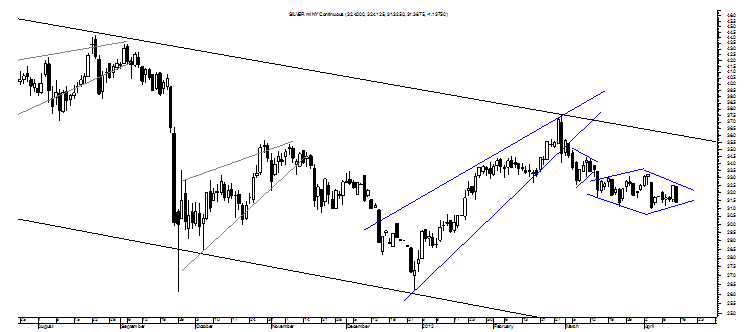

There’s the awkward, for me, possibility that silver avoids getting slammed by what appears to be a Diamond Bottom, but it seems that this pattern of consolidation may, in fact, be a pause prior to a continuation of silver’s near- and intermediate-term downtrend.

Good reason to think this could be the case is shown by a stellar Pipe Top that forms the apex of a nice looking, confirmed and bearish Rising Wedge along with a still-fulfilling Bear Pennant not to mention the fact that the Diamond Bottom’s apex appears to be trading in a Pipe Top of its own. For those of you who like the details, the targets on the first three patterns are $30, $27.50 and $26 per ounce respectively, with confirmation holding for all three below about $34 per ounce while the small Pipe Top confirms on Friday’s close at $31.33 for a target of $30.10 per ounce.

Relative to the Diamond Bottom, its more proper upside scenario confirms at $33.28 for a target of $35.57 per ounce while its downside scenario that may be somehow inappropriate but carries the support of those many other aspects confirms at $30.99 for a target of $28.70 per ounce.

Supporting the Diamond Bottom breaking to the downside, in addition to those many aspects, is the Descending Trend Channel shown above, in part, and something that represents silver’s intermediate-term downtrend that must be presumed to remain in effect unless silver begins to reverse it by rising above, interestingly, the target of that Diamond Bottom at about $35.57 per ounce.

Perhaps this gives the silver bulls some reason to think that one of the worst looking, if not invalid, Inverse Head and Shoulders patterns out there has a chance, but the next note on silver, if it is still relevant, will address why that pattern is so bad and actually a typically bearish pattern in disguise.

Right now in this note, it seems fair to stay off the fence and say that silver’s set to get slammed.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Silver’s Set To Get Slammed

Published 04/16/2012, 02:32 AM

Updated 07/09/2023, 06:31 AM

Silver’s Set To Get Slammed

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Bearish on silver!

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.