It's a sign of the ultimate height of hubris and I have been watching for this for some time, but the Skyscraper Index is flashing a sell signal on China. Here is an explanation of the concept from Wikipedia:

The Skyscraper Index is a concept put forward in January 1999 by Andrew Lawrence, research director at Dresdner Kleinwort Wasserstein, which showed that the world's tallest buildings have risen on the eve of economic downturns. Business cycles and skyscraper construction correlate in such a way that investment in skyscrapers peaks when cyclical growth is exhausted and the economy is ready for recession. Mark Thornton's Skyscraper Index Model successfully sent a signal of the Late-2000s financial crisis at the beginning of August 2007.

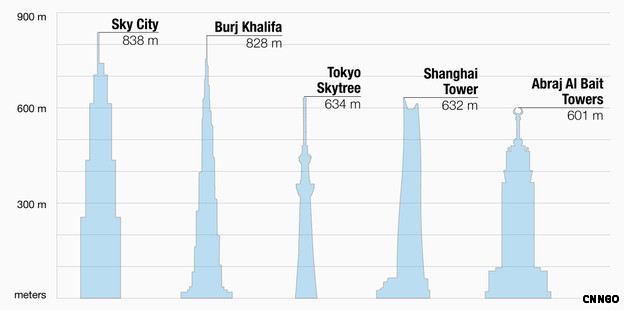

Now comes the news that China plans to build the world's tallest building in just three months! It's a contrarian signal that indicates that an economy is topping out.

The Skyscraper Index is admittedly an imperfect indicator, largely because there are so few data points and the results could be attributable to data fitting. Nevertheless, the ideas are highly intuitive, as Wikipedia explains:

The intuitively simple concept, publicized by business press in 1999, has been cross-checked within the framework of the Austrian Business Cycle Theory, itself borrowing on Richard Cantillon's eighteenth-century theories. Mark Thornton (2005) listed three Cantillon effects that make skyscraper index valid. First, a decline in interest rates at the onset of a boom drives land prices. Second, a decline in interest rates allows increase in average size of a firm, creating demand for larger office spaces. Third, low interest rates provide investment to construction technologies that enable developers to break earlier records. All three factors peak at the end of growth period

Interestingly, the market peak and financial crisis that follow seems to occur sometime between the planning of the building and its completion. Consider, for example, the Empire State Building, which began in January 1930 - after the stock market crash. The Petronas Towers in Malyasia were completed in 1998, a year after the onset of the Asian Crisis. Here is more about the Skyscraper Index from Barclays (via The Big Picture).

To be sure, a peak indicated by the Skyscraper Index doesn't mean that the lights have permanently gone out on the country which constructed the world's tallest building. The United States went on to continue its growth and assume the mantle of global leadership after the Great Depression. The Malaysian economy of today, or the economy of Asia today, can't exactly be characterized as a black hole either.

For today's investor, I remain of the belief that, in terms of the effect on markets, China is at center stage and Europe is the sideshow (see Focus on China, not Europe). This latest signal from the Skyscraper Index confirms that view. If Europe were to stabilize itself but China lands hard, what happens in Greece or Spain won't matter very much.

Disclosure: Cam Hui is a portfolio manager at Qwest Investment Fund Management Ltd. ("Qwest"). This article is prepared by Mr. Hui as an outside business activity. As such, Qwest does not review or approve materials presented herein. The opinions and any recommendations expressed in this blog are those of the author and do not reflect the opinions or recommendations of Qwest.

None of the information or opinions expressed in this blog constitutes a solicitation for the purchase or sale of any security or other instrument. Nothing in this article constitutes investment advice and any recommendations that may be contained herein have not been based upon a consideration of the investment objectives, financial situation or particular needs of any specific recipient. Any purchase or sale activity in any securities or other instrument should be based upon your own analysis and conclusions. Past performance is not indicative of future results. Either Qwest or Mr. Hui may hold or control long or short positions in the securities or instruments mentioned.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

China: The Ultimate Contrarian Sell Signal?

Published 06/17/2012, 12:26 AM

Updated 07/09/2023, 06:31 AM

China: The Ultimate Contrarian Sell Signal?

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Thank you for the information. I am following you in Investing.com and really enjoying your articles. Also i would like to get comments on Turkish Market(as the secong growing economy in the world) Thank you very much indeed.

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.