The Greek election on May 6th will present the European Union (EU), which is already struggling under tough economic conditions and growing political tensions, with yet another challenge. The most likely outcome is a parliament in which no single party has a majority, which means tough negotiations will ensue among the parties to form a governing coalition. Once, and if, this hurdle is overcome, the even more difficult challenge will be to pass further austerity measures in the face of very hostile opposition coming from both the newly empowered anti-austerity parties and the recession-weary public.

All this brings into sharp relief four risks: 1) renewed fears of a Greek default and risks of contagion spreading toother countries; 2) the increasing ability of far left and right parties to counter the policies of the traditional ruling parties; 3) the growing backlash against austerity measures; and 4) a fragmented Greek parliament combined with a Hollande victory in the second round of the French Presidential elections (both of which are being held on the same day), hitting the markets with a one-two geopolitical punch.

As of late, the European Union has had plenty to worry about. Economic conditions are deteriorating, with worries having spread to Spain and Italy. On the political front, meanwhile, the increasing likelihood of a victory by the socialist candidate, François Hollande, in the second round of the Presidential elections, coupled with the collapse of the government in the Netherlands, has also raised alarm bells. Hollande wantsto renegotiate Europe’s fiscal pact so that it is less austerity-focused, setting France on a collision course with Germany, the leading proponent of austerity. The Dutch government collapsed when one of its coalition members refused to approve significant budget cuts.

With all this to worry about, the upcoming Greek election is the last thing the EU needs. This is especially the case since its free-falling economy, which has shrunk by almost 14% since 2009, has left Greek voters in a foul mood. This anger will radically transform Greece’s political landscape. Indeed, PASOK and New Democracy, the two centrist parties which have taken turns ruling Greece since it became a Democracy in1974, are polling at record lows.

If current polls hold, the combined support for these two parties, which have ruled in a fractious coalition for the last six months, will fall from 77% in the 2009 election to anywhere from 30% to 40% in upcoming election. (Polls show New Democracy leading with 23% of thevote, followed by PASOK at 15%.)

Further, as many as 10 parties (up from its current five) could exceed the 3% minimum popular voterequirement for Parliamentary representation. This includes three far left parties - KKE, Left Coalition and Democratic Left - which are against the EU bailout and could together win 21% to 33% of the vote. On the far right, there is the Golden Dawn party which could win up to 5% of the vote. With these polls in mind, the two most likely outcomes for the May 6th Greek election are as follows:

- The First Scenario. Thanks to a new electoral rule awarding 50 extra seats to the winning party or coalition, New Democracy and PASOK win just enough seats to continue their ruling coalition. Intense negotiations follow to divide the spoils of power between them. Soon after the two begin to officially govern, tensions between them rise as they lay the blame on each other for Greece’s predicament.

- The Second Scenario. New Democracy and PASOK fail to agree on a governing coalition or they fail to win enough seats to actually form a coalition. As a result, other parties are invited to join the coalition, or each party goes its own way and tries to form alliances. Either way, the result is a government in constantrisk of collapse.

Regardless of which scenario is realized, the government will be driven by divisions and will face very strong political opposition. Indeed, up to half of the seats in parliament could be filled by far left and right parties that are fiercely against the loan agreements signed with the EU commission and the IMF.

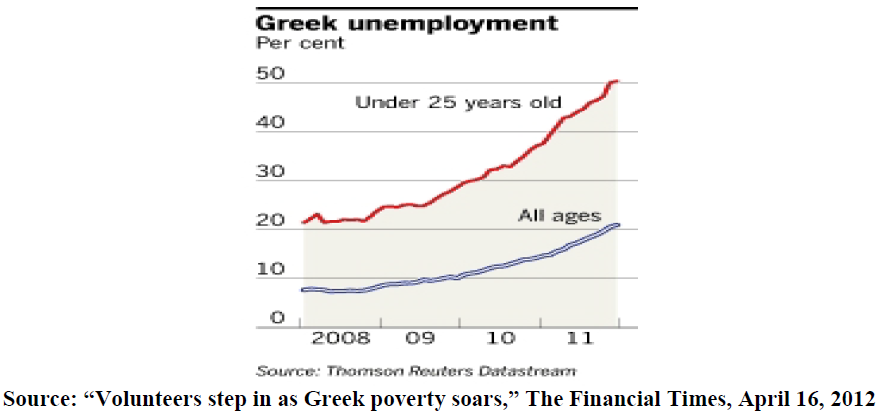

The staying power of this coalition will come under immediate pressure following the election. With unemployment already running at 23% and 50% for youth, the government has promised the EU it would approve another 11 billion euros worth of cuts by as early as June. Resistance to these measures, which would only worsen the economy in the short-term, will come in the form of mass protests and strikes.

This turmoil will immediately lead to renewed doubts over whether Greece will be able to implement the EU-mandated austerity measures.

Fears will be reignited that it is only a matter of time before Greece defaults on its debt, which in turn would spread panic to other countries such as Portugal, Ireland and even Spain. The Greek election will be yet another example of how far left and right parties are transforming the geopolitical landscape in Europe, and are making life very difficult for established political parties. A fragmented parliament in Greece and a Hollande victory in France would be yet another indication ofthe growing anti-austerity sentiment in Europe. This, in turn, would leave Germany increasingly isolated in its position that tough austerity measures are needed to overcome the debt crisis.

Voters will be given other opportunities to express their dissatisfaction. Ireland is holding a referendum on May 31st over whether to support the EU fiscal pact mandating austerity measures, and France is scheduled to have legislative elections for June 10 and June 17.

The EU’s inability to handle the economic-related problems of a tiny country like Greece does not inspire confidence in its ability to deal with the looming challenges facing Portugal, Ireland, Spain and other countries. This situation is made even more difficult by the increasing political divisions in the eurozone. All of this leaves the markets facing several geopolitical storm clouds on the horizon.

Below is a list of reports that NBF Geopolitical Research has written on the euro zone crisis to date.

The Geopolitics of the Euro Zone Debt Crisis: Are the Markets Underestimating the Risks? (February 2011)

The Euro Zone's Growing Geopolitical Impasse Worsens the Debt Crisis (March 2011)

Spain: The Euro Zone's Firewall or Next Domino? (May 2011)

The Geopolitical Obstacles To A Successful Resolution Of The Euro Zone Debt Crisis: An Update (September 2011)

The Geopolitical Obstacles to a Successful Resolution of the Euro Zone Debt Crisis: Prospects for 2012 (January 2012)

The Day After….Are the Markets and Politicians Underestimating the Impact of a Disorderly Greece Default and Euro Zone Exit? (March 2012)

Why The Markets Should Pay Attention To The Upcoming French Elections And The Aftermath (April 2012)

The Collapse Of The Dutch Government Is The Latest Blow To The Euro Zone (April 2012)