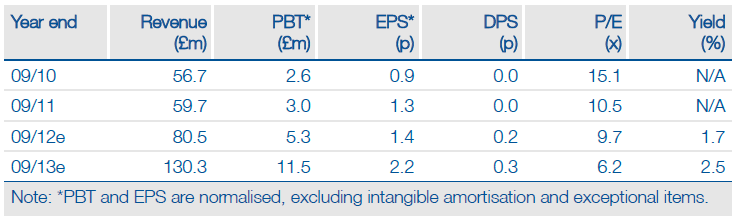

We update our forecasts to reflect both the recently completed reorganisation of the two existing UK businesses (Silverdell UK and Kitsons) and the acquisition. In 2013 we forecast £130m of revenues, including £60m from EDS. Thereafter we assume underlying growth of 2.5% falling to 2%. With this scale and a return to the dividend

list the company should appear on the radar of many new investors.

Valuation: Good value despite recent run

Following the share price run post deal, Silverdell trades on a September 2013 P/E multiple of 6.2x. This appears modest in the context of its expanded market opportunity. Our updated DCF suggests a fair value of 25p/share – twice the current share price.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Silverdell Deal Closes, Valuation Raised To Twice Current Share Price

Published 07/05/2012, 01:04 AM

Updated 07/09/2023, 06:31 AM

Silverdell Deal Closes, Valuation Raised To Twice Current Share Price

Deal closes – placing completed

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.