As I've referred to in previous articles, this time of the year the spotlight turns to the June ASCO meetings in Chicago, IL. ASCO stands for the American Society of Clinical Oncology and is the premier event for oncology professionals including researchers, physicians, and pharmaceutical companies. The message from ASCO is, "Collaborating to Conquer Cancer."

The following company presenting this year (June 4th) sparks my interest as an investor/trader who would like to see progress for this horrible disease:

Sunesis Pharma (SNSS). 5/7/12 pps: $2.58, Market cap: $120.80M

To combine with the possible catalyst trade opportunity of presenting at ASCO, Sunesis just announced on May 3rd that the European Commission has granted orphan drug designation to Vosaroxin, the Company's lead development candidate; for the treatment of Acute Myeloid Leukemia (AML).

The designation provides for 10 years of marketing exclusivity in all EU member countries following product approval. Vosaroxin has previously received orphan drug and fast track designations from the U.S. Food and Drug Administration (FDA).

With the orphan drug designations for Vosaroxin in both the EU and USA, I feel there are a lot of exciting things happening for Sunesis. One thing that increases my interest when looking at pharmaceutical companies is when I hear they are working on an indication that has seen next to zero progress recently. According to the CEO Daniel Swisher, there have been no new drugs to treat this disease in 30 years. If data for Vosaroxin confirms the Phase III trials, the standard of care for patients who relapse from this form of Leukemia will change drastically. With no competing drugs, the company estimates potential Vosaroxin sales, if approved, could range from $400-$600 million annually.

AML is a very sad disease to research and read about. It is way more prominent as people get older with the average age of those affected at approximately sixty. There is an inverse relationship between age and remission rates; the older people are, the tougher it is to survive. The treatment today consists of intense chemotherapy. During this treatment, the patient's blood cell counts will probably be dangerously low, and the patient may be very ill. Because of the elimination of healthy blood cells, the risk for internal bleeding exists, which may lead to death. Many also die from infection while battling AML. Drugs to raise white blood cell counts may be used to curb some of these risks.

Phase III trial:

Sunesis commenced enrollment of a Phase 3, multi-national, randomized, double-blind, placebo-controlled, pivotal trial of Vosaroxin in combination with Cytarabine in patients with relapsed or refractory AML, or the VALOR trial.

The VALOR trial is designed to evaluate the effect of Vosaroxin in combination with Cytarabine, a widely used chemotherapy in AML, on overall survival as compared to placebo in combination with cytarabine. They expect to enroll 450 evaluable patients in the VALOR trial at more than 100 study sites in the U.S., Canada, Europe, Australia and New Zealand. The trial is designed to have a 90% probability of detecting a difference in overall survival, and includes a single pre-specified interim analysis by the independent Data and Safety Monitoring Board, or DSMB, which is expected to occur in the third quarter of 2012.

I was pretty fascinated when I saw their trial expectations. To reiterate, their primary end point is to have a 90% probability for an increase in survival. This could be a huge breakthrough in my opinion when you think about mortality rates among approximately 13,000 in the U.S. alone who are diagnosed AML each year.

The following two large pharmas have had some issues with their approved and marketed Leukemia drugs recently; let's take a look:

Sanofi (SNY)

In Febraury of this year, the company recalled 9,380 vials of the leukemia medicine Fludara because of a "lack of assurance of sterility," U.S. regulators said.

Genzyme, a unit of Paris-based Sanofi, notified customers of the recall of the intravenous drug on Jan. 31 and Feb. 1, the Food and Drug Administration said today in an enforcement report on its website.

The FDA last year issued a warning regarding the safety of Bristol-Myers Squibb Company's (BMY) leukemia drug Sprycel. Sprycel is indicated for treating certain adults suffering from CML or ALL. The FDA stated in 2011 that treatment with the drug may elevate the risk of high blood pressure in the lungs' arteries. The disorder is referred to as pulmonary arterial hypertension (PAH). The FDA also stated that due to high blood pressure the heart has to work harder to pump sufficient blood through the lungs.

The drug, which has treated approximately 32,882 patients since launch, blocks the action of an abnormal protein that causes tumor growth.

Two companies that come to mind with CML drugs in phase clinical are:

Ariad Pharma (ARIA) with its drug Ponatinib, a treatment for CML, which eventually could generate annual sales of more than $1 billion. It has been reported that Ponatinib will by-pass phase 3 clinical and be assigned an approval decision date from the FDA soon.

Ariad Pharma has seen its shares over the course of 3 years hit a 5 bagger, with shares currently trading over $16 a share. I feel Sunesis's treatment could end up being more effective and safer than Ponatinib. Ariad investors might be interested in looking into Vosaroxin, as Sunesis reminds me of Ariad a bit from 3 years ago.

Ariad investors might see the same opportunity with Sunesis many of them had with the Ariad stock when it was priced near the range of what Sunesis is currently selling for.

Novartis (NVS) Drugs: Gleevec and Tasigna.

On Febraury 29th, 2012, Bloomberg reported that 2 experimental drugs from Novartis, Gleevec and Tasigna, fought the deadly Ebola virus in laboratory experiments, suggesting the products could be used against a disease for which there are no treatments.

The two medicines stopped the release of viral particles from infected cells in lab dishes, a step that in a person may prevent Ebola from spreading in the body and give the immune system time to control it, researchers from the U.S. National Institute of Allergy and Infectious Diseases wrote in the journal Science Translational Medicine today.

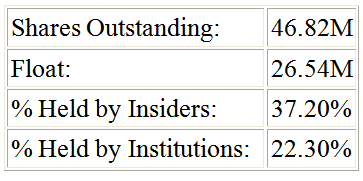

Another reason I feel Sunesis is poised for big things is the stability of their cash position and other portions of their financial statements. They ended 2011 with about $44 million dollars in cash and short term investments. Of this, close to $35 million is in the investment variety which gives me further confidence that they will not burn significant amounts of cash right away. They have a solid representation of insiders who own 37.2% of the shares outstanding. Institutional ownership is also good at 22.3%. This combined with 9.8% short interest could produce a nice pop if further good news is released since these shorts would most likely cover their position.

One thing I found very interesting from their SEC reports is how they have structured several milestone payments. In collaboration with Millennium: The Takeda Oncology Company, Sunesis is eligible to receive up to $60 million dollars in pre-commercialization milestone payments to develop its pan-Raf kinase inhibitor. In this phase one trial, Millennium will pay Sunesis $4 million upfront and take care of the trial costs. I think it is a big benefit to Sunesis that they can collect up to $60 million dollars before this drug would even hit the market and also have the opportunity to collect royalty payments once approved. Many times, I see companies not receiving payments of this size until FDA approval, if ever.

Market Cap: Roughly $120M. Sunesis is grossly under spec valued when considering the positive data seen in prior clinical trials of Vosaroxin.

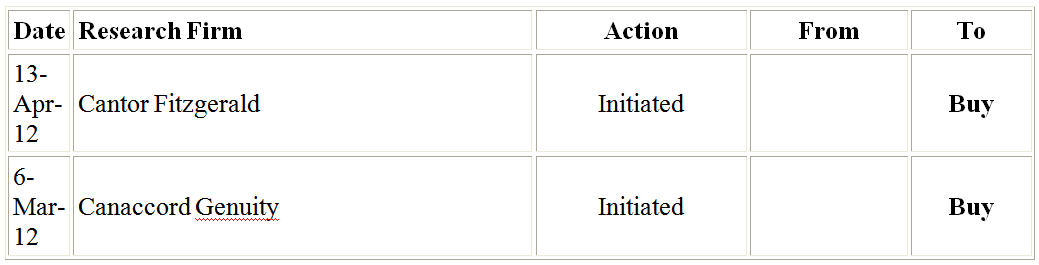

The above 2 firms have recently begun coverage on Sunesis, both recommending Sunesis as a buy. I agree with them obviously.

The stock price lately has been making higher lows and slightly higher highs in a wedge pattern. This is another case where some less experienced chart readers might see a head and shoulders pattern. The price would have to break below $2.40 a share for that bearish pattern to confirm. I see accumulation occurring here right before a break-out on heavy volume occurs in my opinion; a move over 3 seems likely to me.

To summarize, this company will have a big chance to be seen while presenting its phase 3 data on Vosaroxin at the ASCO meetings. I also strongly feel traders will have a nice shot at a strong short term catalyst trade for the same reason.

When I consider these factors with the orphan drug designations in both the EU and the U.S.A., I like the track Sunesis is currently on and in my opinion, I expect a short term stock price leading up to the June 4th presentation to hit around $3.10 a share, maybe a tad higher.

Price target opinions:

Short term pps: $3.10

1 Year pps target: $14.50, which is dependent on Vosaroxin getting the green light from the FDA.

Chart data sourced from Yahoo Finance.

Disclosure: I am long SNSS.

Disclaimer: This article is intended for informational and entertainment use only and should not be construed as professional investment advice, but rather my opinions as a writer only. Always do you own complete due diligence before buying and selling any stock.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Sunesis Pharma: Promising Leukemia Drug With Potential

Published 05/08/2012, 03:04 AM

Updated 07/09/2023, 06:31 AM

Sunesis Pharma: Promising Leukemia Drug With Potential

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.