The September data profile is nearly complete and the numbers provided so far reflect an economy that continues to grow. Of the 12 indicators published to date for The Capital Spectator Economic Trend Index (CS-ETI), 9 are trending positive. That’s a strong signal for assuming that recession risk was still low last month.

As the table below shows, there are relatively few signs of trouble according to a broad set of economic and financial indicators. In fact, one danger sign for July and August turned positive last month (ISM Manufacturing).

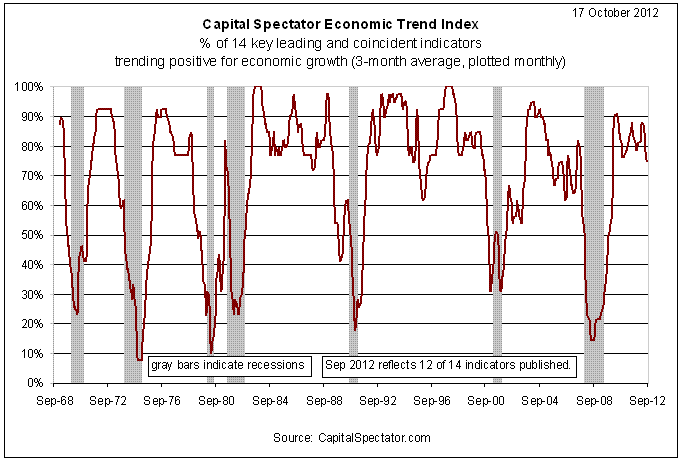

The 3-month moving average for CS-ETI, which is calculated from the numbers in the table above, is currently at 75.0% through September, based on the published data. As the next chart suggests, recession risk at these levels is a low-probability event according to the historical record. A drop below 60% would be a warning sign, and sliding under 50% would indicate that a new recession is a virtual certainty. Fortunately, CS-ETI’s 75.0% reading appears relatively stable and comfortably above the hazard zone. Although the September level to date is slightly below August's 76.2% on a 3-month moving average basis, that's a slight fall and well within the normal range of fluctuations during periods of economic growth.

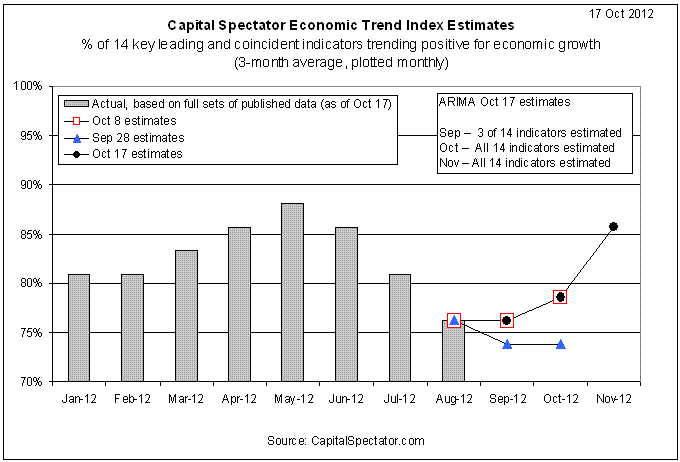

For some perspective on CS-ETI’s outlook for the immediate future, consider ARIMA estimates to fill in the missing numbers for September, along with guesstimates for October and November. 1 Each indicator for CS-ETI is forecast independently, with the results aggregated to estimate CS-ETI's 3-month average. Any one forecast is likely to suffer error, of course, but predicting all the indicators in a robust econometric framework should minimize the risk a bit if some of the errors cancel each other out. Using the ARIMA estimates to fill in the gaps tells us that CS-ETI's 3-month average for September will more or less hold steady in the 75% range once the final numbers arrive. Meantime, October and November are expected to post higher readings for CS-ETI, according to the ARIMA outlook.

1. The ARIMA forecasts are calculated in R software, using Professor Rob Hyndman’s “forecast package, which optimizes the model's parameters based on each data set's historical record.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

U.S. Economic Trend Update

Published 10/18/2012, 01:59 AM

Updated 07/09/2023, 06:31 AM

U.S. Economic Trend Update

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.