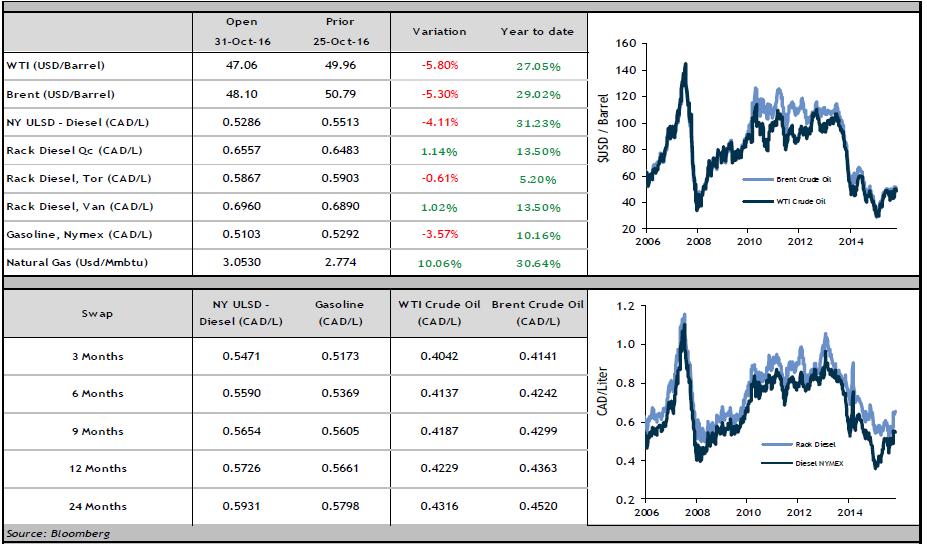

Last week, the prices of WTI oil fell by 3.60% which is the first drop in weekly prices since mid-September. The price of diesel, in Canadian dollars, fell by one cent.

Amongst the noteworthy news:

- An OPEC committee participated in a meeting held in Vienna on October 28 and 29. OPEC, who controls 40% of global production, aims for cooperation of nonmembers, such as Brazil and Russia, in order to reach an agreement to reduce production. Certain analyst forecast OPEC will reach an agreement of collective cuts, without specifying individual concessions. Echo’s regarding Iraq looking to be exempt from production cuts are also being heard.

- The Seaway Legacy pipeline, linking Cushing Oklahoma to the Golf of Texas was non-operational since the spill of last October 23. According to the latest news, the pipeline transporting 400,000 barrels/day will be up and running by the end of the week.

- In Nigeria, after 8 months of problems with oil exportations due to rebel attacks, the force majeure will most likely be lifted over the course of the week, according to the Minister of State: Petroleum, Emmanuel Kachikwu.

- According to the U.S. Department of Energy, crude oil stocks at Cushing increased by 40,000 barrels in the week ended October 21, 2016. American production is at 8.5 million barrels/day, level where it has been over the last three months.

- In light of the market movements, we invite our clients to contact us in order to discuss hedging strategies for you fuel expenses.