: This commentary has been revised to include today's release of the July Real Income Less Transfer Payments data. This is the last of the Big Four to be updated through July.

-----------------------------------

Official recession calls are the responsibility of the NBER Business Cycle Dating Committee, which is understandably vague about the specific indicators on which they base their decisions. This committee statement is about as close as they get to identifying their method.

There is, however, a general understanding that there are four big indicators that the committee weighs heavily in their cycle identification process. They are:

- Industrial Production

- Real Income

(excluding transfer payments) - Employment

- Real Retail Sales

The weight of these four in the decision process is sufficient rationale for the St. Louis FRED repository to feature a chart four-pack of these indicators along with the statement that "the charts plot four main economic indicators tracked by the NBER dating committee." In his July 10 Bloomberg TV interview, ECRI's Lakshman Achuthan cites these four at about the 2:05 minute point in his remarks. He says, and I quote "When you look at those four measures, they are rolling over."

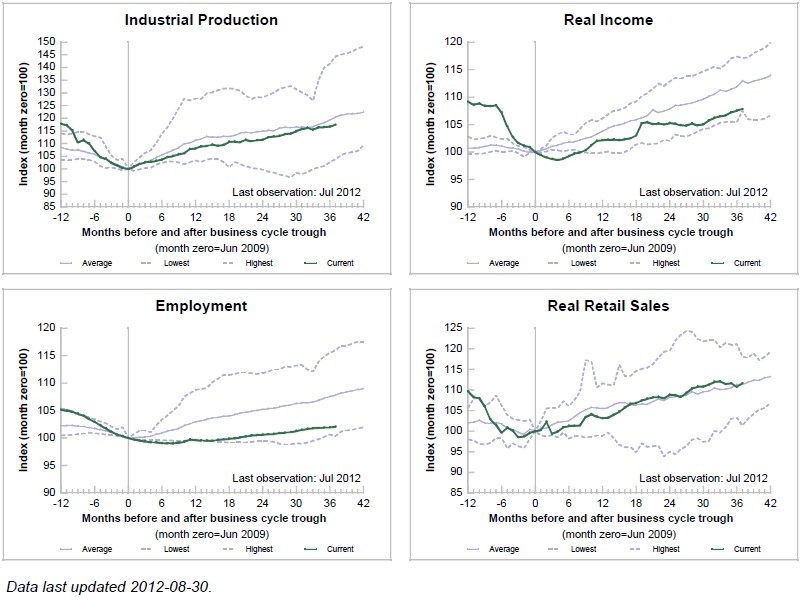

Are they really rolling over? First, here are the four as identified in the Federal Reserve Economic Data repository. See the data specifics in the linked PDF file with details on the calculation of two of the indicators.

The FRED charts are excellent. They show us the behavior of the big four indicators currently (the green line) as compared to their best, worst and average behavior across all the recessions in history for the four indicators (which have start dates). Their snapshots extend from 12 months before the June 2009 recession trough to the present.

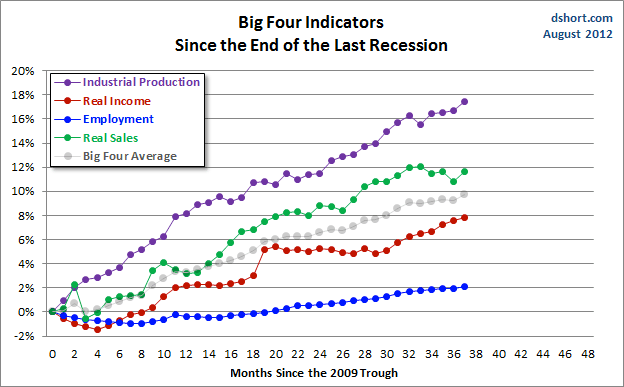

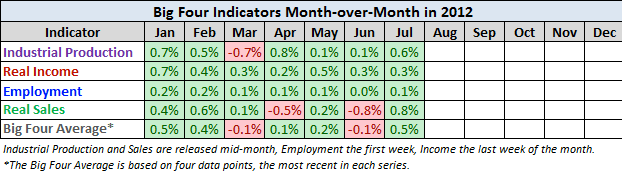

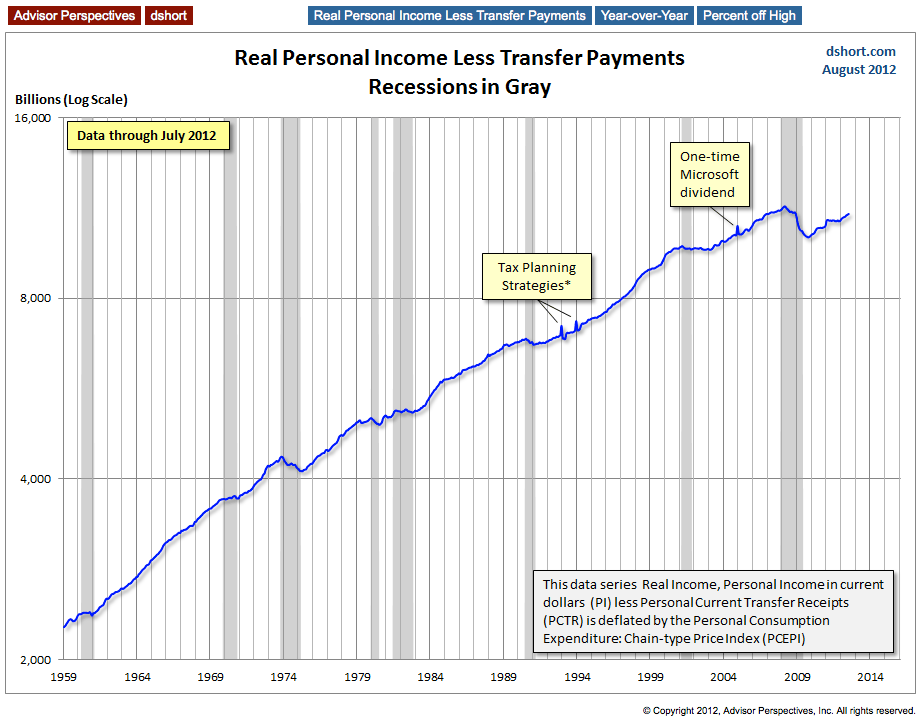

The latest update to the Big Four was today's release of the July Real Income Less Transfer Payments data (the red line in the chart below), which rose 0.3 percent over last month, which matched the consensus expectations.

Background Analysis

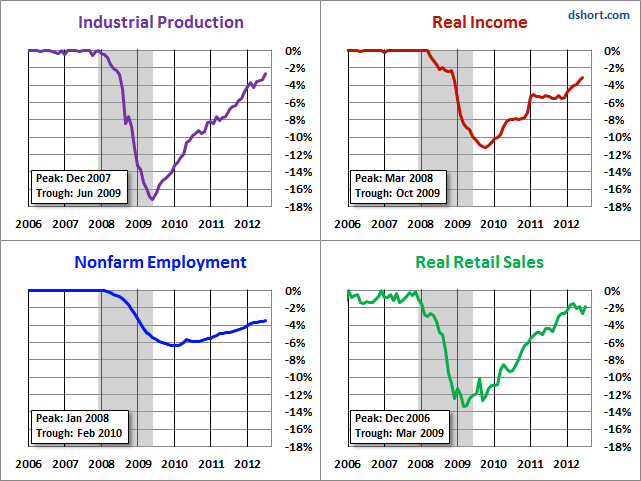

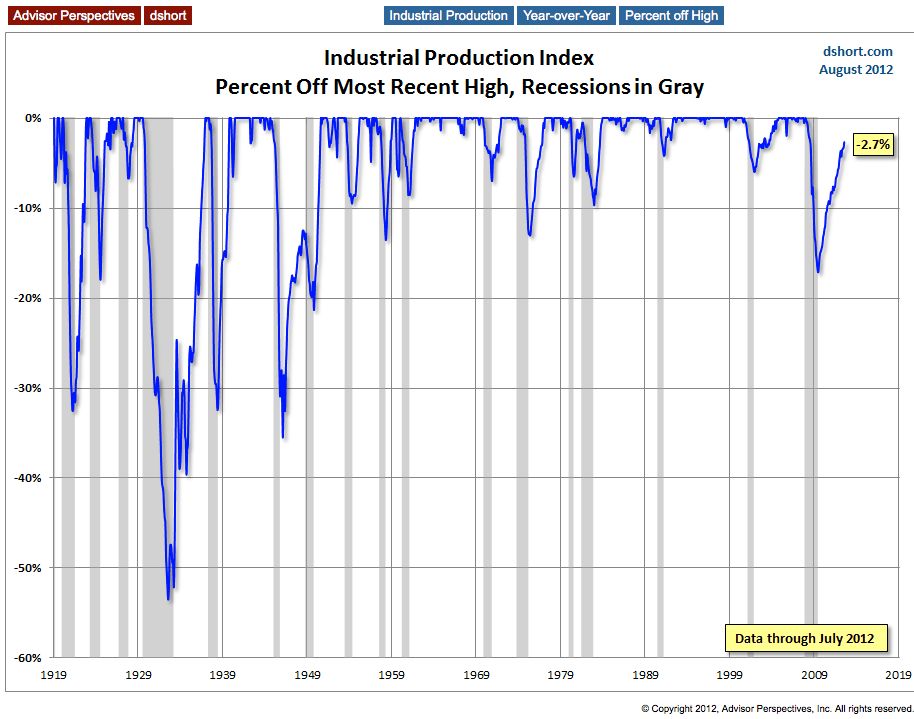

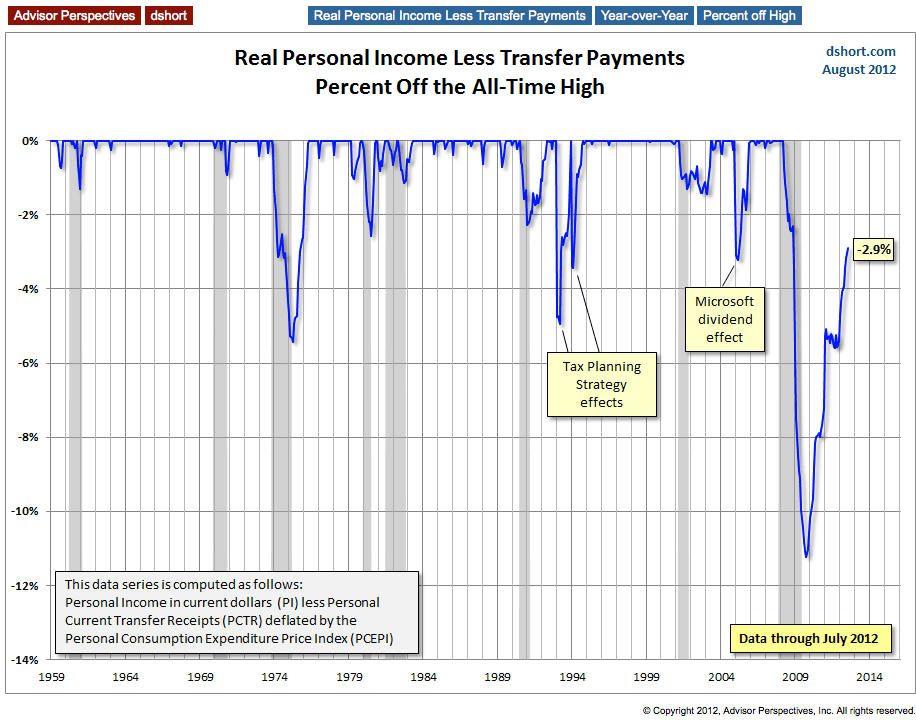

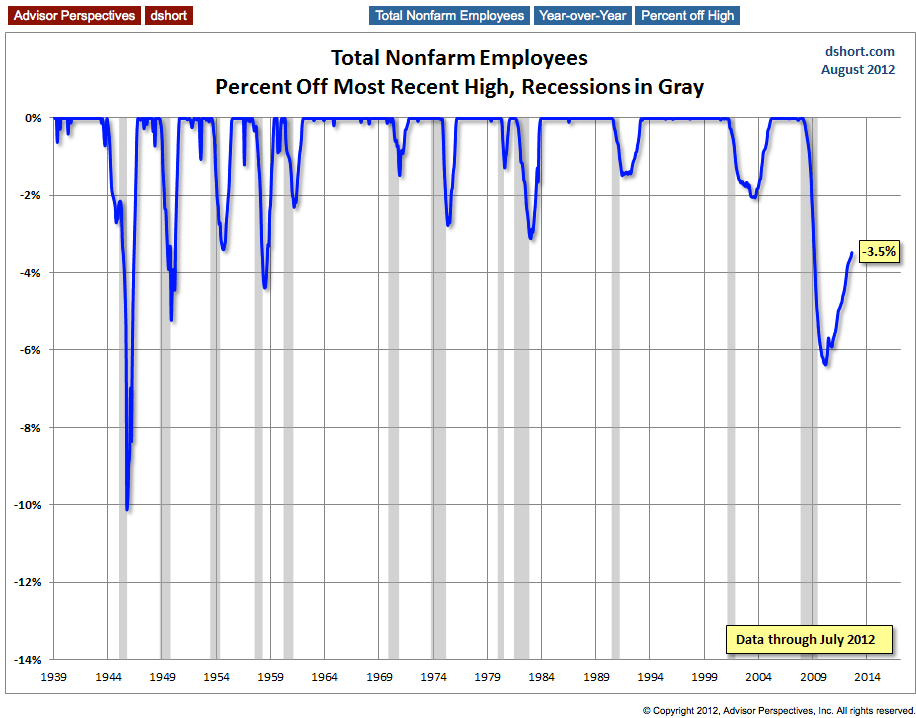

The Big Four Indicators and Recessions The charts above don't show us the individual behavior of the Big Four leading up to the 2007 recession. To achieve that goal, I've plotted the same data using a "percent off high" technique. In other words, I show successive new highs as zero and the cumulative percent declines of months that aren't new highs. The advantage of this approach is that it helps us visualize declines more clearly and to compare the depth of declines for each indicator and across time (e.g., the short 2001 recession versus the Great Recession). Here is my own four-pack showing the indicators with this technique.

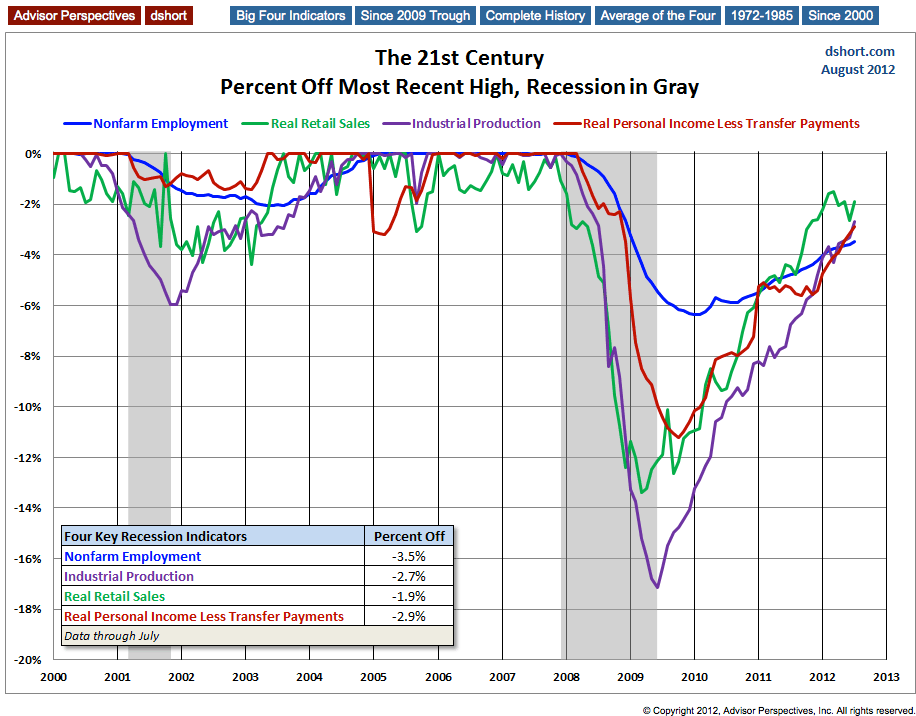

Now let's examine the behavior of these indicators across time. The first chart below graphs the period from 2000 to the present, thereby showing us the behavior of the four indicators before and after the two most recent recessions. Rather than having four separate charts, I've created an overlay to help us evaluate the relative behavior of the indicators at the cycle peaks and troughs. (See my note below on recession boundaries).

The chart above is an excellent starting point for evaluating the relevance of the four indicators in the context of two very different recessions. In both cases, the bounce in Industrial Production matches the NBER trough while Employment and Personal Incomes lagged in their respective reversals.

As for the start of these two 21st century recessions, the indicator declines are less uniform in their behavior. We can see, however, that Employment and Personal Income were laggards in the declines.

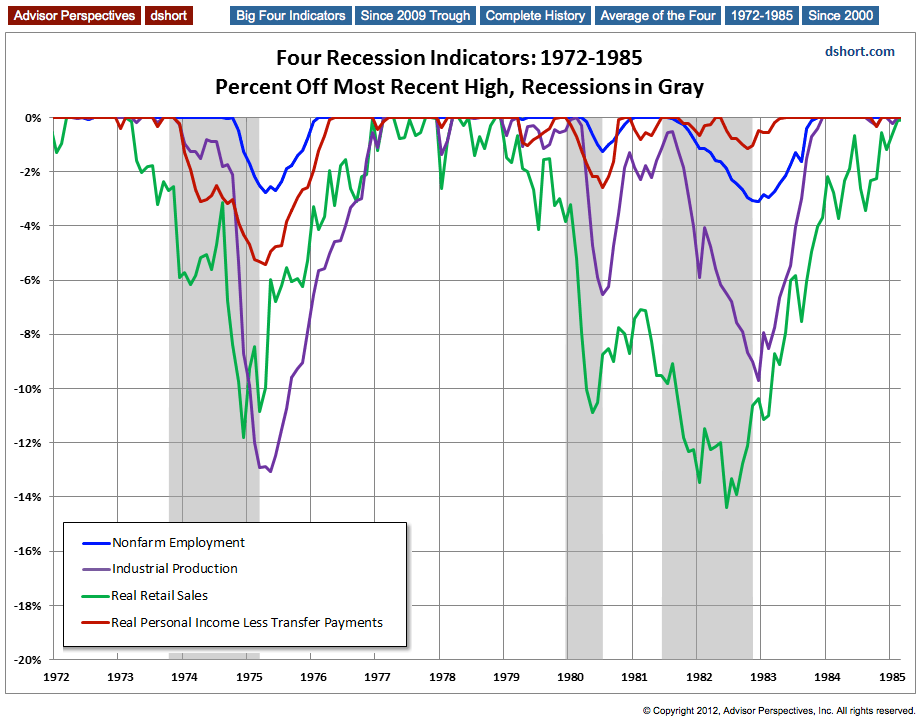

Now let's look at the 1972-1985 period, which included three recessions -- the savage 16-month Oil Embargo recession of 1973-1975 and the double dip of 1980 and 1981-1982 (6-months and 16-months, respectively).

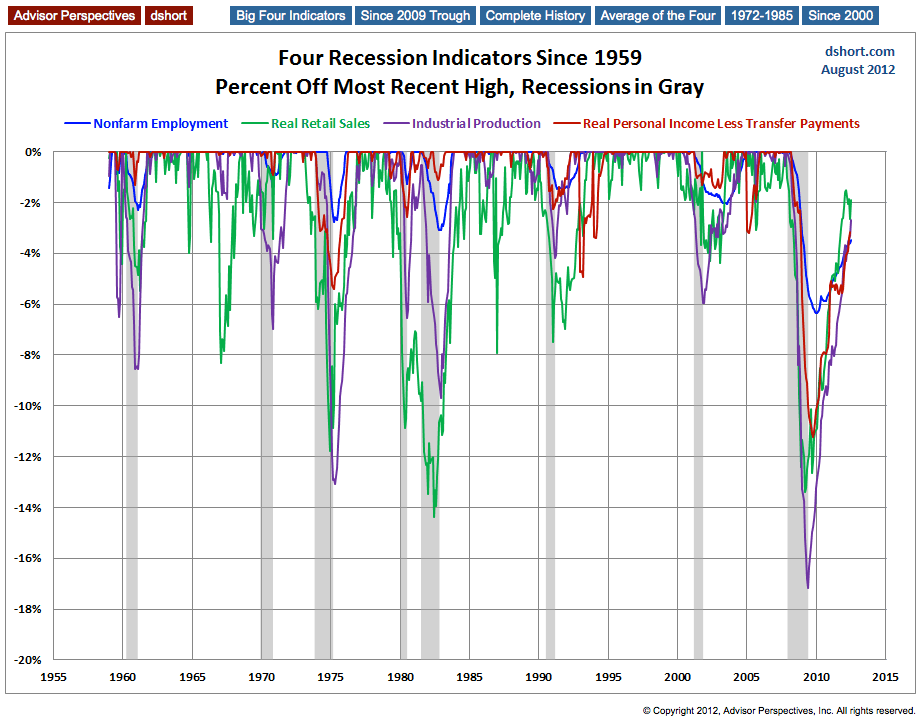

And finally, for sharp-eyed readers who can don't mind squinting at a lot of data, here's a cluttered chart from 1959 to the present. That is the earliest date for which all four indicators are available. The main lesson of this chart is the diverse patterns and volatility across time for these indicators. For example, retail sales and industrial production are far more volatile than employment and income.

Are The Big Four Rolling Over?

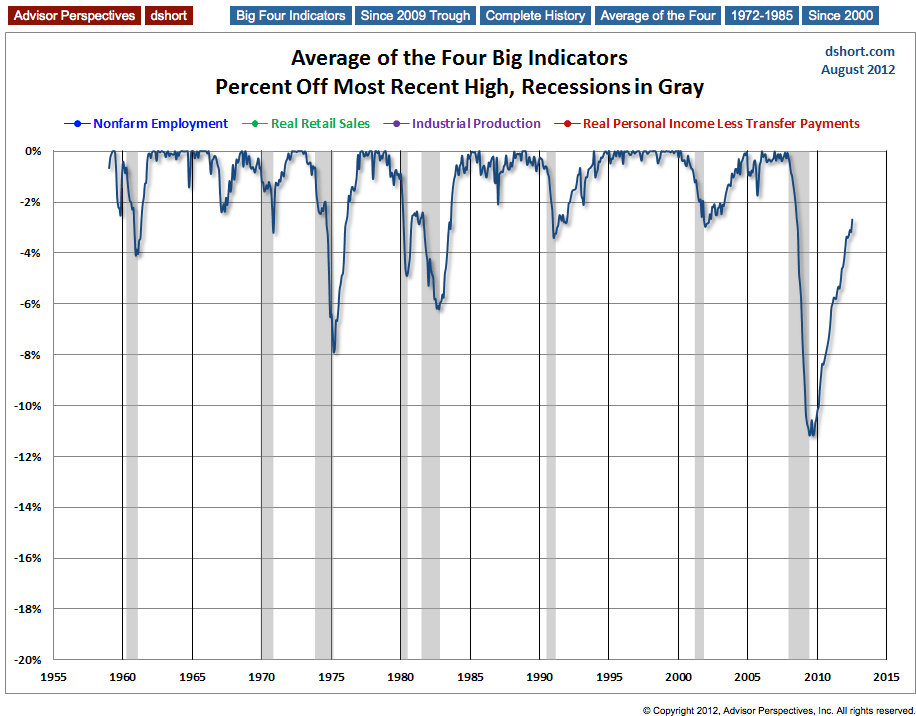

As of the latest data, no, they are not collectively rolling over. Here is the big picture since 1959, the same chart as the one above, but showing the average of the four rather than the individual indicators. This chart clearly illustrates the savagery of the last recession. It was much deeper than the closest contender in this timeframe, the 1973-1975 Oil Embargo recession. While we've yet to set new highs, the trend has collectively been ever upward.

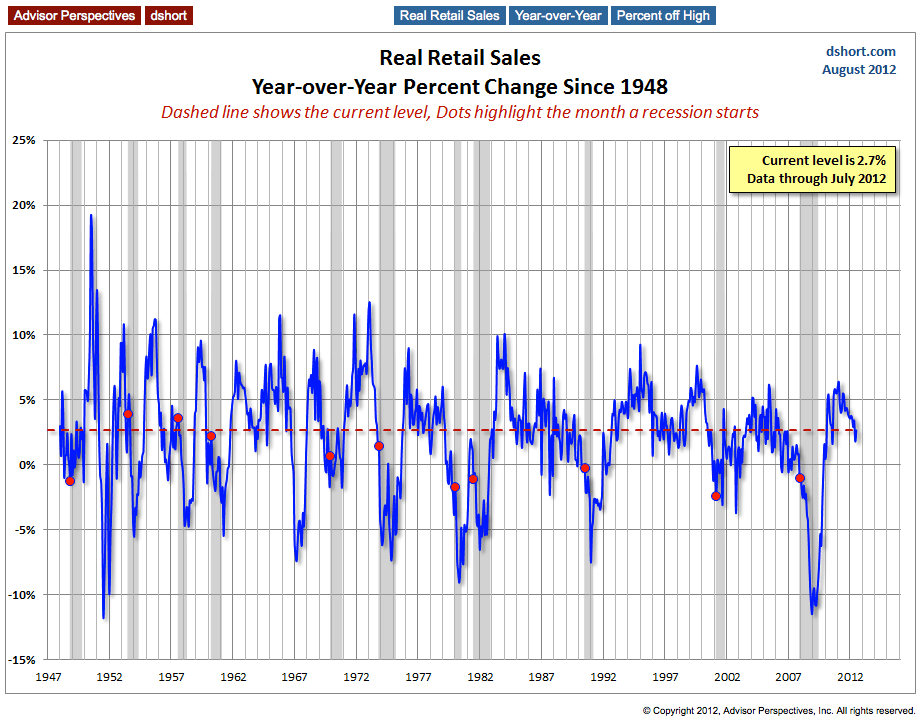

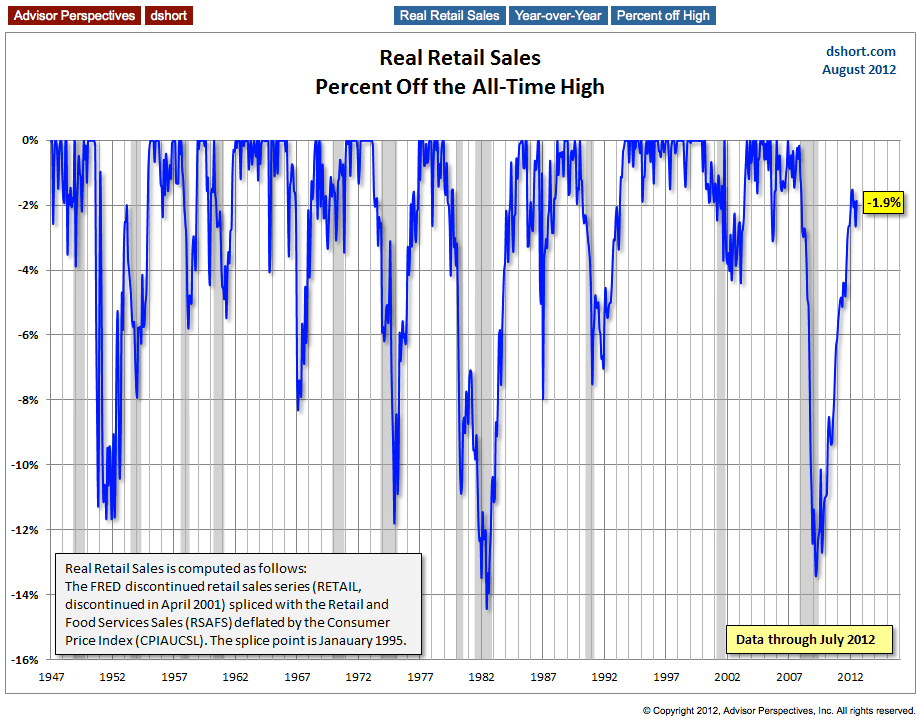

The one outlier in recent months has been Real Retail Sales. As the charts above illustrate, it has undergone a contraction in two of the past four months. The erratic behavior of real retail sales is definitely a concern. A close study of the longer historical data shows that of the big four indicators, this one has tended to be a leader in the trend, although its higher volatility cautions us to take the recent months with a grain of salt. Contractions in retail sales have frequently happened without a recession lurking around the corner.

Appendix: Chart Gallery With Notes

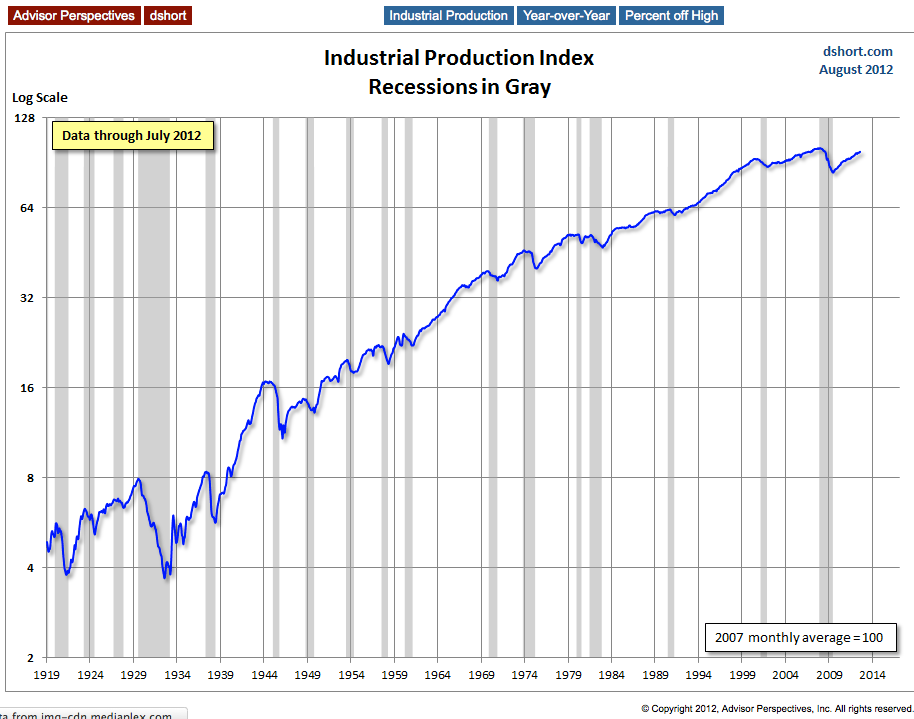

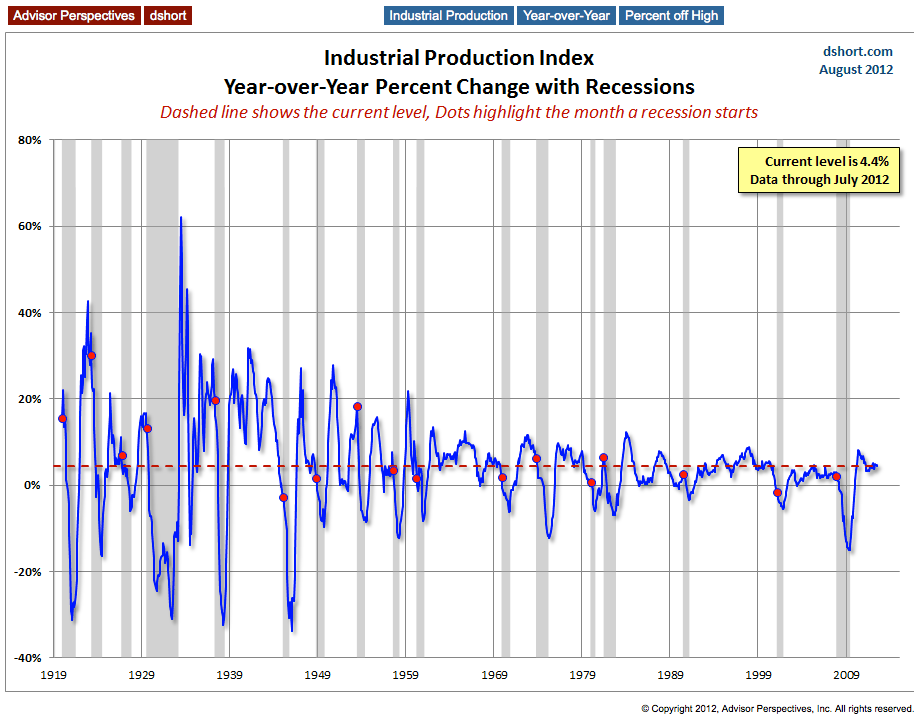

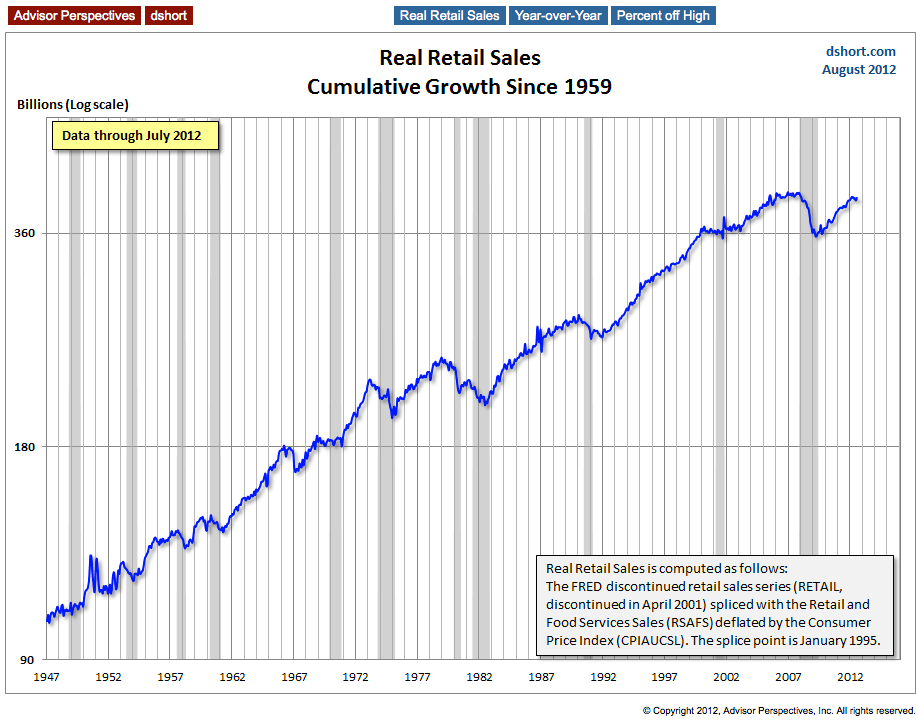

Each of the four major indicators discussed in this article are illustrated below in three different data manipulations:

- A log scale plotting of the data series to ensure that distances on the vertical axis reflect true relative growth. This adjustment is particularly important for data series that have changed significantly over time.

- A year-over-year representation to help, among other things, identify broader trends over the years.

- A percent-off-high manipulation, which is particularly useful for identifying trend behavior and secular volatility.

The U.S. Industrial Production Index (INDPRO) is the oldest of the four indicators, stretching back to 1919. The log scale of the first chart is particularly useful in showing the correlation between this indicator and early 20th century recessions.

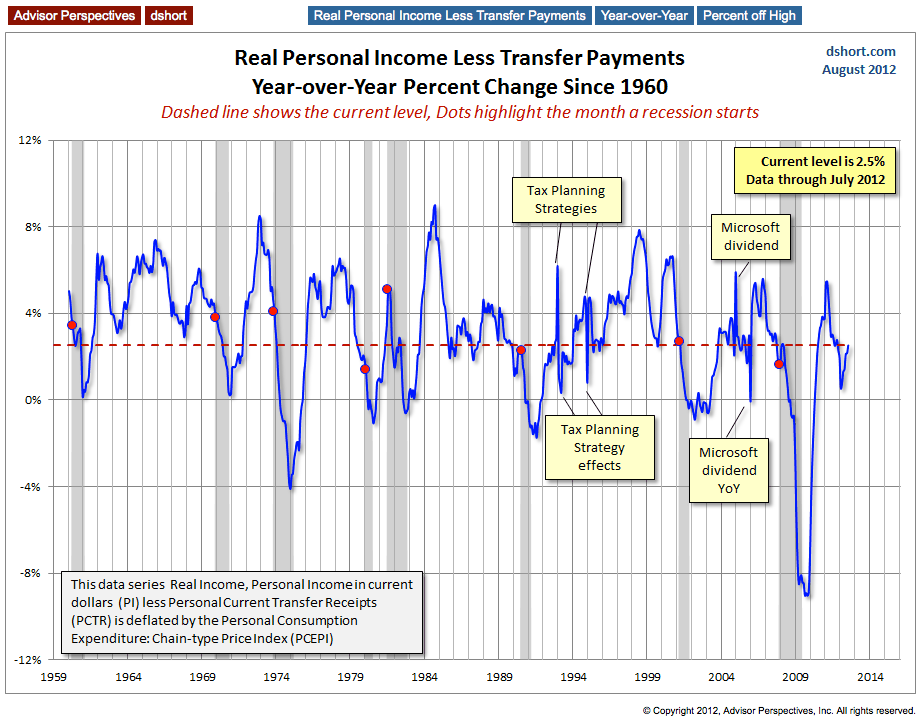

Real Personal Income Less Transfer Payments

This data series is computed as by taking Personal Income (PI) less Personal Current Transfer Receipts (PCTR) and deflated using the Personal Consumption Expenditure Price Index (PCEPI). I've chained the data to the latest price index value.

The "Tax Planning Strategies" annotation refers to shifting income into the current year to avoid a real or expected tax increase.

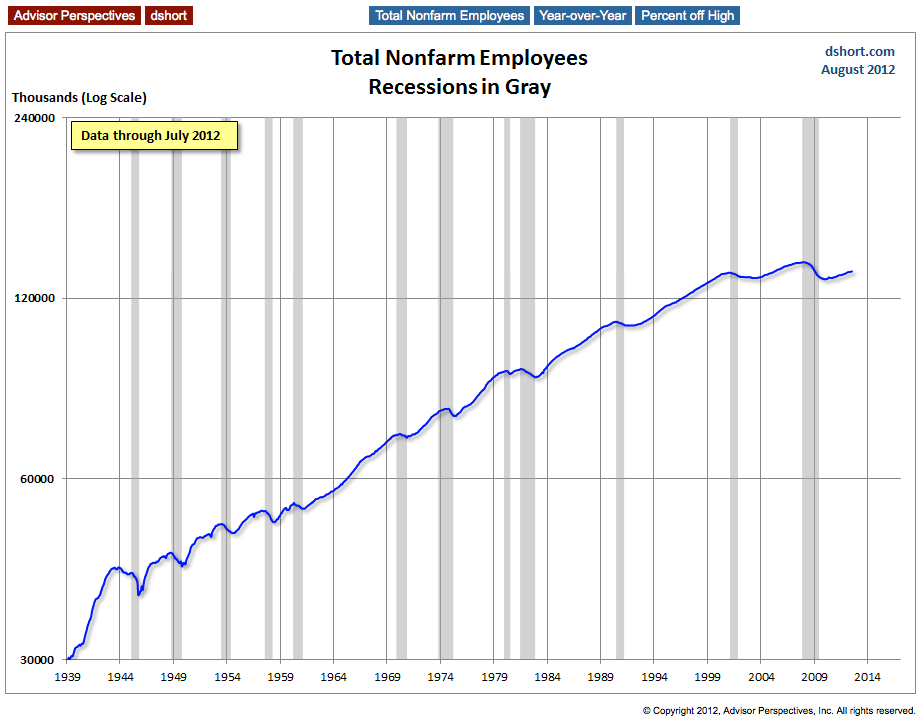

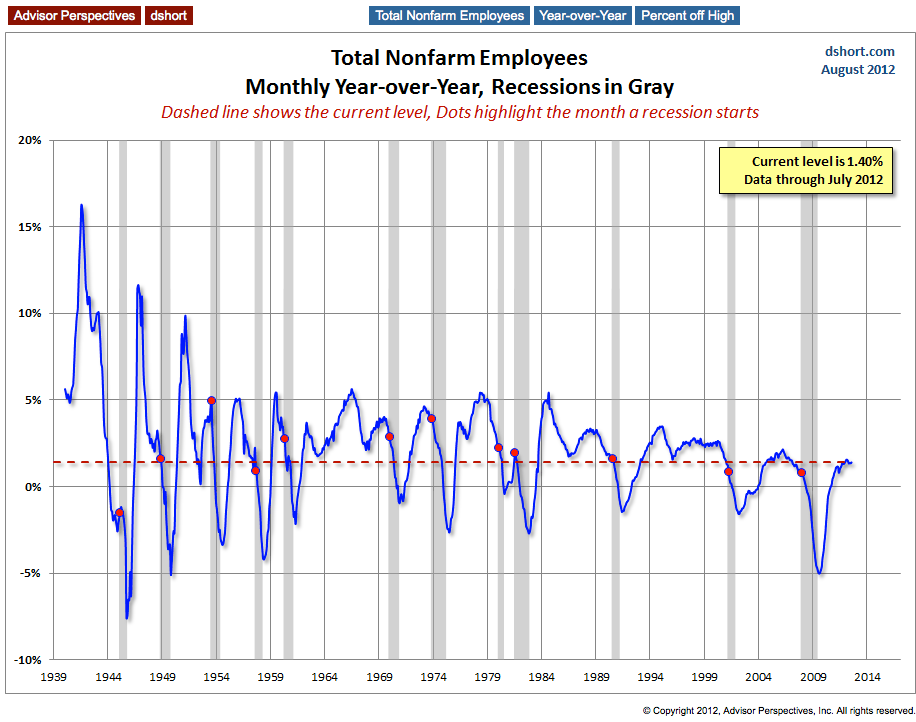

Total Nonfarm Employees

There are many ways to plot employment. The one referenced by the Federal Reserve researchers as one of the NBER indicators is Total Nonfarm Employees (PAYEMS).

Real Retail Sales

This indicator is a splicing of the discontinued retail sales series (RETAIL, discontinued in April 2001) spliced with the Retail and Food Services Sales (RSAFS) and deflated by the Consumer Price Index (CPIAUCSL). I used a splice point of January 1995 because that was date mentioned in the FRED notes. My experiments with other splice techniques (e.g., 1992, 2001 or using an average of the overlapping years) didn't make a meaningful difference in the behavior of the indicator in proximity to recessions. I've chained the data to the latest CPI value.

Note: I represent recessions as the peak month through the month preceding the trough to highlight the recessions in the charts above. For example, the NBER dates the last cycle peak as December 2007, the trough as June 2009 and the duration as 18 months. The "Peak through the Period preceding the Trough" series is the one FRED uses in its monthly charts, as explained in the FRED FAQs illustrated in this Industrial Production chart.