- Amid recent market fluctuations, maintaining a long-term perspective is crucial.

- Corrections are a normal part of the market cycle and offer opportunities for disciplined investors.

- Instead of reacting impulsively to market shifts, focus on a disciplined, long-term investment strategy.

- For less than $9 a month, access our AI-powered ProPicks stock selection tool. Learn more here>>

The stock market enjoyed a historic rally for over five months, which took a breather just days ago. However, many investors missed out on these gains. They tried to time the market and their fear of a repeat of the 2022 bear market led them to exit in October 2023 during a routine 10% correction.

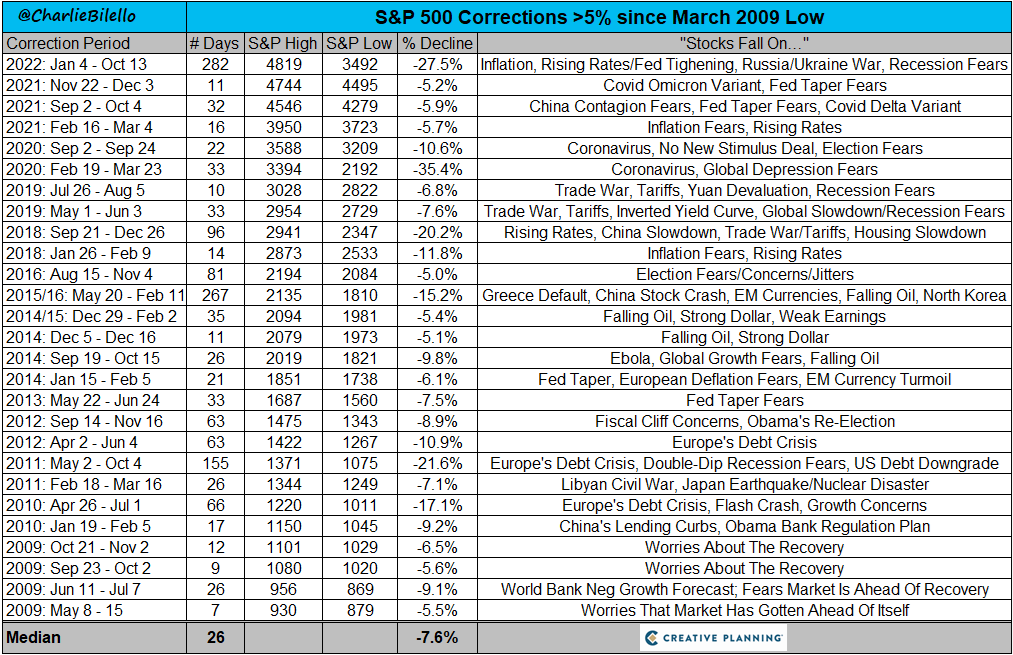

Today, after a significant run-up, the market appears to be entering another correction phase. While this may seem concerning, it's important to remember that corrections of 5-10% occur on average every year. This is a normal part of a healthy market cycle.

This image perfectly compares the current correction to the one we saw last summer. It's fascinating how the media barely mentioned one of the strongest rallies ever, while a typical 5% correction in recent days is hyped as the next market crash. Classic behavioral finance at play.

Don't Panic During Market Downturns

But let me assure you, this is completely normal. Here's a secret: markets go down sometimes. It's healthy! If they only went up, there wouldn't be any risk or reward – no extra return, no alpha, none of the things that (with patience) make the stock market the best long-term asset class. Declines, whether frequent or infrequent, are necessary.

As the title suggests, the difference between winners and losers in the market comes down to investor behavior. It's all about how you react to these down moments.

The chart above reveals all the corrections that buffeted the market since the depths of the Great Subprime Crisis in March 2009, all the way to the close of the 2022 Bear Market. Remarkably, in those 14 years (almost two corrections per year on average), the market has navigated a staggering 27 corrections, some minor and some major.

But here's the key takeaway: despite these periods of decline, the market has delivered an impressive overall performance, surging over 620%. This growth, however, hasn't been smooth sailing – it's come with these very moments of correction.

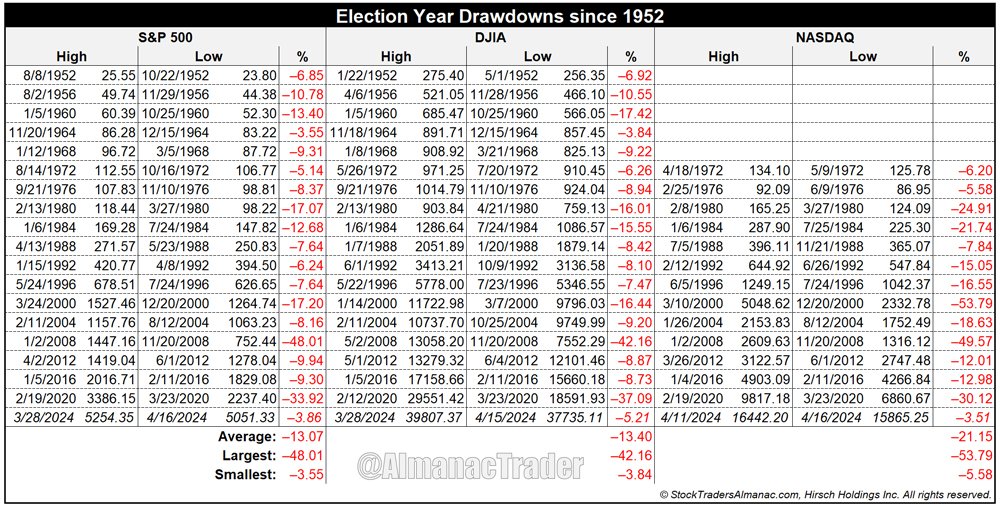

Election Years Are Generally Bullish

Election years are historically positive for the stock market. However, even during these bull periods, we can expect corrections, both large and small. The average correction in the last year of a presidential cycle is 13.07% for the S&P 500.

Market timing is a recipe for disaster. As Howard Marks points out, it requires two perfect decisions: when to exit and when to re-enter the market, which is nearly impossible. Lack of patience is another enemy of investors. Investing for 1-3 years is speculation, not investing. A 10-year minimum horizon is crucial for success. History and statistics support this - shorter timeframes significantly increase the risk of losses.

Understanding risk is critical. Investing in stocks always carries the potential for significant downturns (-20% to -40%). If you can't stomach these drops, consider safer options like deposit accounts or short-term bonds.

Remember, "bullish people make money." While permabears may sound smart in the short term, history shows they often miss out on long-term gains. Look at John Hussman, who has consistently called for expensive markets. He's been right in crashes like the dot-com bubble, but he's also missed out on major bull runs. The chart clearly shows the market (red line) consistently outperforming his bearish calls (blue line).

Investing is a marathon, not a sprint. Focus on a long-term strategy and avoid the pitfalls of market timing and impatience. Embrace volatility as a natural part of the process and remember, even broken clocks are right twice a day.

While I'm not a complete optimist – in fact, I've been urging caution in my Telegram channel for the past few weeks. We need to avoid excessive risk exposure and consider tactical portfolio adjustments.

Frankly, selling everything or predicting imminent collapse just isn't my style. After all, I hope to be in the markets for at least another 20 years, health permitting!

***

Remember to take advantage of the InvestingPro+ discount on the annual plan (click HERE), where you can uncover undervalued and overvalued stocks using exclusive tools: ProPicks, AI-managed stock portfolios, and expert analysis.

Utilize ProTips for simplified information and data, Fair Value and Financial Health indicators for quick insights into stock potential and risk, stock screeners, Historical Financial Data on thousands of stocks, and more!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.