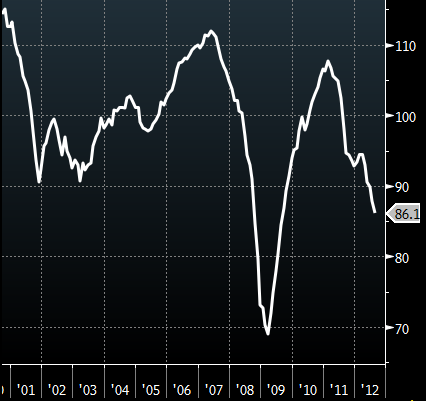

Since we've been discussing sentiment indicators recently, let's turn our attention for a moment to business and consumer sentiment in the eurozone. The confidence index from the European Commission now shows the eurozone recession deepening.

This weakness in sentiment is to be expected given the Eurozone's unemployment rate of 11.3% and the under-25 unemployment of exactly double that rate. What is new here is the low confidence reading in the eurozone's core.

WSJ: Confidence among euro-zone consumers and businesses fell to its lowest level in three years in August, official data showed, suggesting economic weakness in the debt-saddled currency bloc will continue, and is likely to spread further to core economies, such as Germany.

The European Commission said Thursday its monthly Economic Sentiment Indicator fell to 86.1 in August from 87.9 in July, the fifth-straight monthly drop and the weakest level for the combined gauge of business and household sentiment since August 2009.

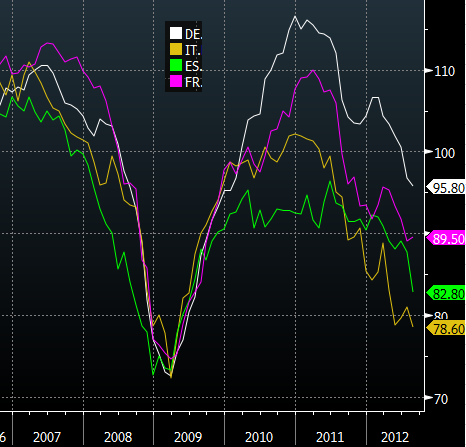

The most severe decline was not surprisingly in Spain, while Italy had the lowest reading among the largest nations of the eurozone. France showed a slight uptick, though the confidence measure remains low.

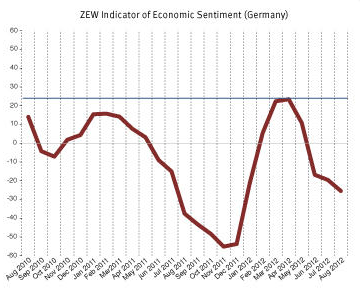

It is becoming clear that it's no longer just an issue for the periphery nations, as Germany now also shows signs of an economic decline (see discussion). Another sentiment indicator released earlier called the ZEW Index - which tends to be more sensitive to changes in confidence - shows a similar trend.

WSJ: "There is clear evidence here that the euro zone as a whole, and not just the periphery, is in need of policy support," Ms. McKeown said, making reference to possible action by the European Central Bank. The ECB Governing Council, which meets September 6, declined to cut its key interest rate or take other action to support the economy at its August meeting.

Signs of weakness in the German economy, evident in Thursday's data, could heighten calls for ECB action and fuel concern about the eurozone's prospects.

The country has been the major source of financial support for struggling member states, and a flagging domestic economy could damage its willingness or ability to bankroll any rescue efforts needed in the future.

Underlining the country's growing problems, the commission said business and household sentiment in Germany weakened for a sixth straight month, to a reading of 95.8 from 96.8.

The WSJ comment that "flagging domestic economy could damage [Germany's] willingness or ability to bankroll any rescue efforts" remains a topic of debate. Are the Germans actually less inclined to support the ECB's bond buying program and a more potent ESM structure because of their own economic difficulties? Some argue it's just the opposite.

Whatever the case, the weakness in sentiment indicators across the eurozone certainly gives the ECB more ammunition to fix the "monetary transmission" problems. And a targeted bond buying program is the only tool the ECB can come up with at this stage. It seems that Europe's historical addiction to government support to fix all economic ills is shifting to a full dependence on central bank stimulus.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Sentiment Indicators Point To A Deepening Recession In The Eurozone

Published 09/03/2012, 02:17 AM

Updated 07/09/2023, 06:31 AM

Sentiment Indicators Point To A Deepening Recession In The Eurozone

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Latest comments

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2024 - Fusion Media Limited. All Rights Reserved.