The second quarter is far behind us, but the time is fast approaching for economic data releases and earnings reports that may send shudders and panic or sheer joy through the investment community. At least forex traders can win big time during either scenario, but you still must be on the right side of the trade. Strange things have been happening lately, especially with the euro and commodity currencies, but, as always, the question is what happens next? Volatility refuses to get off its “summer doldrums” floor, but the gathering consensus is that it might just do that and in short order.

The prevailing themes for 2017 have changed very little: 1) Central bank policy divergence; 2) Energy and commodity prices; 3) China, and 4) Europe, to a lesser degree, but only if Brexit, political unrest, and economic failings remain at a low boil. The “Trump Trade” has been regarded as an anomaly, but reality may finally be setting in. Expectations have already been a bit overblown, but equity valuations refuse to acknowledge the presence of gravity. This storyline seems eerily reminiscent of Europe some years back.

Financial articles have lately battened down the hatches, as if a storm is brewing. Better to be prepared for an ill wind than be caught flatfooted in a raging gale. Analysts are expressing caution. Investor sentiment is all over the map, but worsening over time. In situations, such as these, it is time for a mid-course correction. In that vein, here is a brief recap of the fundamental drivers, as of this moment, from the analysts’ perspective, including their present opinions on the illusory prospects of investor attitudes.

What are the latest worrisome events that rest heavy on investor sentiment?

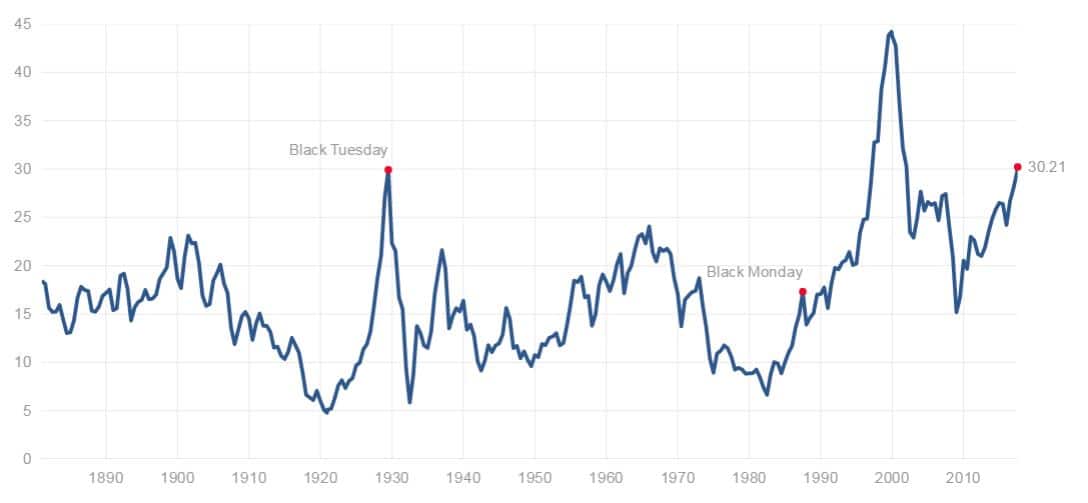

The Shiller CAPE Index has, according to many, kept its author, Nobel laureate Robert Shiller, awake at night. His renowned ratio, as can be seen in the above diagram, is resting at a value of 30.2, just above the same value prior to “Black Thursday” in 1929. Yes, irrational exuberance pushed the index to greater heights before the Dot-Com crash, but are we due for another crash of epic proportions?

The folks over at CNBC.com were curious about this same scenario and polled nearly 12,000 of their readers to ascertain where their hearts and minds were currently residing. The question asked was rather straightforward: “Is the stock market about to suffer an epic crash?” The query could have been softer, asking only if stocks were overvalued or if values would decline by yearend, but the bluntness of the survey struck two chords with words like “about” and “epic”. Believe it or not, a solid 44% of the readership participating in the survey said, “Yes”.

Bulls tend to laugh with glee, when such reports are published. A frightened public means that there is a great deal of cash on the sidelines, waiting to be invested, hardly a sign that market values have reached a top. The opposing view is that the readers may not be a fair representation of the investment community. In other words, the degree of bearishness in the survey may actually be understated.

So what is one to believe? Despite a number of positive protestations from happy Bulls, the general flavor of articles in the financial press over the past year has primarily been bitter to the taste buds, more sour than sweet. The author at CNBC was cautious in his summation, but guardedly optimistic, as well: “The bottom line is, there is an extremely and unusually high level of skepticism about this bull market. This is rather amazing for a market that has more than quadrupled since the bottom of the bear market in March 2009.”

Will the Fed continue to pursue normalization on several fronts?

The word on the street is that Janet Yellen is softening her stance on monetary tightening, even though the Fed has hiked interest rates three times in the past year and telegraphed quite often that it will begin to shrink its bloated balance sheet. It is an accepted fact that equity valuations are tied to cheap money, i.e., QE liquidity expansion and low interest rates. Yellen’s comments to Congress apparently caught Trump’s ear. He wants a weak Dollar and low interest rates, and it appears that Janet will toe that line, as well as she can, if she wants another term as Fed Chair.

Risky assets continue to be buffeted by psychological factors, which could change in an instant, but, if you dig into the numbers, one concern emerges that is disconcerting to those in the know: “What is of interest is the out-performance of the large caps/blue chips over the small caps over the last couple of months. Historically, an under-performance of small caps versus large caps is usually one of the first signs that marks a top.” More pessimism on another front is not what the doctor ordered.

The Fed, if anything, is worried more about the U.S. economy than whether Trump likes its chairperson. GDP growth data for the second quarter came in at 2.6%, a good bit better than the revised 1.2% rate posted for Q1. There was one more bright side, as well: “The employment cost index increased, even after adjusting for inflation. This is a median rather than an average measure, so it means that most workers saw some improvement in their pay in the second quarter.” All was not rosy, however. Private residential investment was down by 6.8%, and corporate income data also declined. Time will tell if these two latter indicators are true harbingers of bad news or merely statistical “noise”.

What about oil and commodity prices and the energy sector?

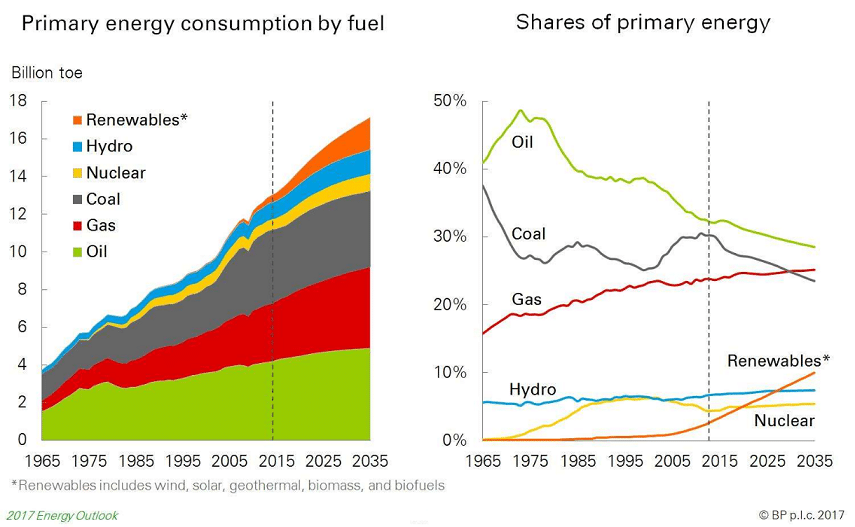

Results in the energy sector, the world’s largest market, have been mixed. Exxon (NYSE:XOM) and Chevron (NYSE:CVX) announced improving profit margins, but both behemoths fell short of analyst expectations, a surprise since the trend had been to surprise in the other direction. Both companies complained of a tough quarter, where cash generation was weak, and production woes ruled the day. Oil prices have been hovering around $45 a barrel for weeks, but on a more positive note, oil prices surged toward $50 over the past week. The long-term narrative has not changed. Oil and coal will decline in share, as natural gas and renewables ramp up over the next two decades, as detailed below:

What are the near-term prospects going forward? Per one expert: “The energy sector had a solid start to 2017, but could not sustain the momentum in the second quarter. Broadly speaking, energy was down, and midstream followed, all tracking crude oil prices lower. OPEC has deliberately reduced exports and there is an opportunity for further action given Saudi Arabia’s pledge to do “whatever it takes” to defend oil prices.” Expectations are that inventories will decline over the remainder of 2017, as demand once again exceeds supply, making $50 oil a better bet in 2018 and beyond.

Commodity currencies, like the Aussie and the Loonie, have responded in kind with material appreciation runs of late, due to improving prices and a decline in the strength of the greenback. The US Dollar Index has fallen from 103 at the beginning of the year to below 94. Both Australia and Canada are blessed with abundant natural resources, and the positive moves of each currency have been a reflection of commodity prices in general. Over 2017, The AUD and CAD have appreciated versus the Dollar by 10.5% and 7.5%, respectively.

News about China has been subdued. How are things in the Middle Kingdom?

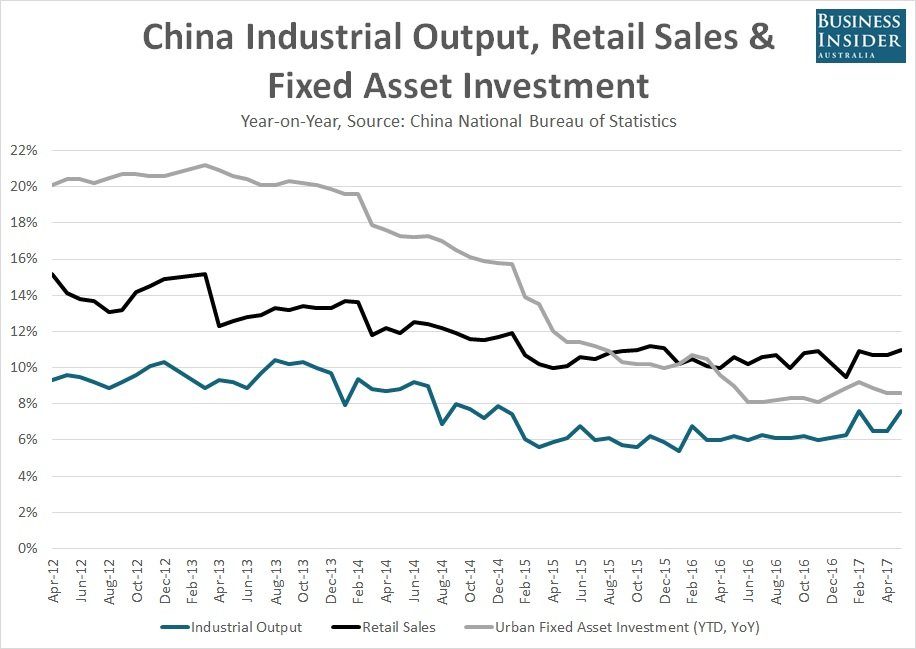

China has been out of the limelight, so to speak, while Trump has commanded center stage, somewhat to the chagrin of both Yellen and Draghi over in Europe. China, however, just reported GDP growth of 6.9%, a bit higher than the expected figure of 6.8%, but a healthy increase, just the same. In fact, economic things have been gathering steam, as the chart below will attest:

China’s so-called “soft landing” began in 2015 and has extended through to the present, but a gradual trend upward has been ever so slightly developing for the past twelve months. The issue, however, has been whether these figures are a true reflection of the China situation or more propaganda-based to serve the parties in power. As difficult as it has been to predict economic outcomes across the planet, Chinese officials have always managed to be spot on or just barely above expectations. Are these figures to be believed? Many analysts have confessed disbelief, but are now grudgingly accepting these figures to be valid, another reason that commodity prices have recently improved.

What about Europe? Is it “same old story” or another tune this time around?

The euro has been on a tear of late. Its fast track began in early March, bouncing off 1.05 and ascending to the heavens, if over 1.17 can be described as such. Draghi’s recent comments that he is not concerned with a stronger euro only added fuel to the fire. Inflation remains the inescapable goal, if bond purchases are to recede or interest rates are to be raised. A stronger euro, however, may prevent inflation from budging to the north.

Analysts believe that the euro has benefited, as have other currencies, from a weakening dollar, but when will fundamentals take over? Fed watchers are presently discounting future rate hikes. The Euro could remain lofty for weeks to come, but at some point, gravity must return. Keep in mind that many forex experts have lost fortunes shorting the Euro. This scenario could be déjà vu all over again.

Concluding Remarks

The forex narrative for 2017 has definitely changed. No longer is the USD seen as King Dollar. Parity with the euro was just another pipe dream. The USD Index ended 2016 above 103, but it now languishes just below 94. Per one analyst: “Investors are unsure that the Trump administration can advance its pro-growth agenda meaningfully at the moment.” As political uncertainty diminishes and other global economies improve, the central bank policy divergence theme becomes less compelling.

Forex experts have made their own mid-course corrections, but after factoring in the new narrative, a rebound in the dollar’s fortunes is embedded in their new forecasts. The USD index may sit below 94 today, but revised projections suggest a value of 97 by yearend. Is it time to buy USD and short the other majors? There will come a time, if you believe the experts, but their track record for the first half of 2017 was a bit off. Caution remains the best advice, but be prepared for either scenario, long or short.

Risk Statement: Trading Foreign Exchange on margin carries a high level of risk and may not be suitable for all investors. The possibility exists that you could lose more than your initial deposit. The high degree of leverage can work against you as well as for you.