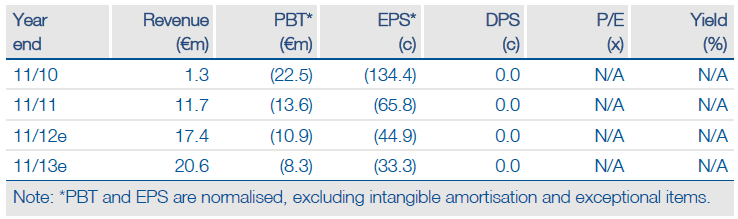

Wilex AG (WL6.DE) reported H1 revenues of €7.2m made of €5.9m of research payments and deferred income from the 2011 Prometheus deal plus €0.2m of diagnostic and €1.2m of research for customers. Other income, including grants, was €1m. Guidance for FY12 has increased to €16-18m; the H2 rise of €2m is mainly due to the deferred recognition of $17.5m cash received from Prometheus in July in respect of Rencarex. H1 operating costs were €13.3m, of which €6.9m was R&D. The cash use is €1.7-2m per month. (€20-24m annually). Losses in H1 reduced to €5.6m vs €10.6m.

Money for Rencarex US rights; Redectane ODAC

Wilex had an option on either a marketed product in respect of the Rencarex US rights or $20m cash. On 10 July, it took the cash in a restructured deal. The payment now due is $17.5m with the other $2.5m added to the milestones for filing, assumed to be received in 2013. There is an agreement to introduce Wilex to the holder of a product (believed to be Proleukin marketed by Novartis for renal cancer) so a deal might still be done. However, Wilex needed additional cash and taking the product would have needed alternative cash funding ahead of Rencarex ARISER data in Q4. The 25 July ODAC meeting will illuminate the future Redectane development options and any additional cash needs for further trials.

Financial position

Edison has modelled the July $17.5m (€13.4m) payment as deferred income over 36 months adding €1.9m in FY12 and €4.5m in FY13; the exact treatment is not disclosed. The 2011 $19m Prometheus signing fee is modelled in FY12 as €5.4m plus a contribution, assumed to b €5.5m, for Rencarex development; this is fully offset in cost of sales but reduces R&D. Heidelberg (ADC technology: delivery of cytotoxic drugs by antibodies) revenues are running at €2.4m with Diagnostics at €0.4m. The cash need is estimated at €20m. This is being covered by the earlier equity issue of €9.8m and the $17.5m (€13.4m) received in July. Wilex could have about €6.7m cash by 30 November, although this could be €4m lower depending on trial costs.

Valuation: Priced in data

Edison’s indicative valuation for Wilex is €207m, or €7.35/share. The value of some technologies (like ADC) is not included but could be significant. Further funds of at least €15m will be needed in FY13; some of these should come from milestones. A Mesupron deal, with a significant fee, is expected in 2013 after good trend data was seen in both the pancreatic and breast cancer studies.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Wilex Strategic Funding And H112: Data Priced In

Published 07/19/2012, 06:49 AM

Updated 07/09/2023, 06:31 AM

Wilex Strategic Funding And H112: Data Priced In

Taking the cash

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.