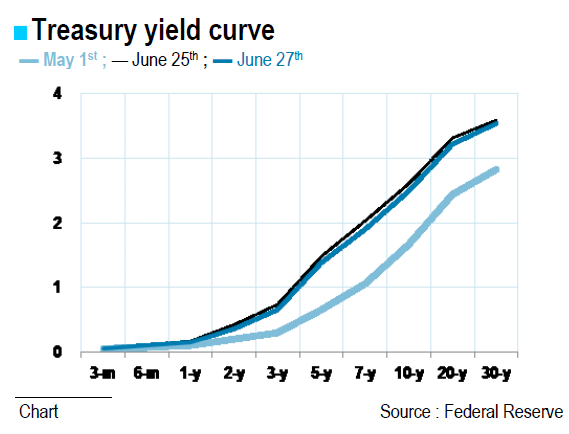

The week was filled with economic data that shed a positive light on Q2 trends. Yet the financial markets focused on the sharp downward revision in Q1 growth, which brought to an end the abrupt upturn in long-term rates.

Q2 statistics continue to be upbeat. New orders in the durable goods industry rose rapidly in April and May, up 3.6% m/m. This dynamic momentum owes much to the aeronautics sector, but other sectors also contributed. Excluding defence and transport, new orders of durable goods rose in May at an annualised rate of 12.7% over a three-month period. Corporate investment seems to have rebounded after a disappointing Q1, while the housing market continues to be very buoyant. In May, sales of existing homes were up 12.7% year-on-year, while sales growth was even more impressive in the new home segment, up 29%. This upbeat momentum was accompanied by a sharp decline in the number of units in the market. The stock of houses dropped to 5.1 months at the current pace of sales, from 6.3 a year earlier, a trend that is driving up house prices. The S&P/Case-Shiller house price index for the twenty biggest US metropolitan areas rose 10.9% year-on-year in March. Household consumption is also maintaining a robust growth rate with real growth of 0.2% in May, despite a slight increase in the savings rate (to 3.2% of disposable income). Assuming household consumption is stagnant in June, it would still rise at an annualised rate of 2.1% in Q2, compared to 2.6% in the first three months of the year. Indeed, the household confidence surveys such as the Conference Board index are very upbeat. After pausing earlier this year with the increase in fiscal pressure, confidence has clearly picked up, thanks notably to job-related components.

Indeed, the healthy job market is the main reason for the US economy’s current performances. Nearly 1 million jobs were created in the first five months of the year, which helped lower the unemployment rate from 7.9% in January to 7.6% in May. Wage revenues increased 3.3% year-on-year in the first five months of the year, while the consumer price deflator rose only 1%. Consequently, the purchasing power of wage revenues increased rapidly, helping offset higher taxes. In brief, GDP growth may well accelerate between the first two quarters of the year. Yet this is also due to the fact that Q1 growth was not as dynamic as initially predicted, at only 1.8% (quarterly annualised rate), down from previous estimates of 2.4%. Of course, these results are disappointing, but their impact must be kept in perspective. First, these statistics refer to the past, whereas what really counts are future prospects. Data published this week covering economic activity and confidence in the months of April to June are much more critical, and provide grounds for optimism. The downward revisions also brought an end to the upsurge in long-term rates.

The yield on 10-year Treasuries, which had dropped to a low of about 1.65% in early May, rose sharply to about 2.60%, with nearly half of this increase occurring after the last FOMC meeting. Yields on private bonds also rose rapidly, especially for securities with the lowest credit ratings. The uptick was not quite as sharp for mortgage rates. The equity markets contracted and the dollar appreciated by a little over 2% compared to the main foreign currencies. This rather abrupt movement corresponds in part to a poor interpretation of the Fed’s announcements. Ben Bernanke stated that he was only confirming what had already been said by most of the other FOMC members for several months. As these members tried to explain, a slowdown in the pace of monthly securities purchases does not correspond to a tightening of monetary policy. Indeed, the easing trend will continue, although the dose injected each month will be slightly smaller. In the end, with the yield on 2-year Treasuries up by about 20bp since early May, there seems to be some confusion between the ending of QE3 and the beginning of a new interest rate cycle.

Yet Ben Bernanke was very clear: QE3 will be brought to an end once the unemployment rate falls back to 7%, while interest rates will not be raised until unemployment falls below 6.5%, given that this is a necessary condition but not a sufficient one. Over the next few weeks, we will very probably see the FOMC members renew their pedagogical efforts, and everything suggests they will manage to hold down pressures in the US bond market. The publication of new Q1 growth estimates helped calmed down the rise in interest rates, and the speeches gave by some Fed officials allowed them to correct part of the previous rise. Jerome H. Powell (member of the Board of Governor), William C. Dudley (New York Fed President) et Dennis P. Lockhart (Atlanta Fed President, a non-voting member this year) were very much similar in tone. There was no breaking news, as they emphasised that 1/ Fed’s decisions will remain data-dependent, 2/ tapering is no tightening and, 3/ the first rate hike is unlikely to be decided before mid-2015. All three of them, however, stressed that financial markets over-reacted to recent Fed’s communication, and it appears that they were heard loud and clear as the 10-year Treasury yield lost some 15 basis point.

BY Alexandra ESTIOT

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

The Week In The US : Managing Expectations

Published 06/30/2013, 05:28 AM

Updated 03/09/2019, 08:30 AM

The Week In The US : Managing Expectations

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.