From the country that brought us the tulip mania - roughly on the 375th anniversary of the tulip bubble crash - comes the latest property market correction in the eurozone.

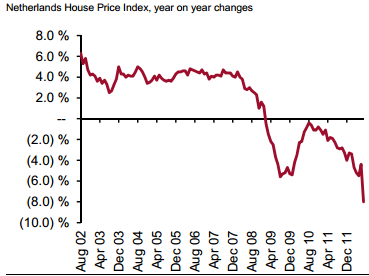

WSJ: The slump in the Dutch housing market deepened in July as prices posted the steepest drop on record, highlighting the challenges facing the Netherlands ahead of next month's general elections.

With prices now plumbing levels last seen in 2004, the downturn is weighing heavily on household consumption and has raised concern about the country's huge mortgage debt pile, among the largest in Europe.

So far, this is not nearly as bad as the property market corrections in Spain or Ireland, but this was certainly unexpected. And now just as in the US, there is no shortage of blame to go around.

WSJ: Regulators blame loose lending practices in the late 1990s and early 2000s and a tax relief program for home buyers that distorted the Dutch housing market. As a result, they say, the country's banks have become too reliant on wholesale funding to finance their large mortgage books. At around €640 billion ($790 billion), Dutch mortgage debt is roughly the size of the country's entire economic output last year.

The Dutch central bank warned earlier this year that a prolonged slump poses a risk to the financial system as banks could face rising loan losses and more trouble securing funding. It could also squeeze public finances, as the Dutch government guarantees around €140 billion in home loans.d concern about the country's huge mortgage debt pile, among the largest in Europe.

What got banks, politicians, and regulators really spooked was the sharpness of the correction. It is also an indication that the eurozone "core" is not immune to the crisis.

Similar to the political backlash that took place in the US after the housing crisis, the Dutch government remains vulnerable to significant changes that could have a eurozone-wide impact.

CS: We think that negative headlines could arise during the process of forming a new government. The Socialists are leading in the polls and they could become the strongest party.

They propose a longer time frame – 2015 instead 2013 - to reach the 3% budget deficit. They also reject the European fiscal pact.

And similar to the tulip crash, it is the leverage that makes this housing correction so dangerous.

CS: Dutch household liabilities are the highest in Europe, mainly due to the high residential mortgage debt. Therefore, the adjustment in the housing market has a negative wealth effect which should have a relatively larger impact on household spending, and thereby, on GDP growth.

With 80% of the Netherlands' GDP coming from exports, the nation is already highly exposed to global growth. This housing market decline could tip the Dutch economy into a recession.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Crash Of The Dutch Housing Market Reminds Us Of A Much Older Market

Published 08/26/2012, 02:21 AM

Updated 07/09/2023, 06:31 AM

The Crash Of The Dutch Housing Market Reminds Us Of A Much Older Market

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.