We wrote in our newsletter this past weekend that:

While the market could certainly move lower in the short term, as there is currently no catalyst present to reverse the decline, it is very likely that some event will occur in the next week or two with regard to the Eurozone that will spark a rally in the markets. It will be short lived.

Over the weekend this is precisely what happened as Spain received EU support, a financial assistance package of €100 Billion. This de facto bailout is roughly equivalent to 10% of Spain's current GDP as compared to the $700 billion bailout in the U.S. which was 5% of GDP at that time. This was no small measure. The question remains whether this solves any longer term issues or if it simply postpones the inevitable conclusion for a while longer?

According to the de Guindos press conference, the bailout cash will go to the Fund for Orderly Bank Restructuring which is a fund set up specifically to fund insolvent banks. For Spain this means that it will be completely absorbed by the massive levels of failing real estate loans. Since the "bailout" will be a loan with better terms than the market, 3% or roughly half of the Spanish GGB's, it will still result in a material increase in Spain's total debt (National and European) to GDP pushing it well past 140%. Of course, therein is the real story. The bailout, in the eyes of sovereign creditors, just made the country a materially worse bet as Spain's debt increases by up to 17% and the structure of the loan subordinates existing creditors. This is why we saw Spanish bond yields push higher after the bailout announcement was made.

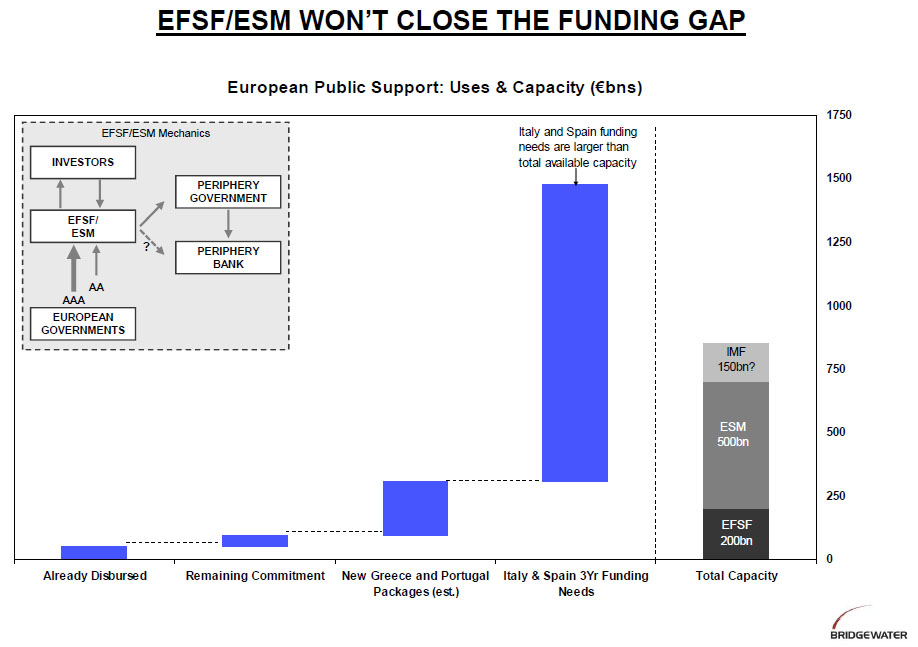

So where is the money coming from? The EU announced that the sole source of cash would be the ESM (European Stability Mechanism) or the EFSF (European Financial Stability Fund). This is interesting when you consider that the ESM has yet to be ratified by Germany whose parliament has been steadfast against allowing the ESM to fund a direct bank bailout like that being done in Spain. Without German ratification of the ESM, which is highly doubtful in this case, and without having to give ESM Bonds "preferred creditor status", the bailout will fall onto the EFSF which currently only retains about €200 billion in liquidity. However, the dilemma is that Spain's obligation to the EFSF is about €93 Billion which is now unlikely to be contributed thereby leaving the EFSF with only about €7 Billion after the bailout is complete.

This is where the problem arises. In the famous words of Clarke & Dawes:

How can broke economies lend money to other broke economies who haven't got any money because they can't pay back the money that the broke economy loaned to the other broke economy and shouldn't have lended it to them in the first place because the broke economy can't pay it back?

That question has yet to be answered.

The Beginning Of The End

With Spain getting an effective "unconditional" bailout from the EU it will just remain a function of time before more requests begin to arise. Italy is the most likely next candidate as the Eurocrisis has spread pushing borrowing costs to unsustainable levels for Italy as economic weakness continues to exacerbate the problem.

The problem is that with only €7 billion remaining after the Spanish bailout there really is not much firepower left. The overriding problem of the EFSF and ESM from their inception has been that they are too small to fix the problems in the Eurozone. Ultimately, it will require much greater cooperation and intervention by the respective countries to find a lasting solution which can only be found within the framework of a constitutional union which is highly unlikely to occur anytime soon. The chart from Bridgewater clearly explains the funding gap.

This is likely to be the beginning of the end for the Eurozone as it exists today. Spain's bailout comes without the conditions that Ireland, Portugal and Greece were subjected to. Excessively restrictive targets on taxes, spending and social welfare have constricted their respective economies sending them into sharp recessions.

Greece, already in turmoil and likely to have a new party in power by the end of the month, has already pledged to negotiate part or all of their current bailout deal despite warnings from Germany that they must abide by the original terms or leave the Eurozone. Spain's bailout will serve to embolden Greece to push for a new agreement.

It is not just Greece either. According to the AFP over the weekend Ireland already wants to renegotiate its rescue plan to benefit from the same treatment as Spain which "...looks set to win a bailout for its banks without any broader economic reforms in return..." Then again, why wouldn't they? Why should Ireland, Greece, Italy and Portugal be held to tighter standards than Spain?

Germany is quickly running out of options. Germany can hold fast to its ultimatums of "bailouts with strict reform measures or leave the Eurozone" but what they are quickly finding out is that the "lender is slave to borrower when they owe you enough." The dissension between Germany and the bailout recipients is rapidly growing as the continued fanatical ideologies that have been the backbone of the global delusion to "solve the insolvency" of the EU's financial system. That dissension, not only between the member states but within the political arenas themselves, is why the failed experiment of an European Union will eventually arrive at its final destination.

Sell The Rally

Any rally derived from the announcement is likely to be short lived. The headwinds facing the market are far greater than just the Spanish banking system:

- The economy is very weak and susceptible to external shocks

- The Eurozone will slow economic growth in the U.S. — the only real question is how much?

- The "fiscal cliff" will have to be dealt with — but when and will it be too late?

- The debt ceiling debate is approaching, again.

- Emerging markets are slowing as well putting more pressure on the U.S. economy.

- Economic indicators are all beginning to signs of increased weakness

- The Eurozone crisis continues with no real solution in site.

- Corporate profits continue to weaken

- Market valuations and price targets are still very optimistic

In our recent missive “Forecasting The Rebound and the Bottom" we stated:

All of these issues, and many more, currently put equity investors at risk. This is why we have recommended holding higher cash levels than normal and waiting for a better risk/reward entry point ahead. With our 'sell' signals currently in play it has paid to remain cautious since our initial recommendations back in April.

The bottom of the next decline will likely be between August and September with a potential of 1200-1250 on the S&P 500. If this occurs, and I suspect that this will coincide with the initiation of a new round of bond buying (QE3), which will provide investors with the best opportunity to increase equity exposure in portfolios for the end of the year.

That advice remains salient today.

Below You May Find The Video.