Market movers ahead

The most important global event is the Donald Trump-Xi Jinping meeting in Japan this weekend - in our view, there is hope for an easing of the trade war.

The US jobs report and ISM data could point to a further economic slowdown in June; jobs growth is especially important to watch at this time.

A new attempt to agree on the EU top jobs will be the central point of an extraordinary EU summit on Sunday.

PMI data from China could be weak, as could the important Japanese Tankan survey.

Following the dovish shift from the major central banks, the Swedish Riksbank is under pressure to send new signals at its meeting on Tuesday.

Weekly wrap-up

The global macroeconomic situation remains weak.

The Fed and ECB gave further hints about their potential monetary policy easing.

There are further indications of a possible trade ceasefire between China and the US.

Tensions between the US and Iran continue to run high.

Import prices continue to rise in Sweden, but consumer prices do not.

Market movers

Global

In the US, we expect a few important data releases over the next week. ISM manufacturing for June is due out on Monday and the jobs report for June is due out on Friday. We expect ISM to decrease and come in at 50.8, down from 52.2 In our view, the US manufacturing sector is not immune to the global slowdown but we think the index will remain just above the important 50 threshold. That said, risk is skewed on the downside.

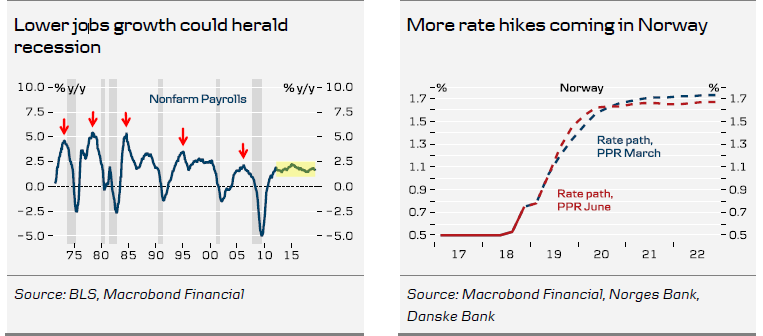

Overall, the labour market has started to show some weakness, so we think it is important to keep an eye on employment growth, which is an important recession indicator, in our view. The average monthly increase in nonfarm payrolls has declined to 164,000 this year, from 223,000 in 2018. We expect employment growth to come in around 175,000. We estimate average hourly earnings rose +0.20% m/m in June, unchanged at 3.1% y/y.

In the euro area, focus is likely to be on Sunday’s extraordinary EU summit, where EU leaders will again discuss the nominations for the EU’s top jobs. The EU leaders discussed the possible candidates for the top positions at the latest European Council meeting in June but did not come to an agreement amid the known Spitzenkandidaten (Let the EU ‘Game of Thrones’ begin). They will now look at other candidates but fronts remain divided in the Council, so the process may very well drag on further into the summer.

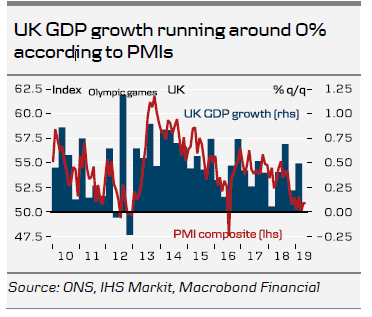

In the UK, we have a quiet week ahead. The most important releases are PMIs at the beginning of the week. The PMI manufacturing index (due out on Monday) is likely to fall further, as it remains elevated compared with the equivalent euro area index and stockpiling ahead of Brexit is finished. We do not have strong reasons to believe the PMI Services Index (due out Wednesday) should move much in either direction and we expect it to continue indicating GDP growth is running close to 0.0%.

The Conservative Party leadership contest continues. Boris Johnson is still favourite to succeed Theresa May, despite slipping in polls recently.

The key event in China is the meeting between Chinese President Xi Jinping and US President Donald Trump. It is set to take place around noon on Saturday. We should expect statements from both sides Saturday morning CEST (seven hours time difference from Japan). As now widely expected, we look for a ceasefire in the trade war and an agreement to resume the trade talks, which broke down in early May. We still expect the path to a trade deal to be difficult though, as the two sides stand firm on conflicting demands. Hence, we should still expect a rocky path from here. Eventually, we believe a trade deal will come though, as we believe Trump will see more benefit in a trade deal than a no-deal scenario when he goes into the critical phase of the election campaign next year. So far, he is in no hurry though, as markets are still strong and the economy is holding up well.

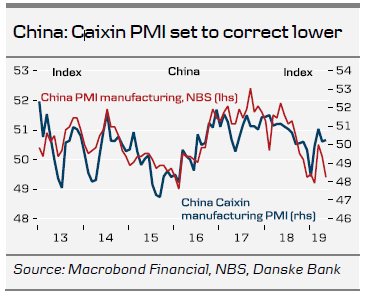

On the data front, we look for PMI manufacturing for June to look weak. The official NBS PMI already fell sharply in May, while the private Caixin PMI manufacturing held up still. However, we look for the Caixin PMI to correct lower in June from 50.2 to 49.5.

To read the entire report Please click on the pdf File Below..