In a post by my friend Cullen Roche at PragCap he pointed out that many economists are suggesting that the second estimate of Q3 GDP, which showed an initial estimate of 2.0% annualized growth, will be revised sharply upward to 2.8%. This 2.8% bump in annualized growth comes on the heels of a very sluggish Q2 growth rate of 1.3%. If Cullen's observations of economic growth in the third quarter is correct it suggests much more than just a mild pickup in the economic underpinnings of personal consumption expenditures, private investment, government spending and net exports but rather something much more material. This would be welcome news for the millions of individuals on extended unemployment gains as such a surge in economic activity will be reflected by increasing employment as businesses gear up to meet increasing demand.

The problem is that the surge in demand isn't materializing at the manufacturing level. For example, it is worth remembering that ex-government defense spending, which jumped $30 billion after being flat in the previous two quarters, the growth rate in initial Q3 estimate would be 1.3% rather than 2.0%. Therefore, that jump in defense spending, which requires manufacturing, should be showing a bump in new orders for manufactured products. Furthermore, if personal consumption expenditures and private investment (i.e. residential construction) are improving then, likewise, there should be improvement in the overall manufacturing makeup as components are required for assembly.

Unfortunately, that has yet to be the case.

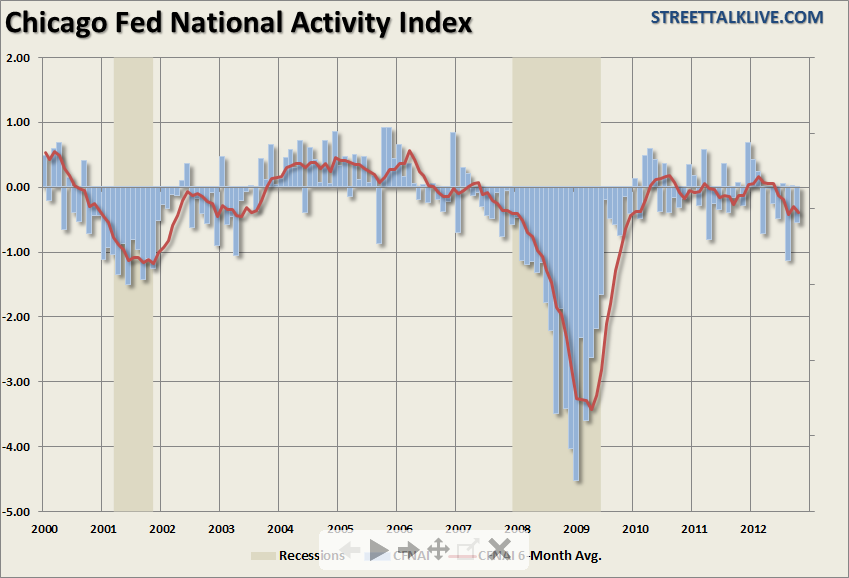

The most recent release of the Chicago Fed National Activity Index (CFNAI), which is a broad measure of 85 subcomponents, declined to a -.56 in October after improving sharply from a -1.13 in August to 0.00 in September. The chart below shows the index versus its six-month average.

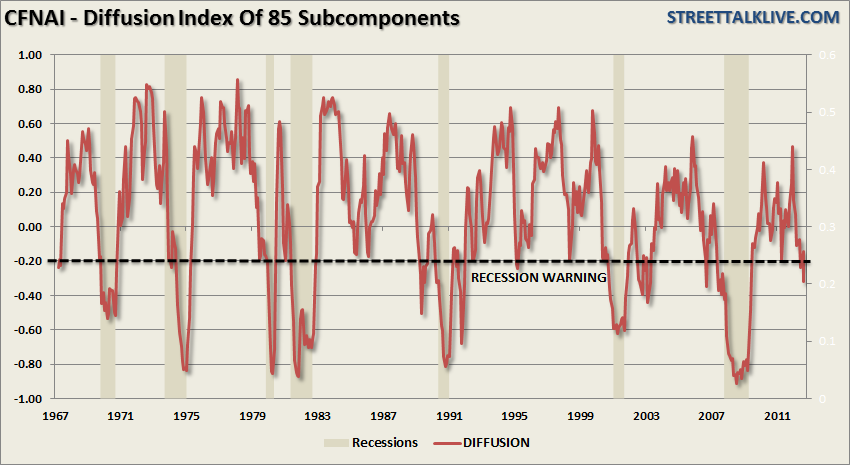

More importantly the diffusion index also deteriorated from -0.14 in September to -0.32 in October which is the lowest level since July 2009. The difference, of course, is that in 2009 the index was rising as the economy was surging due to massive fiscal stimulus. That is not the case now.

Yes, this is just one measure, albeit a very broad one, of economic activity and it is also posting October numbers very late in the month of November. So, what about other manufacturing indexes -- surely those are showing improvement, right?

Maybe not. The Dallas Fed Reserve just released their regional manufacturing survey for November which dropped from 1.8 in October to -2.8 in November. Furthermore, the future activity component plunged from 16.8 to -5.3. As a reminder the Dallas Fed region is one of the strongest economic regions in the country (Texas) and if there was a pickup in economic activity occurring it should be showing up.

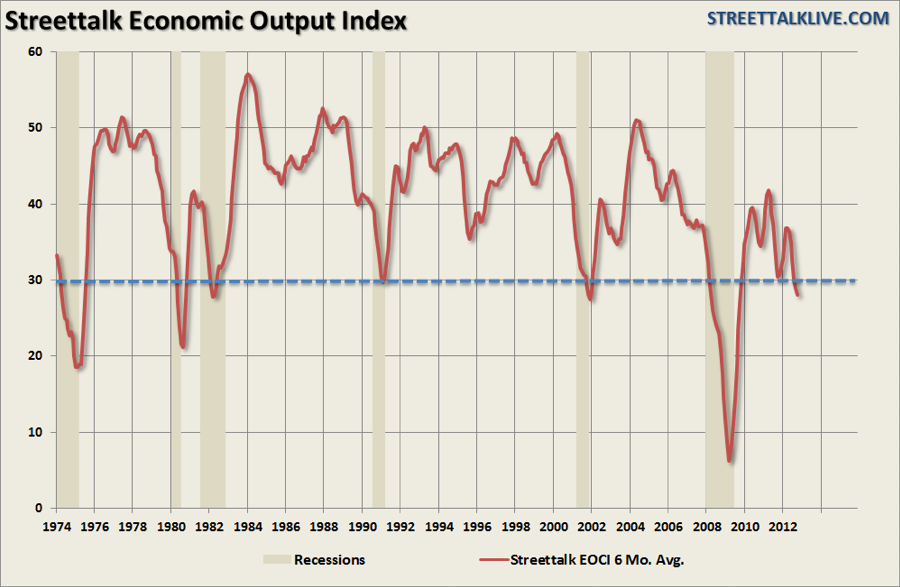

The chart below, as discussed many times before, is the STA economic composite index, which is comprised of the CFNAI, ISM, Chicago PMI, several Fed regions and the NFIB Small Business Index. This is an extremely broad economic composite index which should be seeing incremental pickups in economic activity. Unfortunately, that is not the case as the index declined from 28.68 to 27.73 in October. I have smoothed the data using a six-month average, which shows the overall trend more clearly.

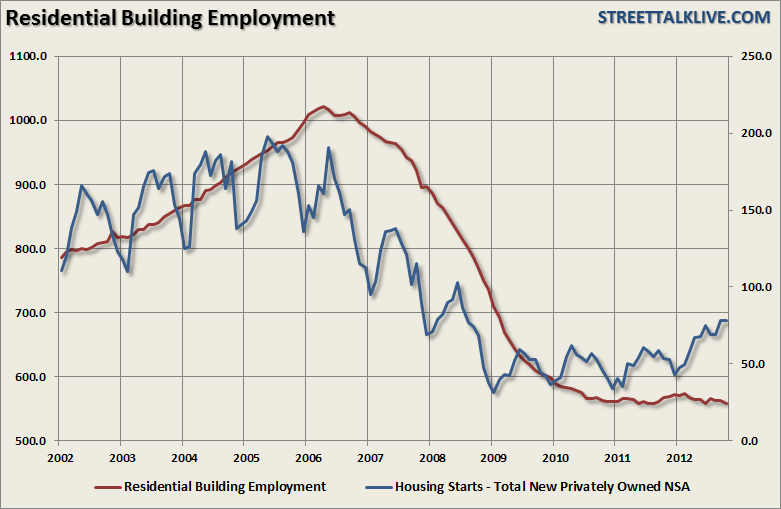

Maybe it is in the housing market? Many economists have been pointing to the resurgence in real estate related activity as a potential catalyst for continued economic expansion. The problems with this thesis are several. First, the majority of the gains seen in housing starts in recent months have come from seasonal adjustments rather than actual activity. This was shown in detail in our previous report on housing activity but most recently seen in the October report where it was reported that on a seasonally adjusted basis new home starts surged from 863,000 to 894,000 whereas the non-seasonally adjusted data saw just 100 new homes started as the number rose to 77,900 from 77,800 in October.

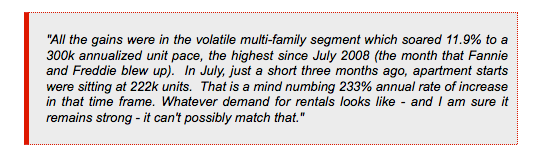

Secondly, the activity has been primarily in the rental unit space, as David Rosenberg points out:

The problem with all of this is that while looking at annualized data is interesting it is the non-seasonally adjusted data that builders are looking at when making hiring decisions. This is why there has been NO increase in the employment of residential construction workers at this point.

Lastly, while it is very true that housing and economic recovery go hand-in-hand, it is important to remember that the residential construction story makes up just a little more than 2% of economy and just 0.1% of the equity market. Therefore, even if the resurgence in housing activity is real, and sustainable, its impact on the overall economic recovery will remain somewhat subdued.

Headwinds Growing

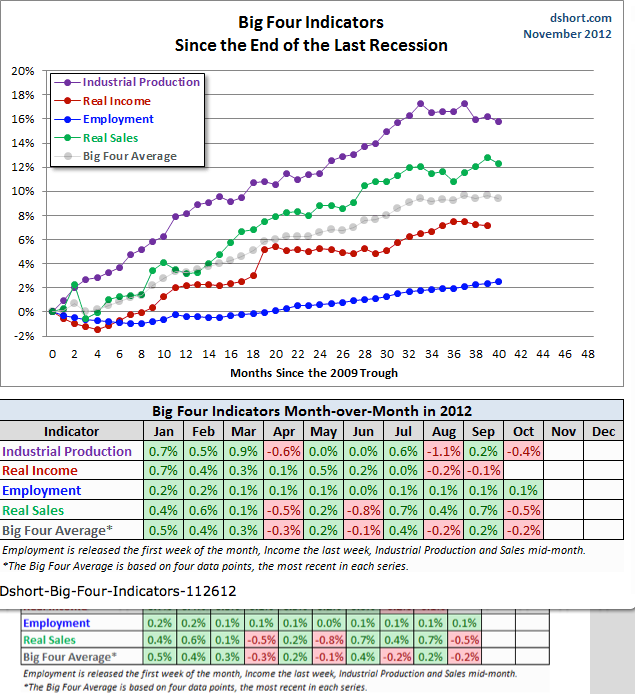

My friend Doug Short does an excellent job in tracking the primary economic components each month as shown in the chart/table below. The month-over-month data has begun to show signs of deterioration as of late which doesn't support the idea of a sharp rebound in economic activity in recent months.

The point is that if the expectations of the majority of economists are correct then we should be seeing activity filtering into the system. Yet, what we are currently witnessing, from a broad measure of indicators, is deterioration in forward outlooks. This has been witnessed not only in the manufacturing reports, such as the CFNAI and Dallas Fed Region surveys where forward expectations were sharply reduced, but also in many of the corporate earnings and guidance's this quarter.

Cullen is correct that the economy is not currently in a recession and Doug's work confirms the same. However, as I stated last week, what is important is where the trend of the data is going.

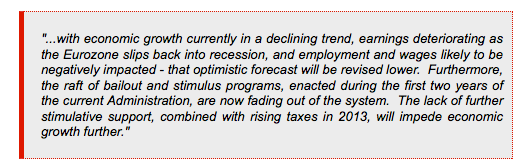

The headwinds to economic growth are gaining strength as the tailwinds from stimulus-related support programs fade. Increasing tax rates, implementation of ObamaCare, increased regulations and Euro-zone related weakness on exports all drag on future economic growth. Later this week we will get the second estimate of third quarter GDP, which will give us some clues about the real direction and strength of the economy. While I sincerely hope that the majority of economists are correct in their assumptions -- I have a nagging suspicion that we might be disappointed with the actual number.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Data Front: We're Not Seeing The Growth Economists Predicted

Published 11/26/2012, 02:17 PM

Updated 02/15/2024, 03:10 AM

Data Front: We're Not Seeing The Growth Economists Predicted

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.